- Italy

- /

- Industrials

- /

- BIT:ITM

3 European Dividend Stocks Yielding Up To 5.8%

Reviewed by Simply Wall St

As European markets experience a positive upswing, buoyed by easing trade tensions and potential economic stimulus in Germany, investors are increasingly looking towards dividend stocks as a reliable income source. In this environment of cautious optimism, selecting dividend stocks with stable yields can provide both income and a measure of stability amidst fluctuating market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.43% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.39% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.59% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.73% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.87% | ★★★★★★ |

| Holcim (SWX:HOLN) | 5.31% | ★★★★★★ |

| ERG (BIT:ERG) | 5.31% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 3.93% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.79% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.49% | ★★★★★★ |

Click here to see the full list of 237 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

Italmobiliare (BIT:ITM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Italmobiliare S.p.A. is an investment holding company that manages a diverse portfolio of equity and other investments across financial and industrial sectors both in Italy and globally, with a market cap of €1.16 billion.

Operations: Italmobiliare S.p.A.'s revenue is derived from several segments, including Caffè Borbone (€334.53 million), Italmobiliare itself (€140.15 million), Italgen (€66.80 million), Officina Profumo-Farmaceutica Di Santa Maria Novella (€69.97 million), Casa Della Salute (€63.23 million), SIDI Sport (€31.68 million), Clessidra Group (€45.16 million), Capitelli (€23.23 million), and Callmewine (€11.57 million).

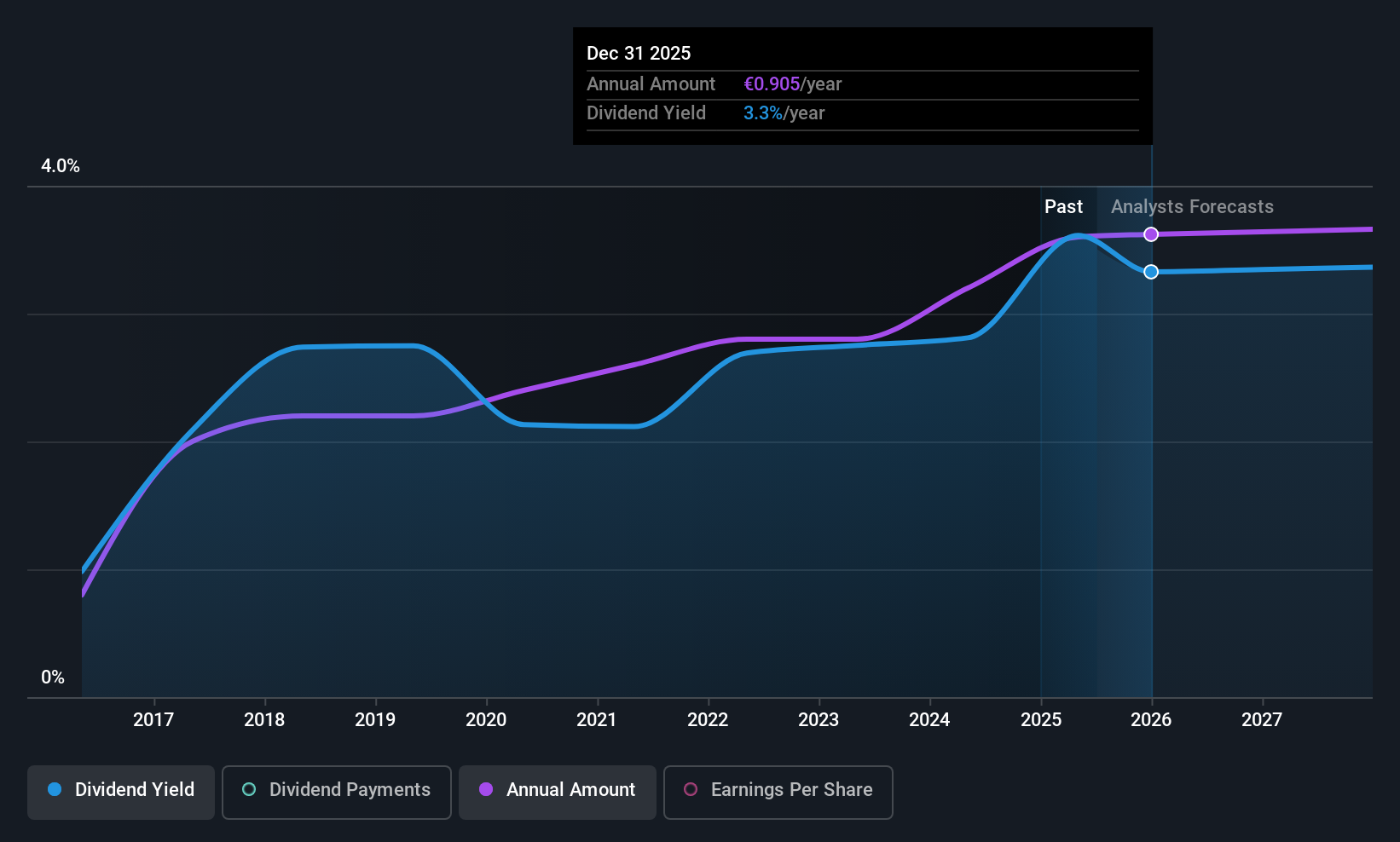

Dividend Yield: 3.3%

Italmobiliare's dividend payments have shown stability and growth over the past decade, with a recent increase to €0.90 per share. Despite a low payout ratio of 40.6%, the dividends are not well covered by free cash flows, raising concerns about sustainability. The current yield of 3.29% is below top-tier Italian market payers, though earnings grew by 40.6% last year and are forecasted to continue growing at 15.84% annually, suggesting potential future support for dividends.

- Click here to discover the nuances of Italmobiliare with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Italmobiliare's current price could be quite moderate.

Clínica Baviera (BME:CBAV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Clínica Baviera, S.A. is a medical company that operates a network of ophthalmology clinics across Spain and Europe, with a market cap of €667.44 million.

Operations: Clínica Baviera generates its revenue primarily from its ophthalmology segment, which accounts for €279.53 million.

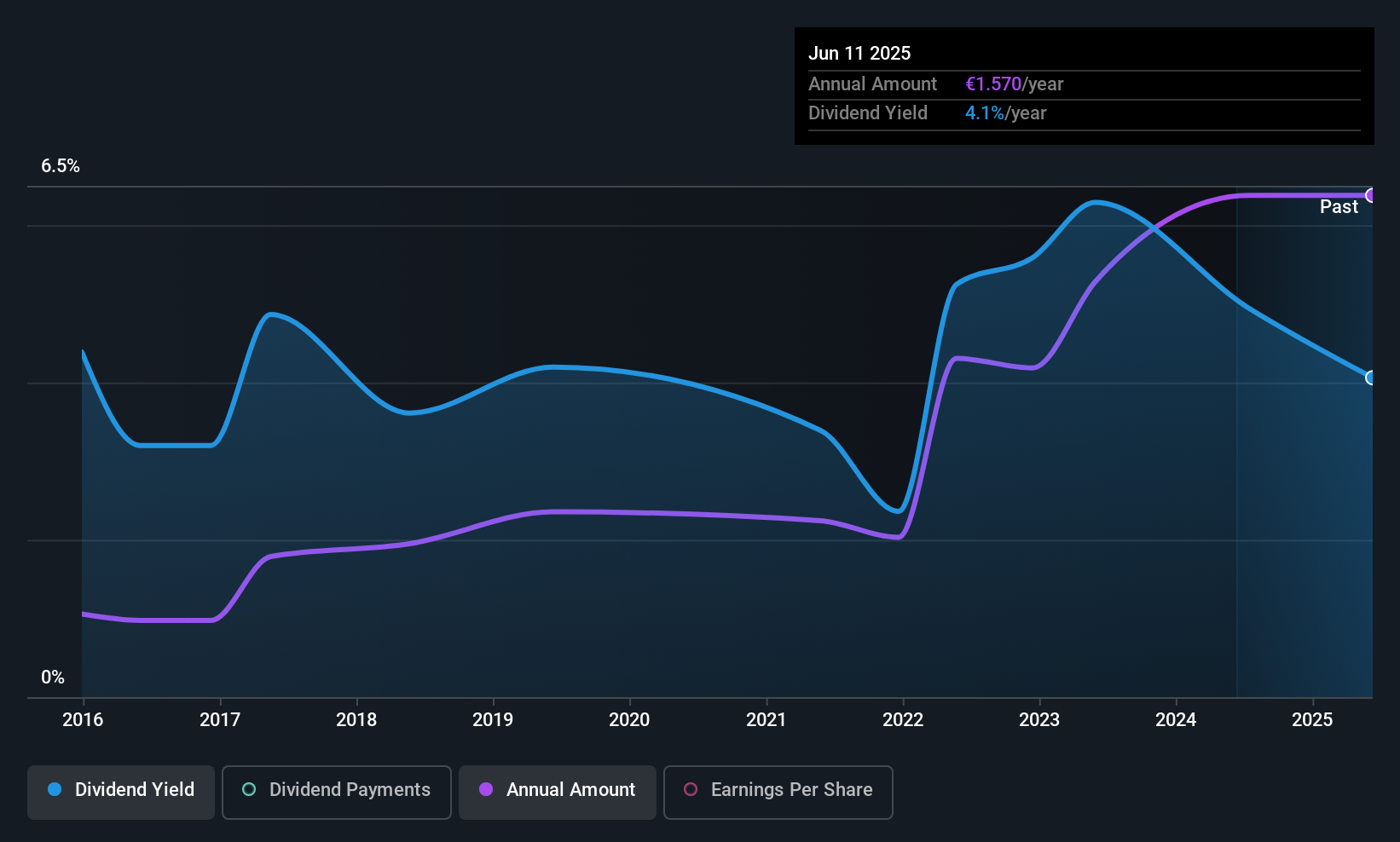

Dividend Yield: 3.8%

Clínica Baviera's dividend payments have been volatile over the past decade, with a current yield of 3.77%, which is below the top tier in Spain. Despite this volatility, dividends are supported by earnings and cash flows, as indicated by payout ratios of 62.5% and 60%, respectively. The stock trades at a discount to its estimated fair value, while recent earnings growth—20.8% annually over five years—suggests potential for future stability in dividends.

- Navigate through the intricacies of Clínica Baviera with our comprehensive dividend report here.

- The analysis detailed in our Clínica Baviera valuation report hints at an deflated share price compared to its estimated value.

Toyota Caetano Portugal (ENXTLS:SCT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toyota Caetano Portugal, S.A. imports, assembles, and commercializes light and heavy vehicles with a market cap of €208.25 million.

Operations: Toyota Caetano Portugal, S.A. generates revenue primarily through the commercialization of motor vehicles domestically (€824.71 million) and externally (€36.62 million), with additional contributions from external motor vehicles industry (€70.01 million), domestic motor vehicles services (€27.36 million), industrial equipment rental domestically (€13.96 million) and other smaller segments within the industrial equipment sector.

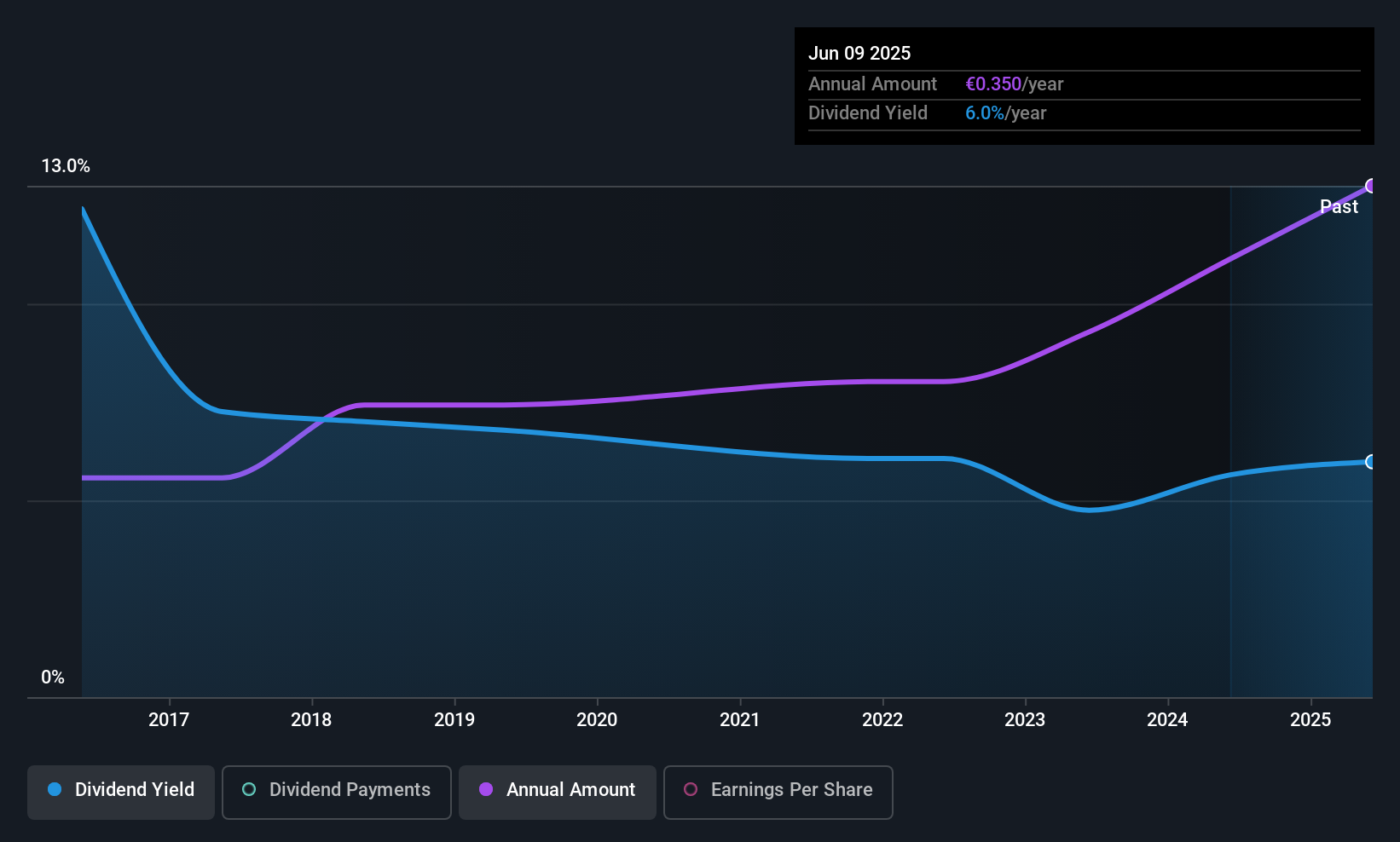

Dividend Yield: 5.9%

Toyota Caetano Portugal's dividend yield of 5.88% ranks in the top 25% of Portuguese dividend payers, yet its dividends have been volatile over the past decade. Despite this instability, recent earnings growth of 62.3% and low payout ratios—44.1% from earnings and 24% from cash flows—indicate strong coverage for current dividends. The stock is trading at a significant discount to its estimated fair value, suggesting potential value for investors seeking income amidst volatility concerns.

- Take a closer look at Toyota Caetano Portugal's potential here in our dividend report.

- Our expertly prepared valuation report Toyota Caetano Portugal implies its share price may be lower than expected.

Next Steps

- Navigate through the entire inventory of 237 Top European Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ITM

Italmobiliare

An investment holding company, owns and manages a portfolio of equity and other investments in the financial and industrial sectors in Italy and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives