- Sweden

- /

- Construction

- /

- OM:NCC B

3 European Dividend Stocks Yielding Up To 4.6%

Reviewed by Simply Wall St

As the European markets navigate a period of economic stagnation and trade uncertainties, the pan-European STOXX Europe 600 Index recently experienced a decline, reflecting broader investor concerns. Despite these challenges, dividend stocks remain an attractive option for investors seeking steady income streams, particularly in times of market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.33% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.15% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.59% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.59% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.04% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.10% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.58% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.61% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.58% | ★★★★★☆ |

| Afry (OM:AFRY) | 4.00% | ★★★★★☆ |

Click here to see the full list of 221 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Billerud (OM:BILL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Billerud AB (publ) is a company that provides paper and packaging materials globally, with a market cap of approximately SEK21.69 billion.

Operations: Billerud AB (publ) generates revenue from its operations primarily in Region Europe with SEK28.02 billion and Region North America with SEK12.39 billion, alongside currency hedging adjustments of -SEK83 million.

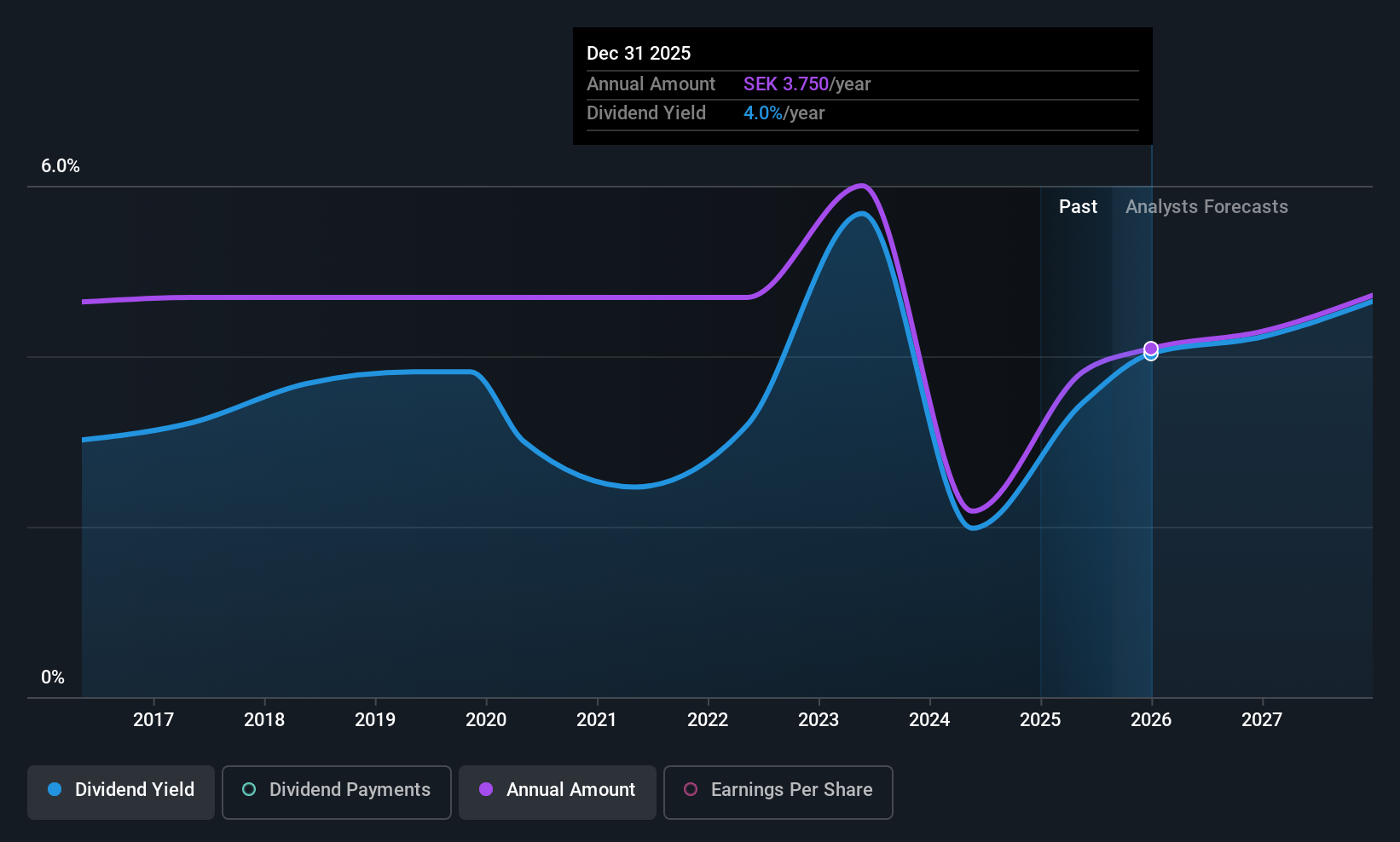

Dividend Yield: 4%

Billerud's dividend yield of 4.01% ranks in the top 25% of Swedish dividend payers, supported by a low payout ratio of 47.3%, indicating sustainability from earnings and cash flows. Despite past volatility with significant annual drops, dividends have increased over the last decade. Recent earnings showed modest growth, with net income rising to SEK 470 million for the first half of 2025, though sales slightly decreased year-over-year in Q2.

- Click here and access our complete dividend analysis report to understand the dynamics of Billerud.

- The analysis detailed in our Billerud valuation report hints at an deflated share price compared to its estimated value.

NCC (OM:NCC B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NCC AB (publ) is a construction company operating in Sweden, Norway, Denmark, and Finland with a market cap of approximately SEK18.97 billion.

Operations: NCC AB (publ) generates revenue through its segments: NCC Industry with SEK12.51 billion, NCC Infrastructure at SEK18.15 billion, NCC Building Sweden contributing SEK13.49 billion, NCC Building Nordics with SEK13.61 billion, and NCC Property Development adding SEK4.26 billion.

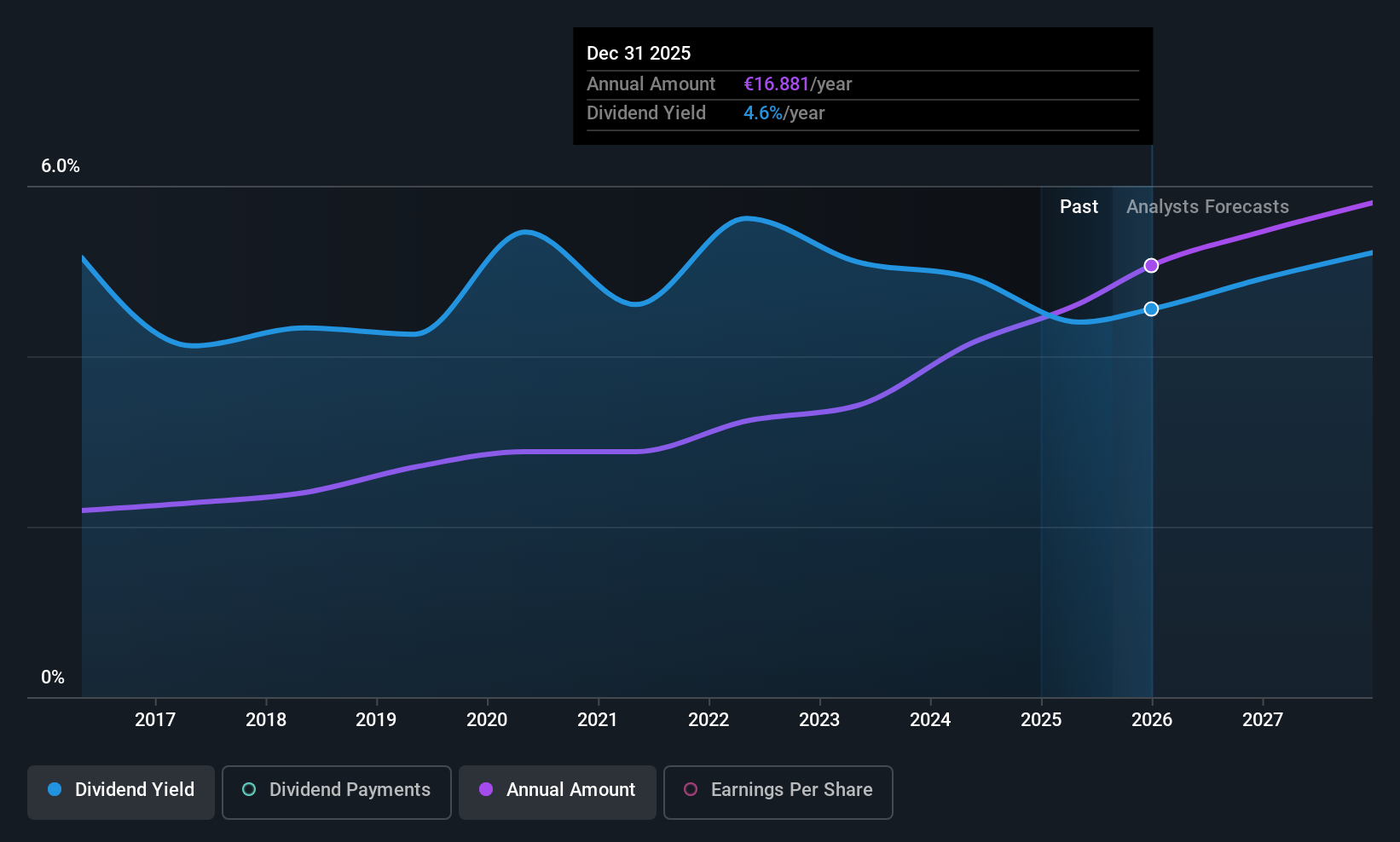

Dividend Yield: 4.6%

NCC's dividend yield of 4.64% places it among the top 25% in Sweden, supported by a sustainable payout ratio of 57.8% from earnings and a low cash payout ratio of 24.4%. However, dividends have been volatile over the past decade with declines. Recent earnings showed a slight decrease in net income to SEK 331 million for H1 2025, alongside new projects like a SEK 400 million building extension in Stockholm, indicating ongoing business activity.

- Get an in-depth perspective on NCC's performance by reading our dividend report here.

- Our valuation report here indicates NCC may be undervalued.

Allianz (XTRA:ALV)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Allianz SE, along with its subsidiaries, offers property-casualty insurance, life/health insurance, and asset management products and services internationally, with a market cap of approximately €139.97 billion.

Operations: Allianz SE generates revenue from three main segments: property-casualty insurance (€78.92 billion), life/health insurance (€24.74 billion), and asset management (€8.45 billion).

Dividend Yield: 4.2%

Allianz's dividends are well-supported with a payout ratio of 61.1% from earnings and a low cash payout ratio of 19.6%. The company's dividends have been stable and growing over the past decade, although its yield of 4.2% is slightly below the top tier in Germany. Recent half-year earnings showed an increase to €5.26 billion, reflecting robust financial health, while ongoing M&A talks highlight strategic expansion efforts in Europe.

- Click to explore a detailed breakdown of our findings in Allianz's dividend report.

- Our valuation report unveils the possibility Allianz's shares may be trading at a discount.

Make It Happen

- Embark on your investment journey to our 221 Top European Dividend Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NCC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NCC B

NCC

Operates as a construction company in Sweden, Norway, Denmark, and Finland.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives