- United States

- /

- Banks

- /

- NasdaqGS:WAFD

3 Dividend Stocks With Yields Up To 5.8% For Your Portfolio

Reviewed by Simply Wall St

As the Dow Jones Industrial Average reaches an all-time high amidst a flurry of corporate earnings reports, investors are keenly observing how dividend stocks can provide stable income in a dynamic market environment. In light of these developments, selecting dividend stocks with attractive yields can be an effective strategy for building a resilient portfolio.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| United Bankshares (UBSI) | 4.13% | ★★★★★☆ |

| Rayonier (RYN) | 11.76% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.71% | ★★★★★☆ |

| Heritage Commerce (HTBK) | 5.28% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 6.04% | ★★★★★★ |

| Ennis (EBF) | 5.82% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 3.83% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.68% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.78% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.53% | ★★★★★☆ |

Click here to see the full list of 137 stocks from our Top US Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Northeast Community Bancorp (NECB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Northeast Community Bancorp, Inc. is the holding company for NorthEast Community Bank, offering financial services to individuals and businesses with a market cap of $236.24 million.

Operations: Northeast Community Bancorp, Inc. generates its revenue primarily through Thrift / Savings and Loan Institutions, with a reported figure of $103.15 million.

Dividend Yield: 4%

Northeast Community Bancorp has consistently provided reliable dividends over the past decade, with stable and growing payments. Despite a dividend yield of 3.96%, which is below the top quartile in the US market, its low payout ratio of 20.7% suggests strong coverage by earnings. Recent announcements include a regular quarterly dividend and a special cash dividend, both at $0.20 per share, reflecting ongoing commitment to shareholder returns despite recent insider selling activity.

- Navigate through the intricacies of Northeast Community Bancorp with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Northeast Community Bancorp shares in the market.

WaFd (WAFD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: WaFd, Inc. is a bank holding company for Washington Federal Bank offering lending, depository, insurance, and other banking services in the United States with a market cap of $2.28 billion.

Operations: WaFd, Inc.'s revenue segment includes Thrift/Savings and Loan Institutions, generating $717.73 million.

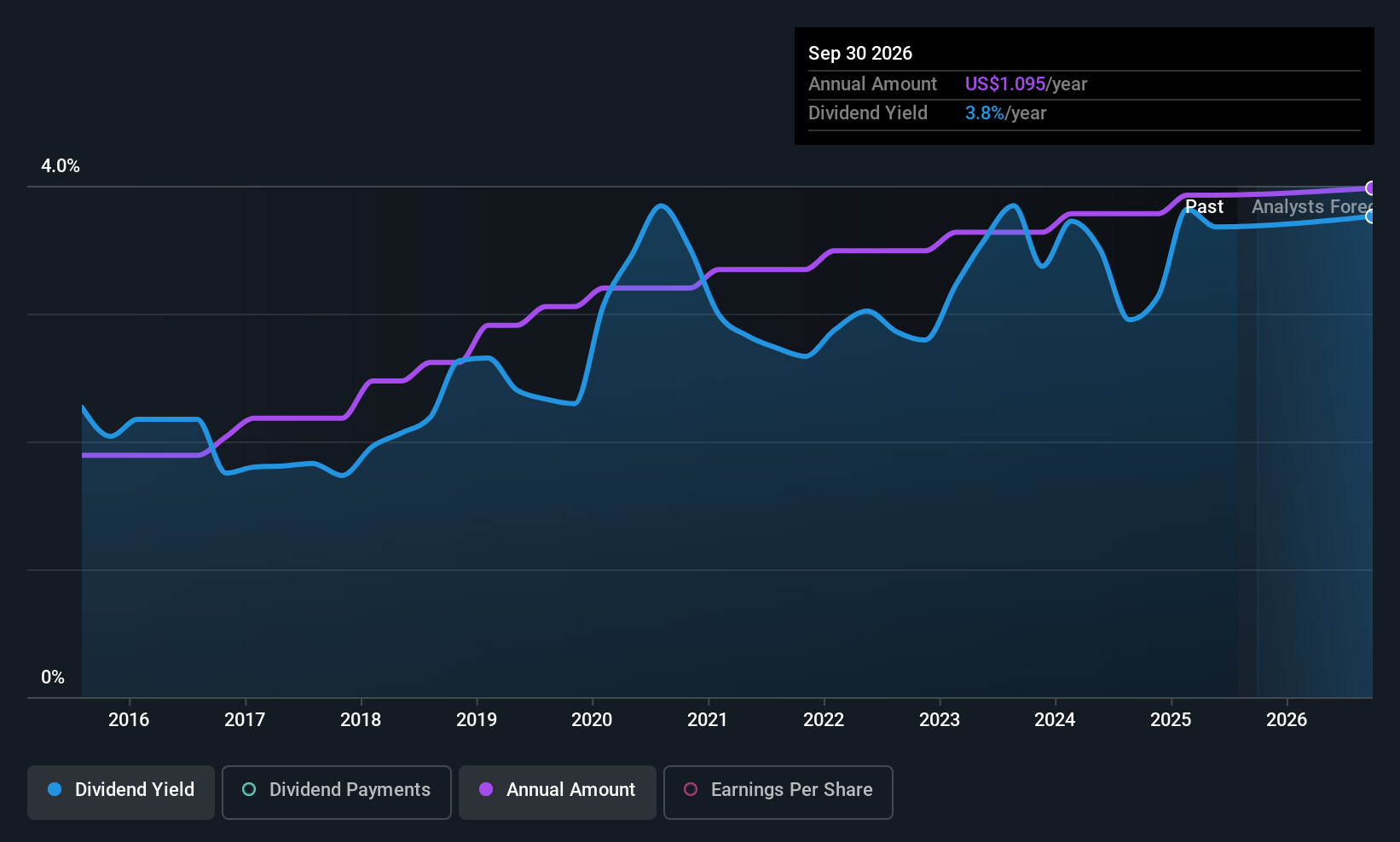

Dividend Yield: 3.7%

WaFd's dividend payments have been stable and growing over the past decade, supported by a low payout ratio of 40.6%, indicating strong coverage by earnings. Despite a lower yield of 3.71% compared to top US dividend payers, WaFd trades at good value relative to peers and below its estimated fair value. Recent earnings showed modest growth in net income for the year, while the company continues share buybacks, reflecting a commitment to shareholder returns.

- Unlock comprehensive insights into our analysis of WaFd stock in this dividend report.

- Our valuation report unveils the possibility WaFd's shares may be trading at a discount.

Ennis (EBF)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Ennis, Inc. produces and sells business forms and other printed products in the United States, with a market cap of approximately $440.58 million.

Operations: Ennis, Inc. generates revenue primarily from its print segment, which accounts for $388.34 million.

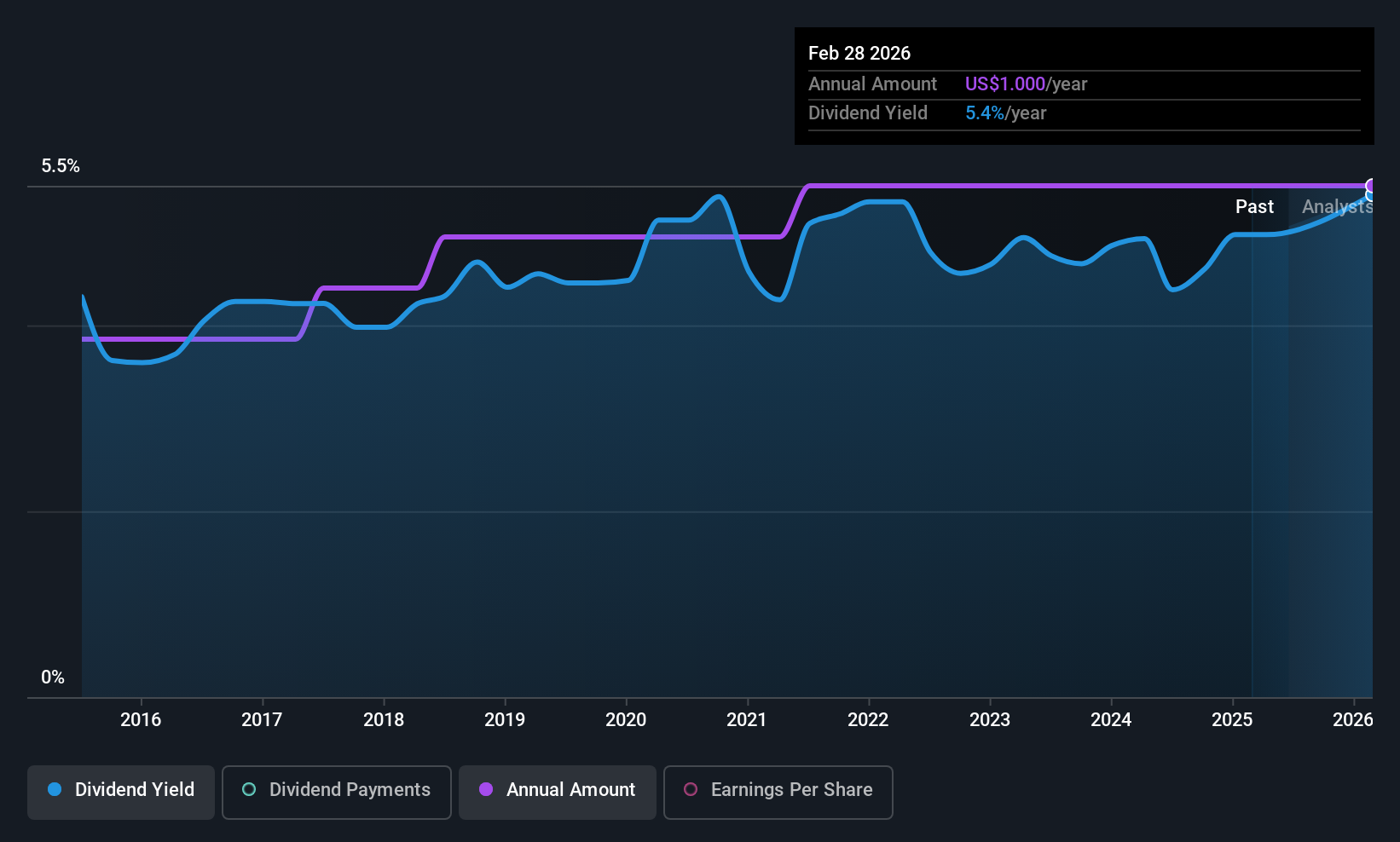

Dividend Yield: 5.8%

Ennis maintains a strong dividend profile with stable and growing payouts over the past decade, supported by a reasonable payout ratio of 61.5% and cash payout ratio of 57.9%, ensuring coverage by earnings and cash flows. With a yield of 5.82%, it ranks in the top quartile among US dividend payers. Recent buybacks totaling $49.01 million highlight shareholder value focus, while recent earnings show improved net income despite slightly lower sales year-on-year at $98.68 million for Q2 2025.

- Click to explore a detailed breakdown of our findings in Ennis' dividend report.

- Our valuation report here indicates Ennis may be overvalued.

Next Steps

- Dive into all 137 of the Top US Dividend Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WaFd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WAFD

WaFd

Operates as the bank holding company for Washington Federal Bank that provides lending, depository, insurance, and other banking services in the United States.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives