- United States

- /

- Trade Distributors

- /

- NYSE:WSO

3 Dividend Stocks To Consider With Yields Up To 3.7%

Reviewed by Simply Wall St

As the U.S. stock market concludes a volatile week with major indices posting solid gains, investors continue to navigate uncertainties surrounding banking sector health and trade tensions. Amidst this backdrop, dividend stocks present an appealing option for those seeking steady income streams, offering potential stability in turbulent times.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (PEBO) | 5.83% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 4.00% | ★★★★★☆ |

| Heritage Commerce (HTBK) | 5.43% | ★★★★★★ |

| German American Bancorp (GABC) | 3.04% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.29% | ★★★★★★ |

| Ennis (EBF) | 5.81% | ★★★★★★ |

| Employers Holdings (EIG) | 3.10% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 3.89% | ★★★★★☆ |

| DHT Holdings (DHT) | 7.84% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.92% | ★★★★★★ |

Click here to see the full list of 141 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

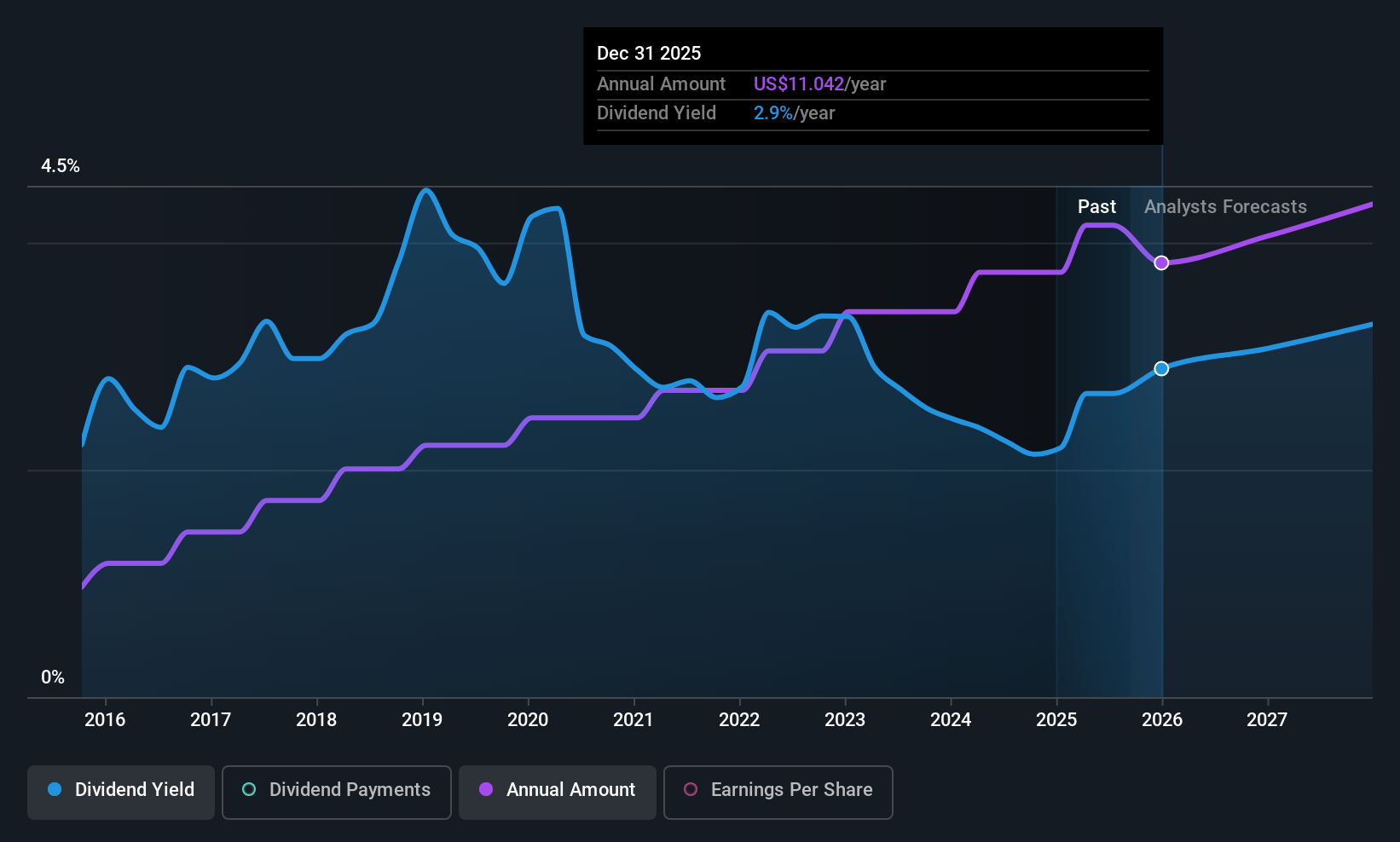

Virginia National Bankshares (VABK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Virginia National Bankshares Corporation, with a market cap of $209.21 million, operates as the holding company for Virginia National Bank, offering a variety of commercial and retail banking products and services in Virginia.

Operations: Virginia National Bankshares Corporation generates its revenue primarily through its banking operations, totaling $54.71 million, and VNB Trust & Estate Services, contributing $0.92 million.

Dividend Yield: 3.7%

Virginia National Bankshares offers a stable dividend yield of 3.71%, supported by a low payout ratio of 40.6%, indicating dividends are well covered by earnings. Despite not being among the top tier for dividend yields in the US, its consistent and growing dividends over the past decade enhance its appeal. Recent earnings growth of 14.5% underscores financial health, though recent removal from the S&P Global BMI Index may affect investor sentiment.

- Take a closer look at Virginia National Bankshares' potential here in our dividend report.

- According our valuation report, there's an indication that Virginia National Bankshares' share price might be on the cheaper side.

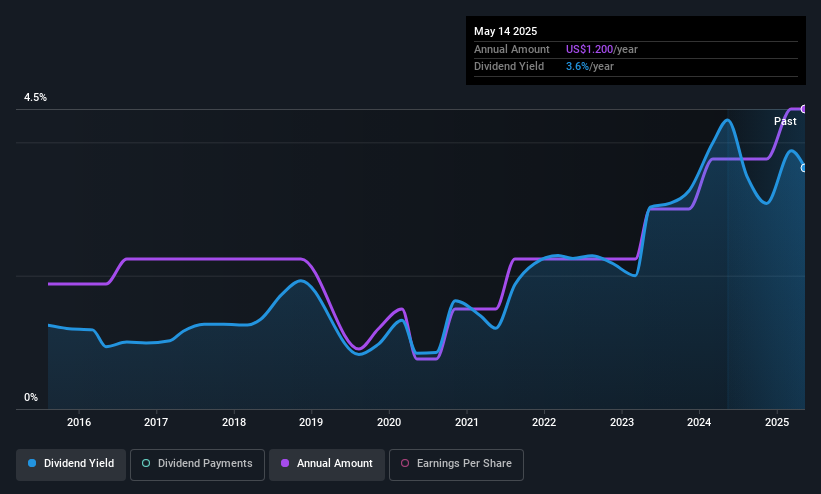

Fresh Del Monte Produce (FDP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fresh Del Monte Produce Inc. is a global company that produces, markets, and distributes fresh and fresh-cut fruits and vegetables across multiple continents, with a market cap of approximately $1.66 billion.

Operations: Fresh Del Monte Produce Inc.'s revenue is primarily derived from Fresh and Value-Added Products at $2.64 billion and Bananas at $1.48 billion, with additional contributions from Other Products and Services totaling $195.90 million.

Dividend Yield: 3.5%

Fresh Del Monte Produce's dividend yield of 3.48% is lower than the top US dividend payers, but its payout ratios of 35.1% for earnings and 39.6% for cash flows suggest sustainability. Despite a volatile dividend history, recent profitability and strategic partnerships, like the joint venture with Managro Group in Colombia and containerized shipping with CMA CGM, bolster growth prospects. These initiatives enhance supply chain efficiency and market presence in high-demand produce categories.

- Click here to discover the nuances of Fresh Del Monte Produce with our detailed analytical dividend report.

- Our valuation report unveils the possibility Fresh Del Monte Produce's shares may be trading at a discount.

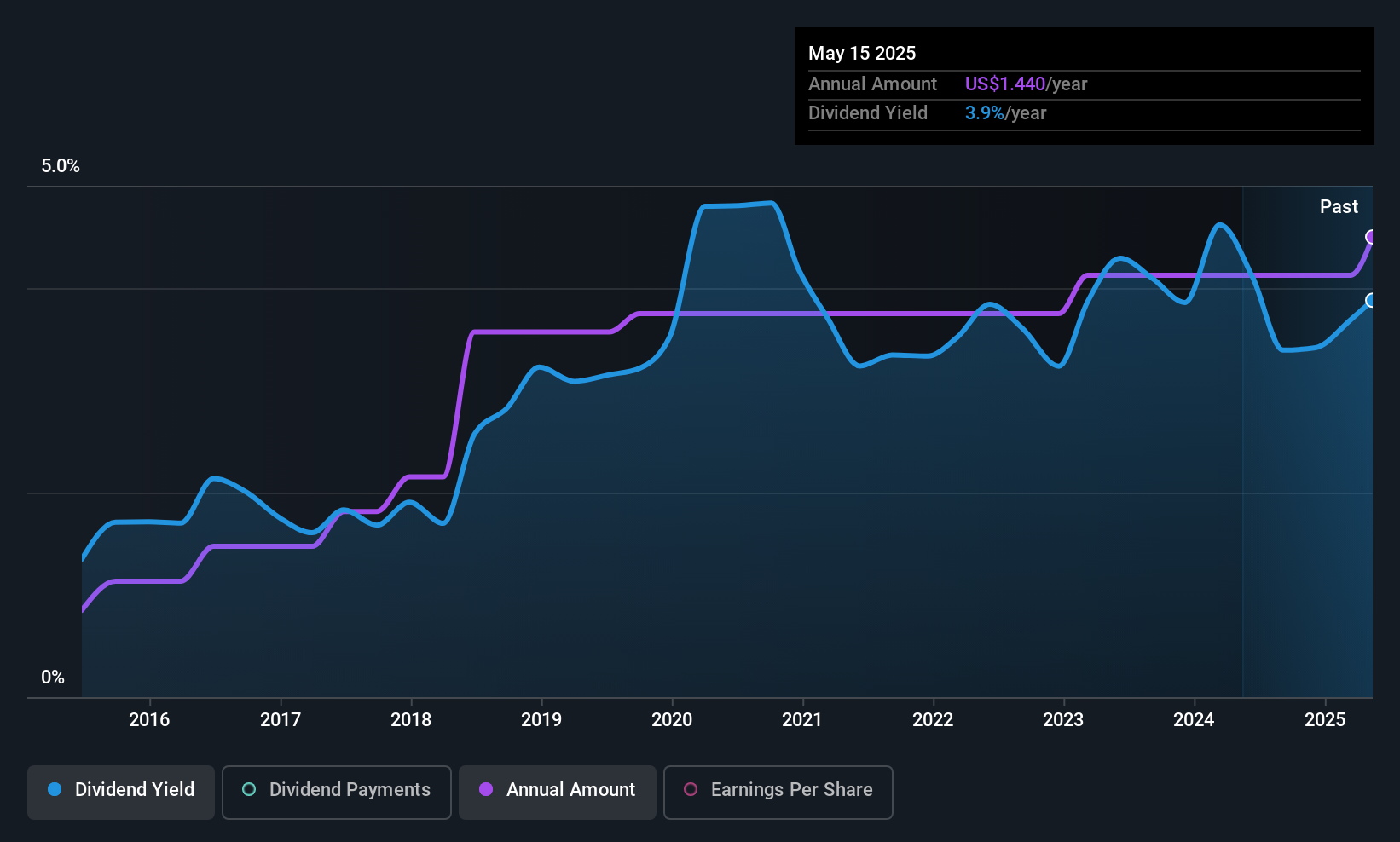

Watsco (WSO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Watsco, Inc. is a distributor of air conditioning, heating, and refrigeration equipment, along with related parts and supplies across the United States, Canada, Latin America, and the Caribbean with a market cap of $14.24 billion.

Operations: Watsco's revenue primarily comes from its wholesale electronics segment, which generated $7.51 billion.

Dividend Yield: 3.2%

Watsco's dividend yield of 3.24% lags behind top US dividend payers, and its high cash payout ratio of 115.4% indicates dividends aren't well covered by cash flows, though earnings cover them at an 84.4% payout ratio. Despite consistent dividend growth over the past decade, sustainability is a concern given limited cash flow coverage. Recent announcements include a quarterly US$3.00 dividend per share payable on October 31, reflecting ongoing commitment to shareholder returns amidst stable earnings performance.

- Click here and access our complete dividend analysis report to understand the dynamics of Watsco.

- According our valuation report, there's an indication that Watsco's share price might be on the expensive side.

Seize The Opportunity

- Click through to start exploring the rest of the 138 Top US Dividend Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Watsco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WSO

Watsco

Engages in the distribution of air conditioning, heating, and refrigeration equipment, and related parts and supplies in the United States, Canada, Latin America, and the Caribbean.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives