- Australia

- /

- Oil and Gas

- /

- ASX:NHC

3 ASX Dividend Stocks Yielding Up To 9%

Reviewed by Simply Wall St

As the Australian market experiences a subdued trading week, with the ASX 200 futures indicating a modest rise and earnings season offering no major surprises, investors are turning their attention to dividend stocks as a potential source of steady income. In such an environment, selecting dividend stocks that offer robust yields can be an attractive strategy for those seeking reliable returns amidst fluctuating market sentiments.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Super Retail Group (ASX:SUL) | 7.34% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.12% | ★★★★★☆ |

| New Hope (ASX:NHC) | 9.03% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.49% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 6.33% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 6.62% | ★★★★★☆ |

| IPH (ASX:IPH) | 6.25% | ★★★★★☆ |

| GWA Group (ASX:GWA) | 5.85% | ★★★★☆☆ |

| Fiducian Group (ASX:FID) | 3.88% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 6.39% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top ASX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Evolution Mining (ASX:EVN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Evolution Mining Limited is involved in the exploration, development, and operation of gold and gold-copper mines in Australia and Canada, with a market cap of A$16.13 billion.

Operations: Evolution Mining Limited generates revenue primarily from its operations at Cowal (A$1.45 billion), Mungari (A$530.15 million), Red Lake (A$566.77 million), Mt Rawdon (A$169.86 million), Northparkes (A$506.39 million), and Ernest Henry (A$980.32 million).

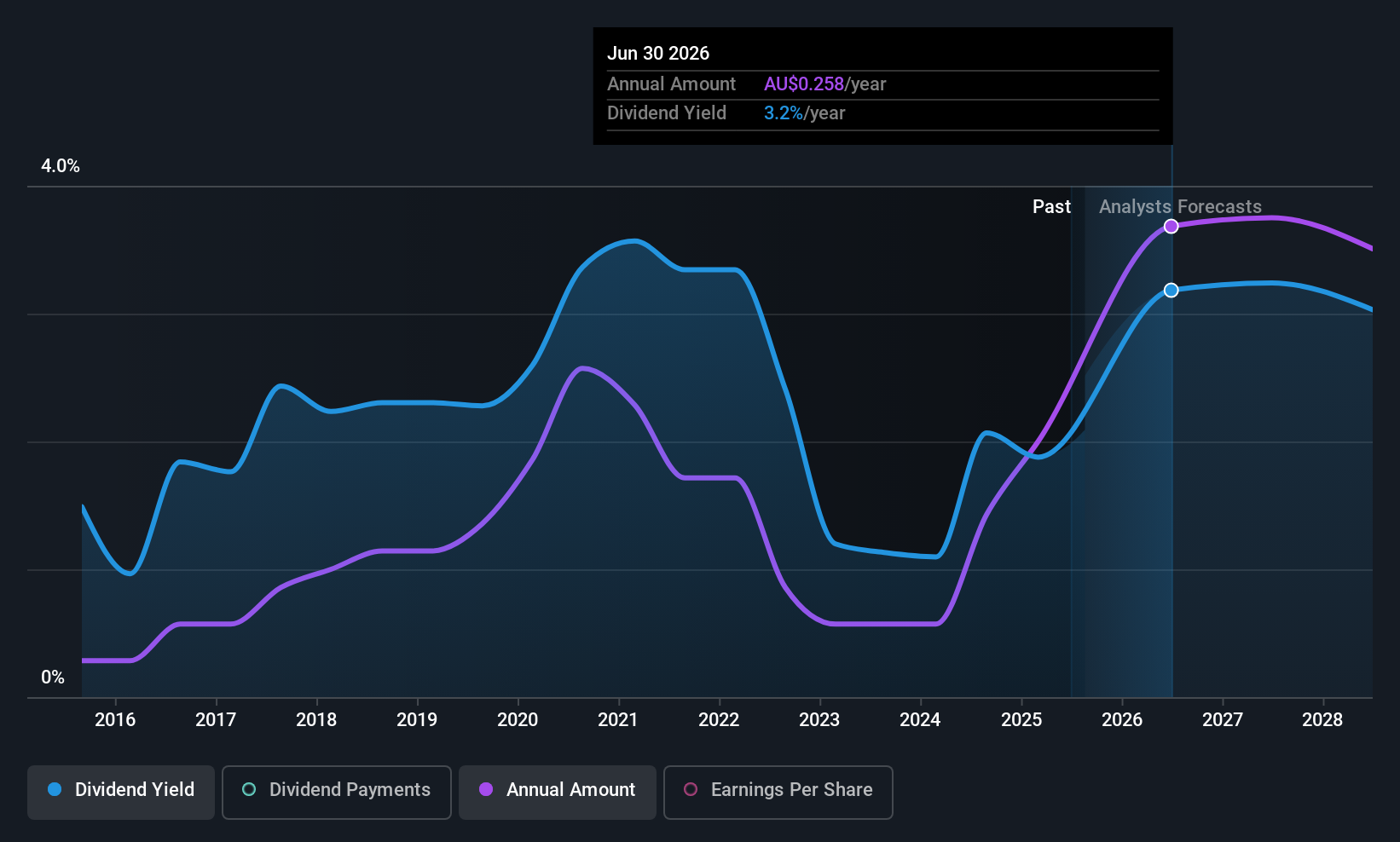

Dividend Yield: 3.2%

Evolution Mining's dividend yield of 3.25% is below the top quartile of Australian dividend payers, yet its low payout ratio (43%) suggests dividends are well-covered by earnings. Despite a history of volatility, recent increases in dividends and strong earnings growth—net income rose to A$926.17 million—indicate potential for stability. The company recently announced a fully franked dividend of A$0.13 per share, reflecting improved financial performance and commitment to shareholder returns despite past inconsistencies.

- Unlock comprehensive insights into our analysis of Evolution Mining stock in this dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Evolution Mining shares in the market.

IPH (ASX:IPH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IPH Limited, along with its subsidiaries, offers intellectual property services and products and has a market capitalization of A$1.46 billion.

Operations: IPH Limited generates revenue through its intellectual property services across various regions, with A$121 million from Asia, A$259.20 million from Canada, and A$300.30 million from Australia and New Zealand.

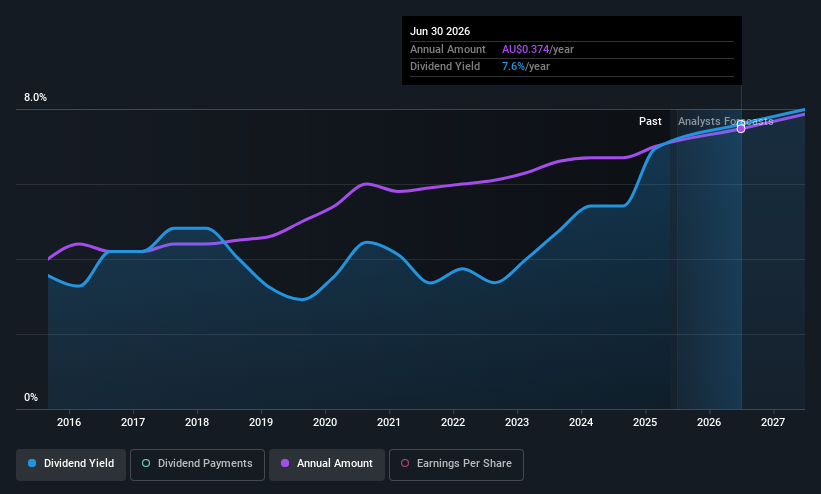

Dividend Yield: 6.2%

IPH's dividend yield of 6.25% ranks in the top quartile of Australian payers, yet its high payout ratio (119.5%) indicates dividends aren't well-covered by earnings, though cash flow coverage is better at 82.8%. Over a decade, dividends have grown steadily with little volatility. Trading significantly below fair value and compared to peers suggests good relative value. Recent board changes and completed share buybacks may influence future strategic direction and shareholder returns.

- Get an in-depth perspective on IPH's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of IPH shares in the market.

New Hope (ASX:NHC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: New Hope Corporation Limited engages in the exploration, development, production, and processing of coal and oil and gas properties with a market cap of A$3.82 billion.

Operations: New Hope Corporation Limited's revenue is primarily derived from its Coal Mining operations in New South Wales, which generated A$1.58 billion, and in Queensland, including Treasury and Investments, which contributed A$315.68 million.

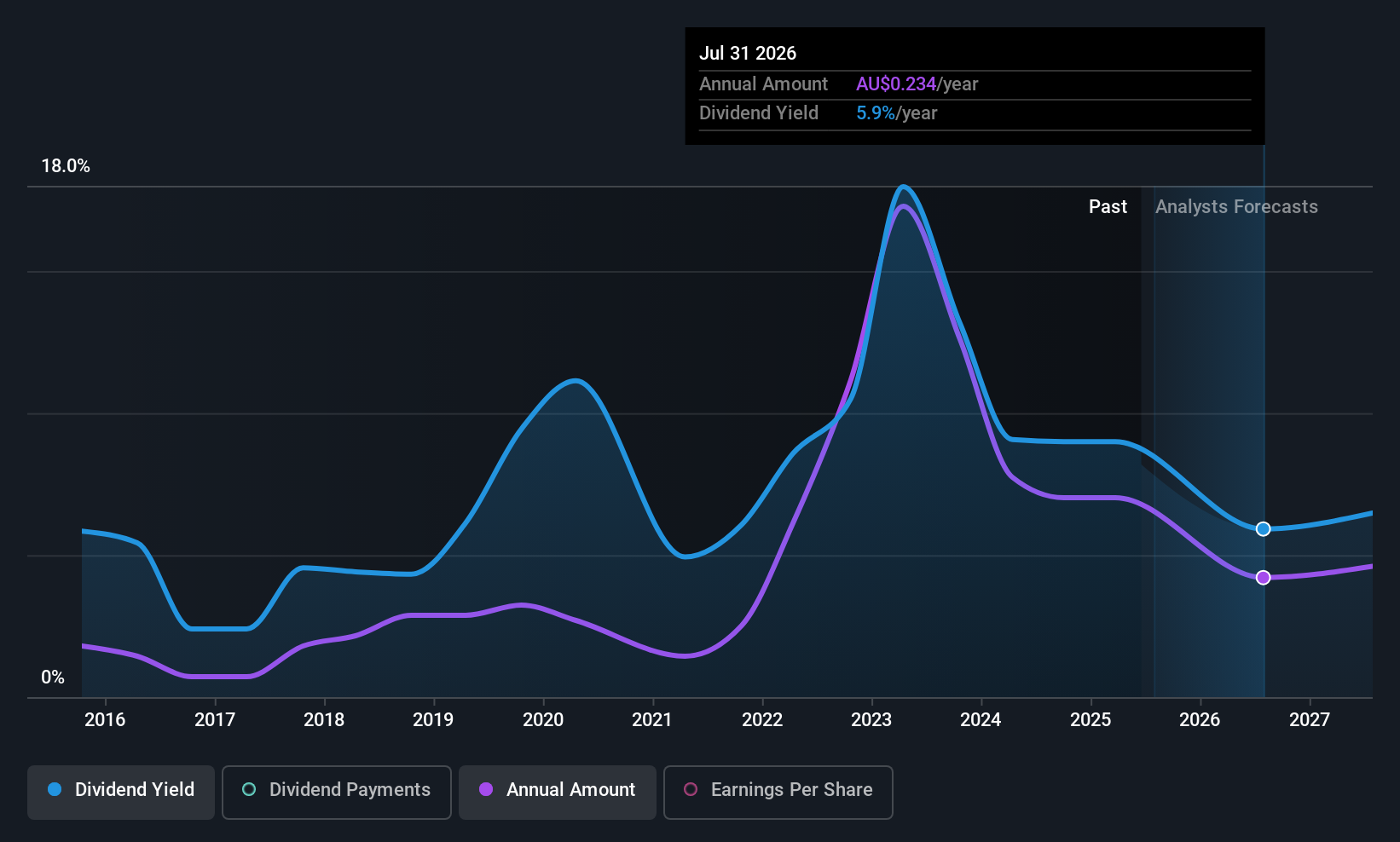

Dividend Yield: 9%

New Hope offers a compelling dividend yield of 9.03%, placing it in the top quartile of Australian dividend payers. Despite past volatility, dividends have grown over the last decade and are covered by earnings (61.4% payout ratio) and cash flows (70.5% cash payout ratio). Trading at 39.4% below estimated fair value suggests good relative value compared to peers, although forecasted earnings declines may impact future payouts' stability and growth potential.

- Click here to discover the nuances of New Hope with our detailed analytical dividend report.

- According our valuation report, there's an indication that New Hope's share price might be on the cheaper side.

Seize The Opportunity

- Click through to start exploring the rest of the 25 Top ASX Dividend Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Hope might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NHC

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives