- Australia

- /

- Consumer Durables

- /

- ASX:FWD

3 ASX Dividend Stocks Yielding Up To 8.6%

Reviewed by Simply Wall St

As Australian markets brace for potential impacts from U.S. tariffs, with the ASX 200 futures reflecting a cautious sentiment, investors are increasingly looking towards dividend stocks as a source of steady income amidst economic uncertainty. In such volatile times, selecting stocks that offer reliable dividends can be an attractive strategy for those seeking to mitigate risk while still participating in market opportunities.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Super Retail Group (ASX:SUL) | 7.85% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.20% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.10% | ★★★★★☆ |

| New Hope (ASX:NHC) | 9.81% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.52% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 6.80% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 6.94% | ★★★★★☆ |

| IPH (ASX:IPH) | 6.67% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 3.92% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 6.69% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top ASX Dividend Stocks screener.

We'll examine a selection from our screener results.

Fleetwood (ASX:FWD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fleetwood Limited, with a market cap of A$244.69 million, operates in Australia and New Zealand focusing on the design, manufacture, sale, and installation of modular accommodation and buildings.

Operations: Fleetwood Limited generates revenue through its RV Solutions segment at A$71.51 million, Building Solutions segment at A$340.12 million, and Community Solutions segment at A$50.02 million.

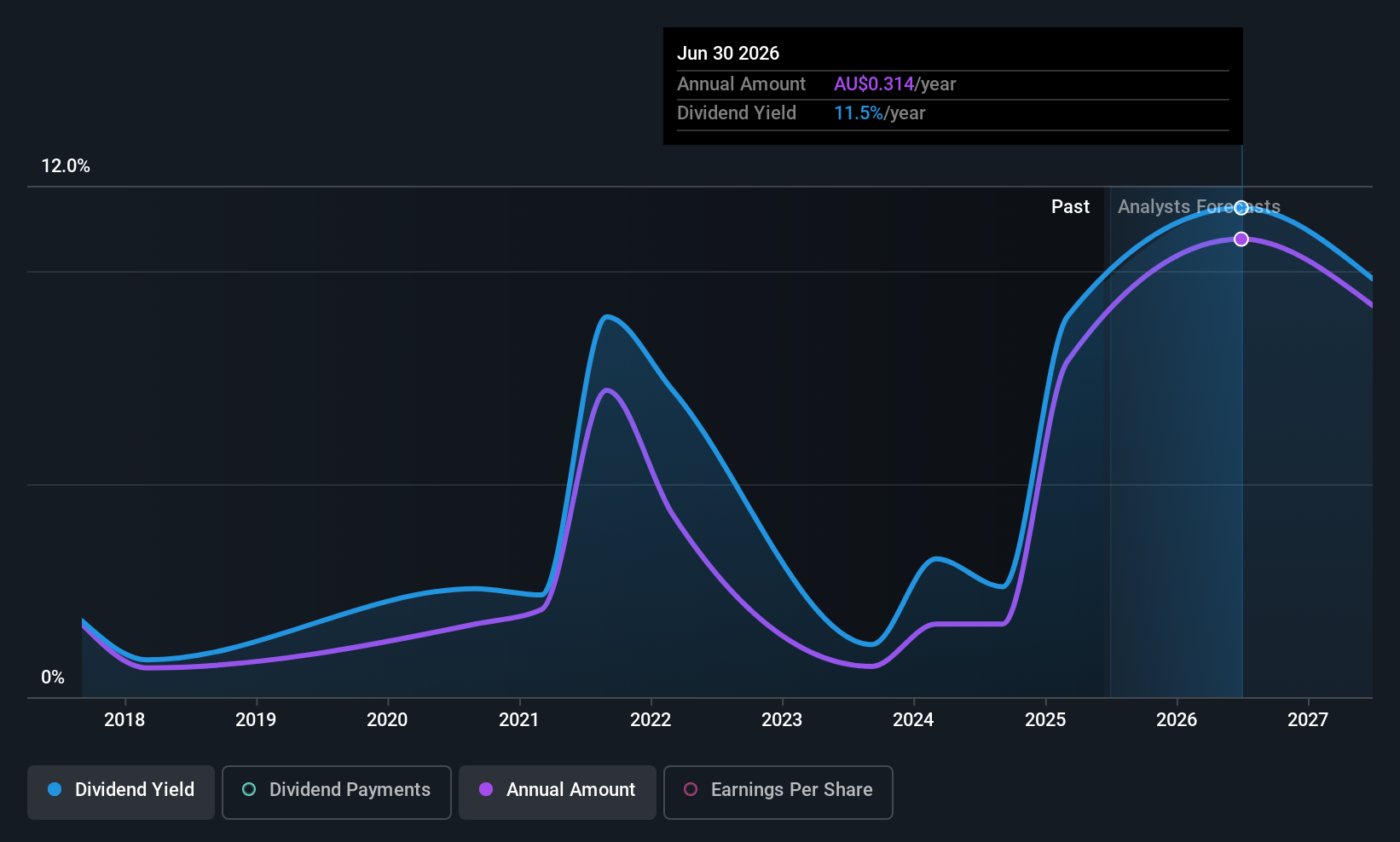

Dividend Yield: 8.7%

Fleetwood's dividend yield of 8.68% ranks in the top 25% of Australian dividend payers, yet its sustainability is questionable due to a high payout ratio of 286.1%, indicating dividends aren't well covered by earnings. Despite trading at a significant discount to estimated fair value, profit margins have declined from last year and dividends have been historically volatile and unreliable. Recent share buybacks totaling A$2.02 million may signal management's confidence but don't directly address dividend stability concerns.

- Get an in-depth perspective on Fleetwood's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Fleetwood's share price might be too optimistic.

Korvest (ASX:KOV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Korvest Ltd, with a market cap of A$154.92 million, manufactures and supplies cable and pipe support systems, fastening solutions, and galvanising services in Australia.

Operations: Korvest Ltd generates its revenue from two main segments: Production, contributing A$10.58 million, and Industrial Products, accounting for A$108.99 million.

Dividend Yield: 5%

Korvest's dividends are reasonably covered by earnings and cash flows, with payout ratios of 58% and 51.3%, respectively. Despite past volatility in dividend payments, the company has announced a final dividend of A$0.40 and a special dividend of A$0.10 for fiscal year 2025, reflecting confidence in its financial position. With a P/E ratio of 11.8x below the market average, Korvest offers value but lacks top-tier yield competitiveness at 4.96%. Recent earnings growth supports future payouts amidst expansion plans funded through cash flow and short-term debt facilities.

- Take a closer look at Korvest's potential here in our dividend report.

- According our valuation report, there's an indication that Korvest's share price might be on the expensive side.

MFF Capital Investments (ASX:MFF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MFF Capital Investments Limited is an investment firm manager with a market capitalization of A$2.66 billion.

Operations: MFF Capital Investments Limited generates revenue primarily through its equity investment segment, amounting to A$1.01 billion.

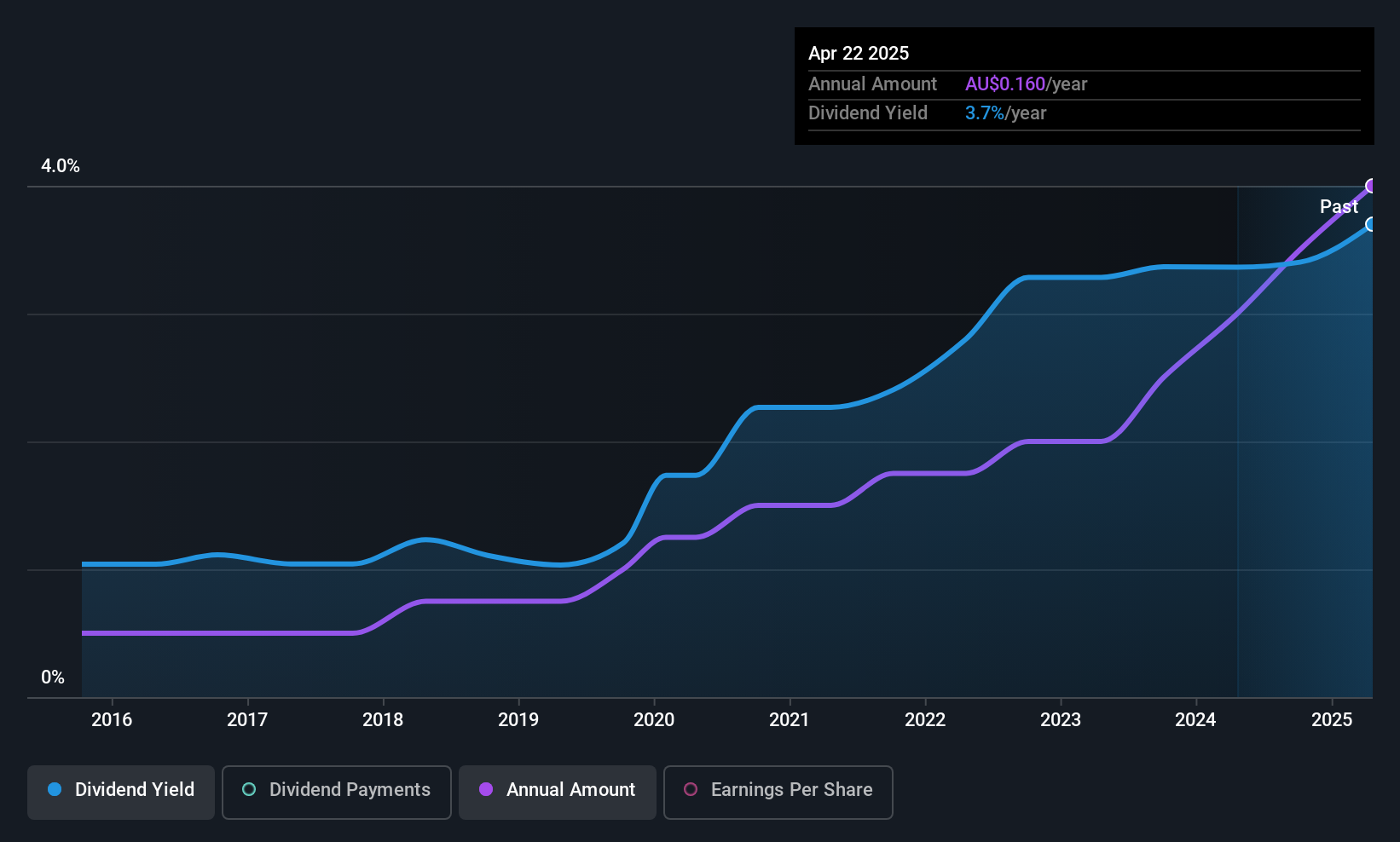

Dividend Yield: 3.5%

MFF Capital Investments offers a reliable dividend, supported by strong earnings and cash flow coverage with payout ratios of 12.7% and 22.9%, respectively. The company's dividends have been stable and growing over the past decade, though its yield of 3.52% is below the top quartile in Australia. Trading at a significant discount to estimated fair value, MFF presents potential for capital appreciation alongside consistent dividend payments backed by recent earnings growth of 51.9%.

- Click here and access our complete dividend analysis report to understand the dynamics of MFF Capital Investments.

- The valuation report we've compiled suggests that MFF Capital Investments' current price could be quite moderate.

Key Takeaways

- Navigate through the entire inventory of 32 Top ASX Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FWD

Fleetwood

Designs, manufactures, sells, and installs modular accommodation and buildings in Australia and New Zealand.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.