- Australia

- /

- Diversified Financial

- /

- ASX:HLI

3 ASX Dividend Stocks With Yields Up To 19.7%

Reviewed by Simply Wall St

As the Australian market navigates through a period of cautious optimism with the ASX teetering around 9,000 points and inflation steady at 3%, investors are keenly observing how these factors might influence future economic decisions. In such a climate, dividend stocks can offer a compelling opportunity for those seeking consistent income, particularly when yields reach impressive levels like up to 19.7%.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Treasury Wine Estates (ASX:TWE) | 5.57% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 5.77% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.70% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.23% | ★★★★★☆ |

| Smartgroup (ASX:SIQ) | 6.27% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.72% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 5.71% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.71% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 3.79% | ★★★★★☆ |

| EQT Holdings (ASX:EQT) | 4.70% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top ASX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

GWA Group (ASX:GWA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GWA Group Limited is involved in the research, design, manufacture, import, and marketing of building fixtures and fittings for residential and commercial properties across Australia, New Zealand, the United Kingdom, and other international markets with a market cap of A$676.27 million.

Operations: GWA Group Limited generates revenue of A$418.48 million from its Water Solutions segment, which involves the provision of building fixtures and fittings across various regions.

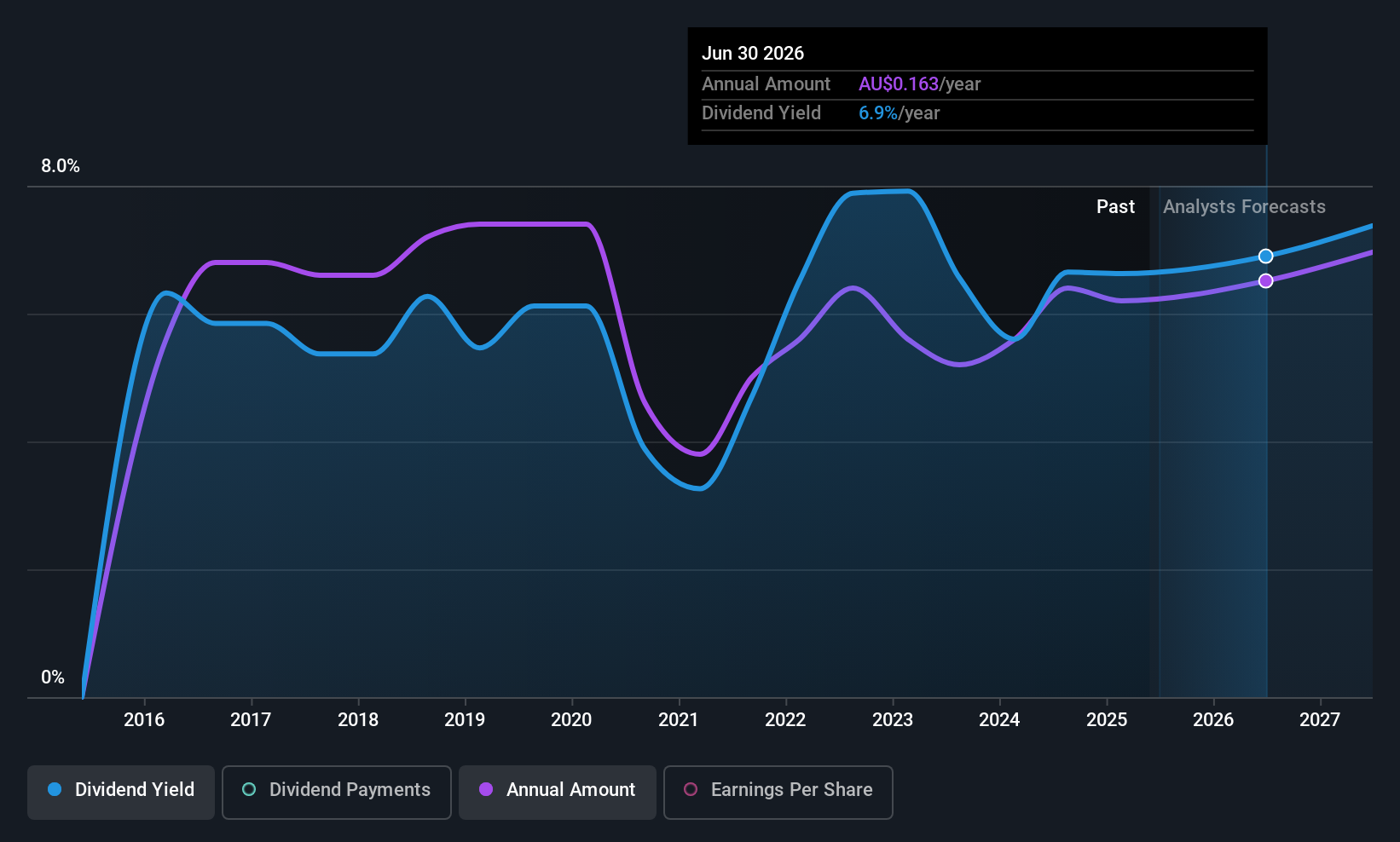

Dividend Yield: 6.1%

GWA Group's dividend yield of 6.05% ranks in the top 25% of Australian payers, yet its high payout ratio (94.8%) suggests dividends are not well covered by earnings, although cash flows provide some support with a cash payout ratio of 61.7%. Despite past volatility and unreliability in dividend payments, GWA has increased dividends over the last decade. Recent events include a share buyback program worth A$30 million for capital management and removal from the S&P Global BMI Index.

- Delve into the full analysis dividend report here for a deeper understanding of GWA Group.

- In light of our recent valuation report, it seems possible that GWA Group is trading behind its estimated value.

Helia Group (ASX:HLI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Helia Group Limited operates in the loan mortgage insurance sector primarily in Australia and has a market capitalization of A$1.55 billion.

Operations: Helia Group Limited generates revenue of A$559.63 million from its operations in the loan mortgage insurance sector within Australia.

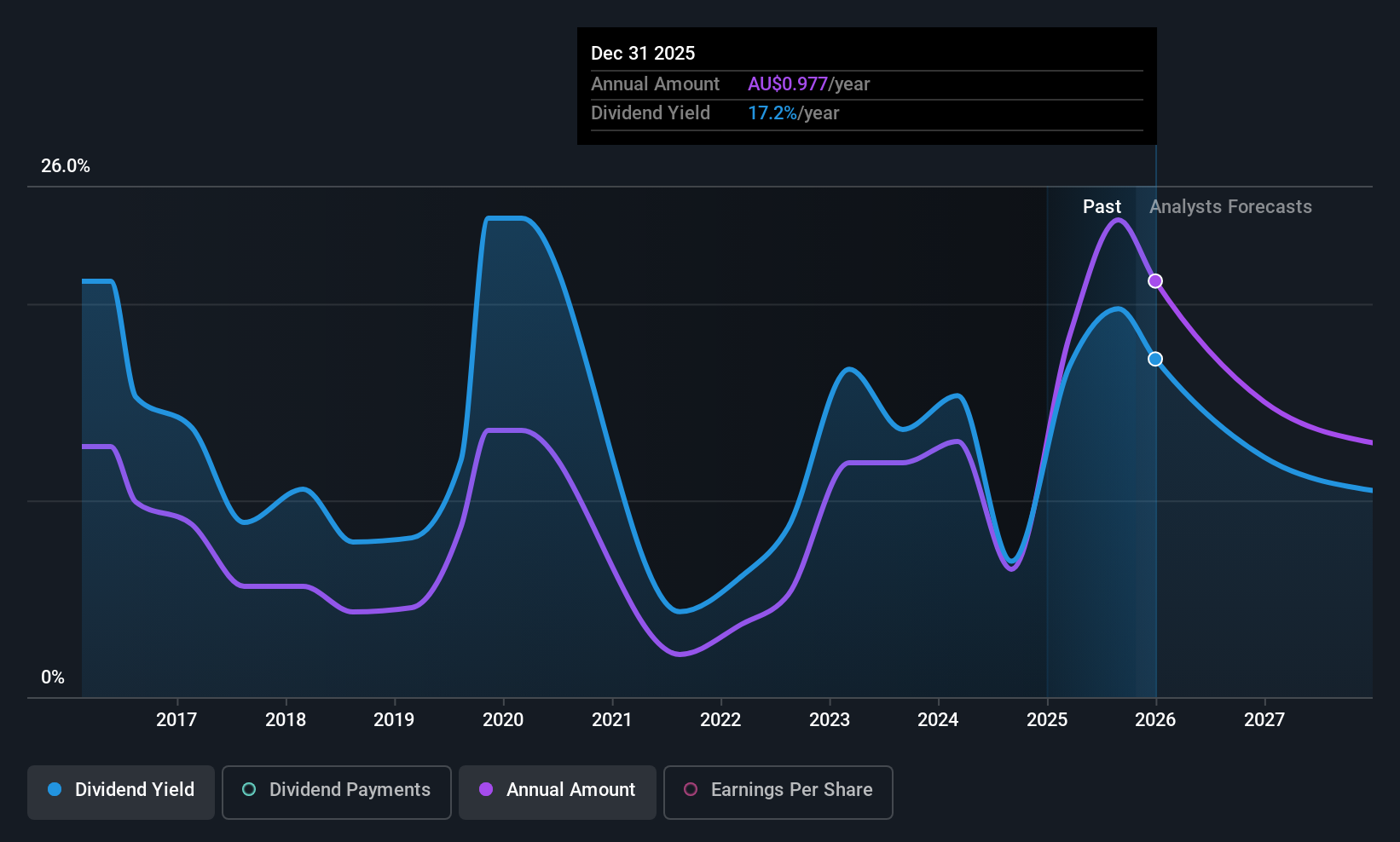

Dividend Yield: 19.7%

Helia Group's dividend yield of 19.72% is among the highest in Australia, but its sustainability is questionable due to a high cash payout ratio of 209.7%. Despite recent increases, dividends have been volatile over the past decade. The company announced both ordinary and special dividends recently, signaling strong current performance with a net income rise to A$133.7 million for H1 2025. Recent buybacks and raised revenue guidance further highlight active capital management strategies.

- Dive into the specifics of Helia Group here with our thorough dividend report.

- Our valuation report unveils the possibility Helia Group's shares may be trading at a discount.

Macquarie Group (ASX:MQG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Macquarie Group Limited is a global financial services provider operating in regions including Australia, New Zealand, the Americas, Europe, the Middle East, Africa, and Asia with a market cap of A$78.71 billion.

Operations: Macquarie Group Limited's revenue is derived from several segments, including Macquarie Capital (A$2.64 billion), Macquarie Asset Management (A$4.22 billion), Banking and Financial Services (A$3.24 billion), Commodities and Global Markets (A$6.02 billion), and Corporate services (A$1.10 billion).

Dividend Yield: 3%

Macquarie Group's dividend yield of 3.01% is lower than the top Australian dividend payers, and its dividends have been volatile over the past decade. Despite a reasonable payout ratio of 66.4%, indicating coverage by earnings, the group's reliance on higher-risk external borrowing for funding raises concerns about sustainability. Recent involvement in advising LA Semiconductor on a major asset sale underscores Macquarie's active role in global financial services, potentially impacting future earnings growth and dividend stability.

- Get an in-depth perspective on Macquarie Group's performance by reading our dividend report here.

- The analysis detailed in our Macquarie Group valuation report hints at an inflated share price compared to its estimated value.

Next Steps

- Unlock our comprehensive list of 30 Top ASX Dividend Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Helia Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HLI

Helia Group

Helia Group Limited, together with its subsidiaries, is involved in the loan mortgage insurance business primarily in Australia.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives