- China

- /

- Entertainment

- /

- SZSE:002602

3 Asian Stocks Estimated To Be Undervalued By Up To 49.3%

Reviewed by Simply Wall St

As global markets navigate a landscape of anticipated rate cuts and technological advancements, Asian indices have shown resilience with notable gains in China and Japan. In this context, discerning investors are on the lookout for undervalued stocks that offer potential growth opportunities amidst economic shifts.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Century Huatong GroupLtd (SZSE:002602) | CN¥19.30 | CN¥38.03 | 49.3% |

| Taiyo Yuden (TSE:6976) | ¥3264.00 | ¥6300.07 | 48.2% |

| Suzhou Alton Electrical & Mechanical Industry (SZSE:301187) | CN¥30.30 | CN¥58.46 | 48.2% |

| SRE Holdings (TSE:2980) | ¥3330.00 | ¥6404.79 | 48% |

| Pansoft (SZSE:300996) | CN¥17.09 | CN¥33.96 | 49.7% |

| Kolmar Korea (KOSE:A161890) | ₩80300.00 | ₩155585.80 | 48.4% |

| Inspur Digital Enterprise Technology (SEHK:596) | HK$9.71 | HK$18.94 | 48.7% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥39.90 | CN¥77.58 | 48.6% |

| Faraday Technology (TWSE:3035) | NT$153.50 | NT$300.64 | 48.9% |

| Anhui Ronds Science & Technology (SHSE:688768) | CN¥49.09 | CN¥97.21 | 49.5% |

Let's review some notable picks from our screened stocks.

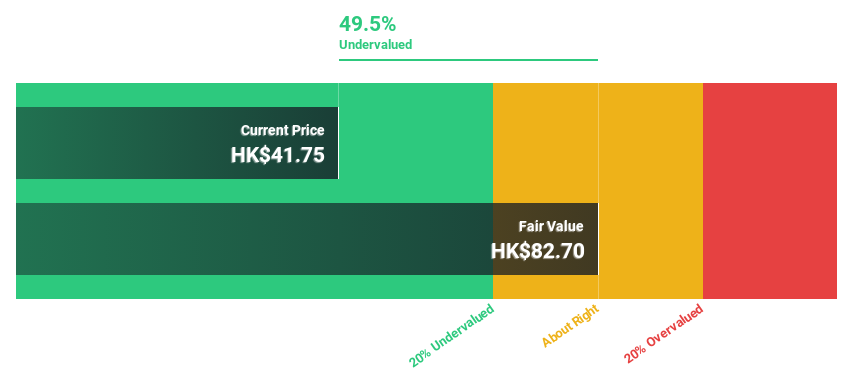

Zhejiang Leapmotor Technology (SEHK:9863)

Overview: Zhejiang Leapmotor Technology Co., Ltd. focuses on the research, development, production, and sale of new energy vehicles both in Mainland China and internationally, with a market cap of HK$90.14 billion.

Operations: The company's revenue primarily comes from the production, research and development, and sales of new energy vehicles, totaling CN¥47.57 billion.

Estimated Discount To Fair Value: 34%

Zhejiang Leapmotor Technology appears undervalued based on discounted cash flow analysis, trading at HK$63.4 against a fair value estimate of HK$96.02. The company is forecasted to achieve high revenue growth of 30.3% annually, outpacing the Hong Kong market, and expects profitability within three years. Recent sales announcements highlight robust performance with August 2025 sales reaching a record high, while recent private placements raised CNY 2.6 billion to support future growth initiatives.

- Our growth report here indicates Zhejiang Leapmotor Technology may be poised for an improving outlook.

- Dive into the specifics of Zhejiang Leapmotor Technology here with our thorough financial health report.

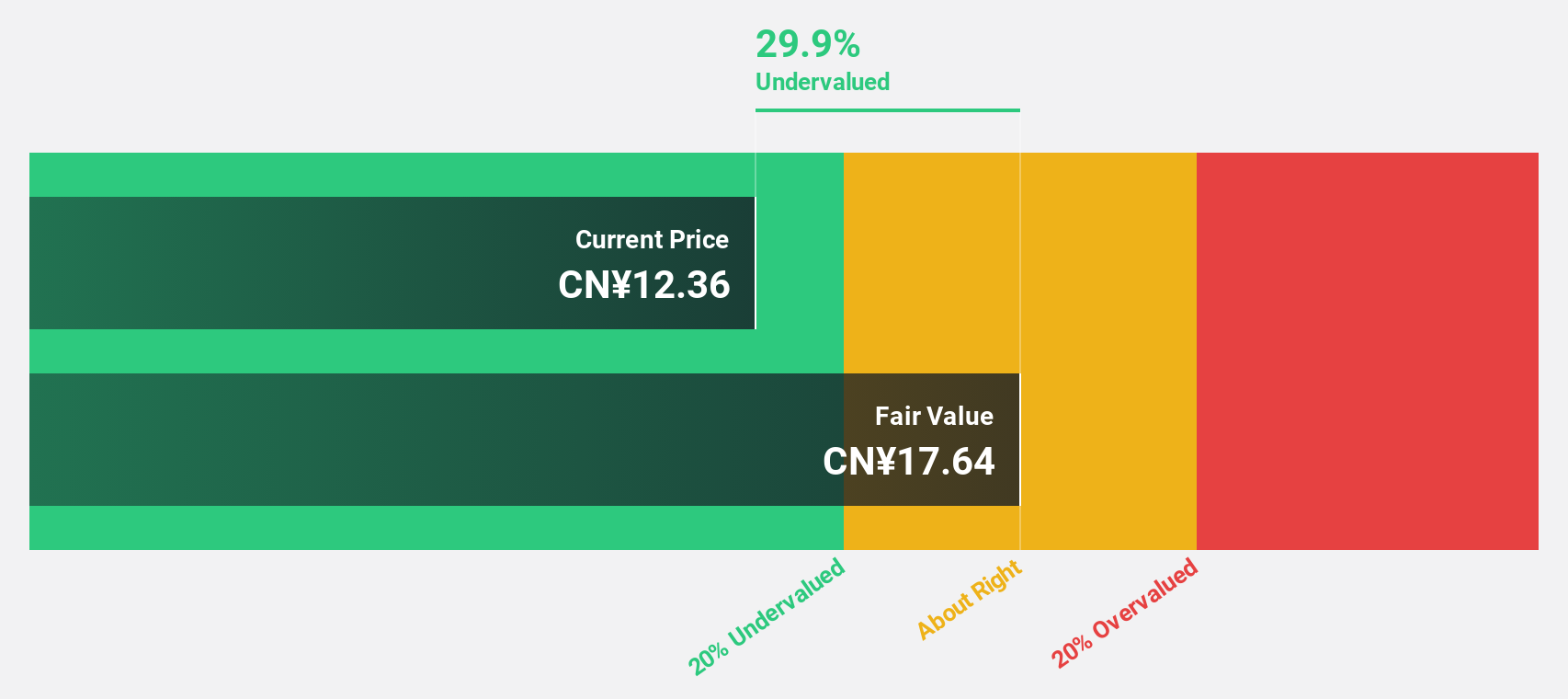

Zhejiang Century Huatong GroupLtd (SZSE:002602)

Overview: Zhejiang Century Huatong Group Co., Ltd operates in the auto parts, Internet games, and cloud data sectors both in China and internationally, with a market cap of approximately CN¥141.93 billion.

Operations: The company generates revenue from its operations in auto parts, Internet games, and cloud data services across domestic and international markets.

Estimated Discount To Fair Value: 49.3%

Zhejiang Century Huatong Group Ltd. is trading at CN¥19.3, significantly below its estimated fair value of CN¥38.03, suggesting it may be undervalued based on cash flows. The company reported strong earnings growth with net income reaching CN¥2.66 billion for the first half of 2025, up from CN¥1.16 billion a year ago, despite volatile share prices and large one-off items affecting results. Earnings are projected to grow faster than the Chinese market average over the next few years.

- Our comprehensive growth report raises the possibility that Zhejiang Century Huatong GroupLtd is poised for substantial financial growth.

- Navigate through the intricacies of Zhejiang Century Huatong GroupLtd with our comprehensive financial health report here.

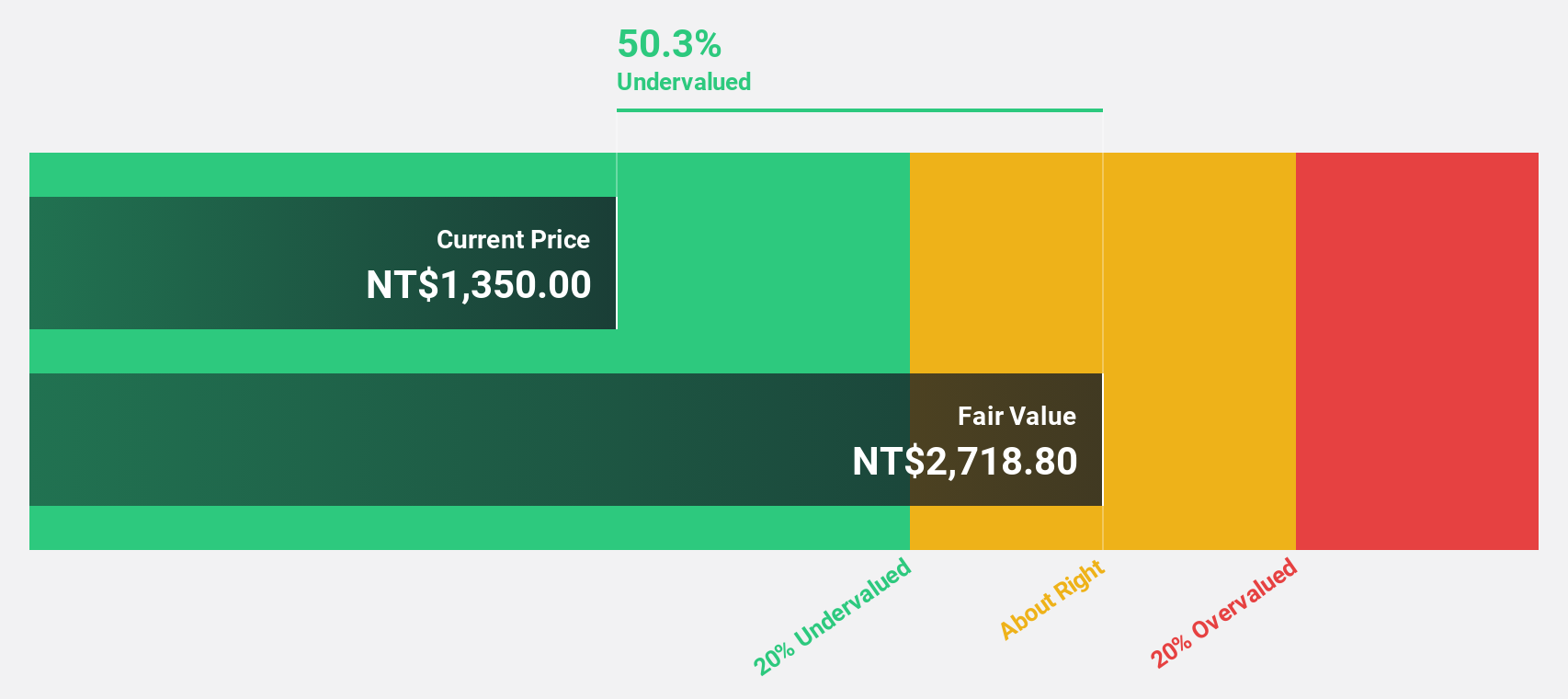

Lotes (TWSE:3533)

Overview: Lotes Co., Ltd. designs, manufactures, and sells electronic interconnect and hardware components in Taiwan, Mainland China, and internationally with a market cap of NT$185.81 billion.

Operations: The company generates its revenue primarily from the Electronic Components & Parts segment, totaling NT$32.47 billion.

Estimated Discount To Fair Value: 42.6%

Lotes is trading at NT$1660, substantially below its estimated fair value of NT$2892.16, reflecting potential undervaluation based on cash flows. Despite a decline in net income to TWD 749.04 million from TWD 2,236.78 million year-on-year for Q2 2025, earnings are expected to grow significantly at 23.3% annually over the next three years, outpacing the Taiwan market average growth rate of 16.9%. However, its dividend track record remains unstable.

- Insights from our recent growth report point to a promising forecast for Lotes' business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Lotes.

Turning Ideas Into Actions

- Embark on your investment journey to our 273 Undervalued Asian Stocks Based On Cash Flows selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Century Huatong GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002602

Zhejiang Century Huatong GroupLtd

Engages in the auto parts, Internet games, and cloud data businesses in China and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives