3 Asian Stocks Estimated To Be Trading At Up To 38.4% Below Fair Value

Reviewed by Simply Wall St

As global markets respond positively to new trade deals and economic indicators, Asian stocks are capturing attention with their potential value. In this environment, identifying undervalued stocks can offer opportunities for investors seeking to capitalize on discrepancies between market prices and perceived intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhuhai CosMX Battery (SHSE:688772) | CN¥14.07 | CN¥27.82 | 49.4% |

| SpiderPlus (TSE:4192) | ¥498.00 | ¥993.27 | 49.9% |

| Shenzhen Envicool Technology (SZSE:002837) | CN¥31.65 | CN¥62.15 | 49.1% |

| Range Intelligent Computing Technology Group (SZSE:300442) | CN¥51.51 | CN¥101.65 | 49.3% |

| Polaris Holdings (TSE:3010) | ¥221.00 | ¥433.91 | 49.1% |

| HL Holdings (KOSE:A060980) | ₩40950.00 | ₩81254.09 | 49.6% |

| HDC Hyundai Development (KOSE:A294870) | ₩23000.00 | ₩45711.05 | 49.7% |

| GEM (SZSE:002340) | CN¥6.68 | CN¥13.13 | 49.1% |

| Forum Engineering (TSE:7088) | ¥1206.00 | ¥2404.16 | 49.8% |

| cottaLTD (TSE:3359) | ¥433.00 | ¥851.54 | 49.2% |

Here's a peek at a few of the choices from the screener.

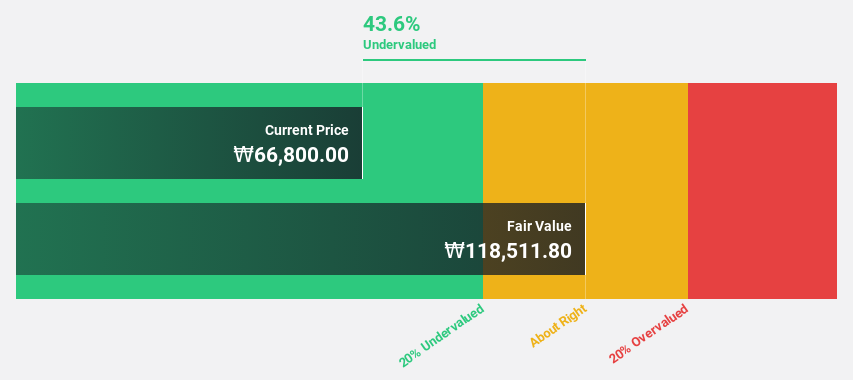

Sanil Electric (KOSE:A062040)

Overview: Sanil Electric Co., Ltd. manufactures and sells transformers in Korea and internationally, with a market cap of ₩3.01 billion.

Operations: Sanil Electric's revenue is primarily derived from its Electric Equipment segment, totaling ₩362.18 million.

Estimated Discount To Fair Value: 10.5%

Sanil Electric, trading at ₩98,900, is considered undervalued with a fair value estimate of ₩110,444.76. The company's earnings are projected to grow significantly at 23.7% annually over the next three years, outpacing the Korean market average of 20.9%. Revenue growth is also expected to exceed market averages at 22.4% per year. Despite high non-cash earnings and a strong forecasted return on equity of 27%, its undervaluation margin remains modest at 10.5%.

- The analysis detailed in our Sanil Electric growth report hints at robust future financial performance.

- Dive into the specifics of Sanil Electric here with our thorough financial health report.

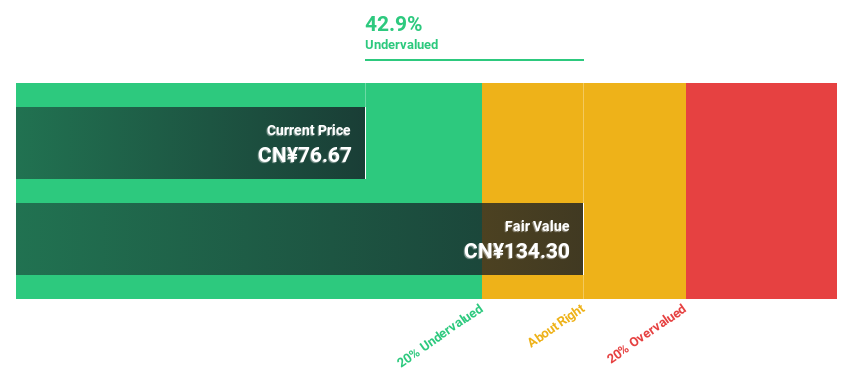

BMC Medical (SZSE:301367)

Overview: BMC Medical Co., Ltd. focuses on the research, development, manufacturing, and supply of respiratory health medical equipment and consumables in China with a market cap of CN¥7.91 billion.

Operations: The company's revenue primarily comes from its Surgical & Medical Equipment segment, which generated CN¥915.44 million.

Estimated Discount To Fair Value: 36.1%

BMC Medical is trading at CN¥88.99, significantly undervalued with a fair value estimate of CN¥139.29, offering potential for investors focused on cash flow valuation. Despite low forecasted return on equity of 10% in three years, its earnings are expected to grow robustly at 27.5% annually, outpacing the Chinese market's average growth rate. Recent product-related announcements highlight BMC's expanding international presence and innovation in digital health solutions, potentially enhancing future revenue streams.

- The growth report we've compiled suggests that BMC Medical's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of BMC Medical.

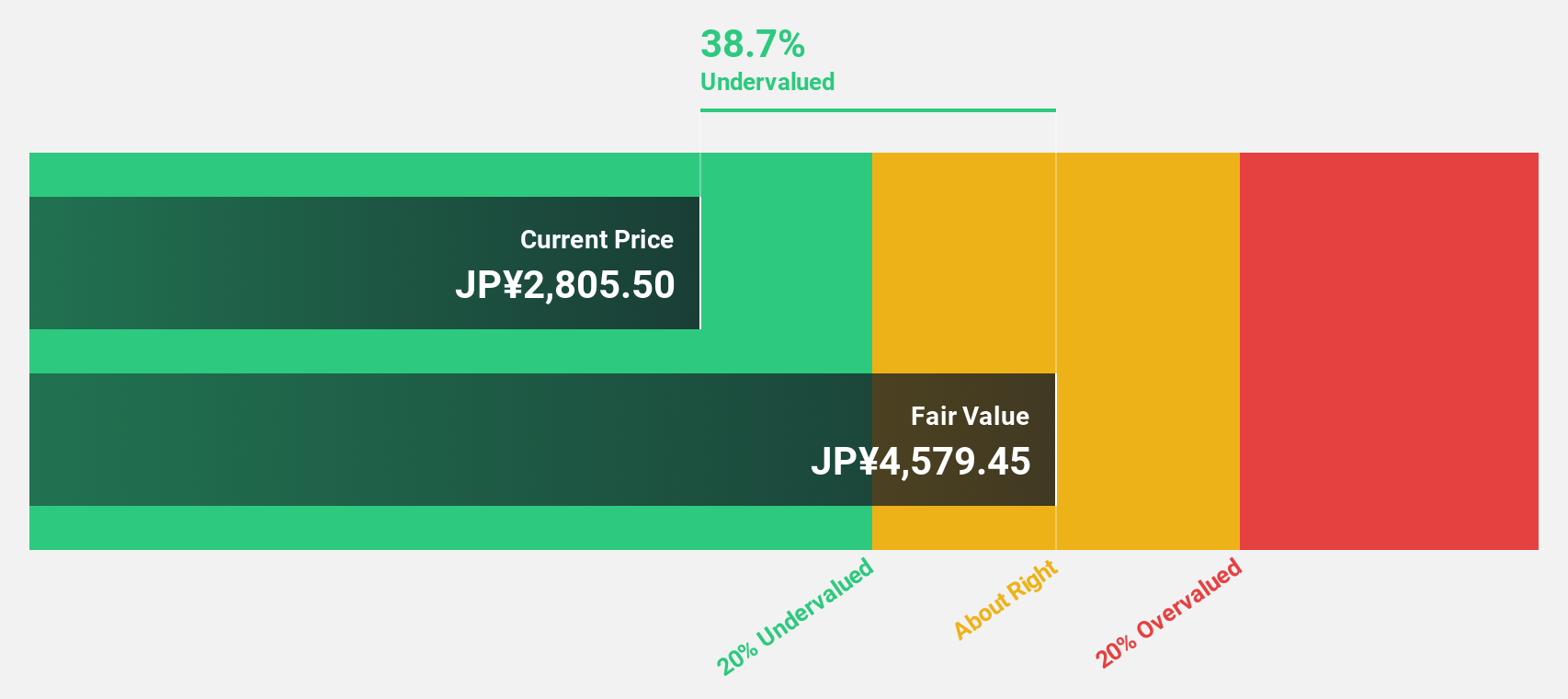

Fuji (TSE:6134)

Overview: Fuji Corporation, with a market cap of ¥246.79 billion, manufactures and sells machines and machine tools in Japan.

Operations: The company's revenue is primarily derived from its Robotic Solutions segment at ¥114.21 billion and Machine Tools segment at ¥11.09 billion.

Estimated Discount To Fair Value: 38.4%

Fuji, trading at ¥2808, is significantly undervalued with a fair value estimate of ¥4558.69. Its earnings are forecasted to grow at 20.8% annually, surpassing the Japanese market average. Despite a low future return on equity of 9.4%, revenue growth is expected to outpace the market at 9.5% per year. Recent completion of a share buyback program and stable dividend affirmations reflect strategic financial management aimed at enhancing shareholder value amidst leadership changes.

- Our growth report here indicates Fuji may be poised for an improving outlook.

- Click here to discover the nuances of Fuji with our detailed financial health report.

Where To Now?

- Discover the full array of 263 Undervalued Asian Stocks Based On Cash Flows right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6134

Fuji

Manufactures and sells electronic component mounting robots and machine tools in Japan.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives