3 Asian Stocks Estimated To Be Trading At Discounts Of Up To 47.8%

Reviewed by Simply Wall St

As global markets continue to navigate trade negotiations and economic shifts, investors are increasingly turning their attention to Asia, where opportunities may be emerging amidst the volatility. Identifying undervalued stocks in this region involves looking for companies that exhibit strong fundamentals and potential for growth, even as broader market conditions fluctuate.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wenzhou Yihua Connector (SZSE:002897) | CN¥38.16 | CN¥75.78 | 49.6% |

| Taiyo Yuden (TSE:6976) | ¥2602.00 | ¥5175.73 | 49.7% |

| Taiwan Union Technology (TPEX:6274) | NT$230.50 | NT$459.98 | 49.9% |

| Shanghai Conant Optical (SEHK:2276) | HK$36.80 | HK$73.36 | 49.8% |

| Prospect Logistics and Industrial Freehold and Leasehold Real Estate Investment Trust (SET:PROSPECT) | THB7.20 | THB14.33 | 49.7% |

| KeePer Technical Laboratory (TSE:6036) | ¥3390.00 | ¥6741.63 | 49.7% |

| Giant Biogene Holding (SEHK:2367) | HK$54.75 | HK$108.84 | 49.7% |

| Duk San NeoluxLtd (KOSDAQ:A213420) | ₩33450.00 | ₩66758.79 | 49.9% |

| Dive (TSE:151A) | ¥925.00 | ¥1837.79 | 49.7% |

| BalnibarbiLtd (TSE:3418) | ¥1178.00 | ¥2324.94 | 49.3% |

Here's a peek at a few of the choices from the screener.

Innovent Biologics (SEHK:1801)

Overview: Innovent Biologics, Inc. is a biopharmaceutical company focused on the research and development of antibody and protein medicine products across China, the United States, and internationally, with a market cap of approximately HK$139.72 billion.

Operations: The company's revenue segment in biotechnology amounts to CN¥9.42 billion.

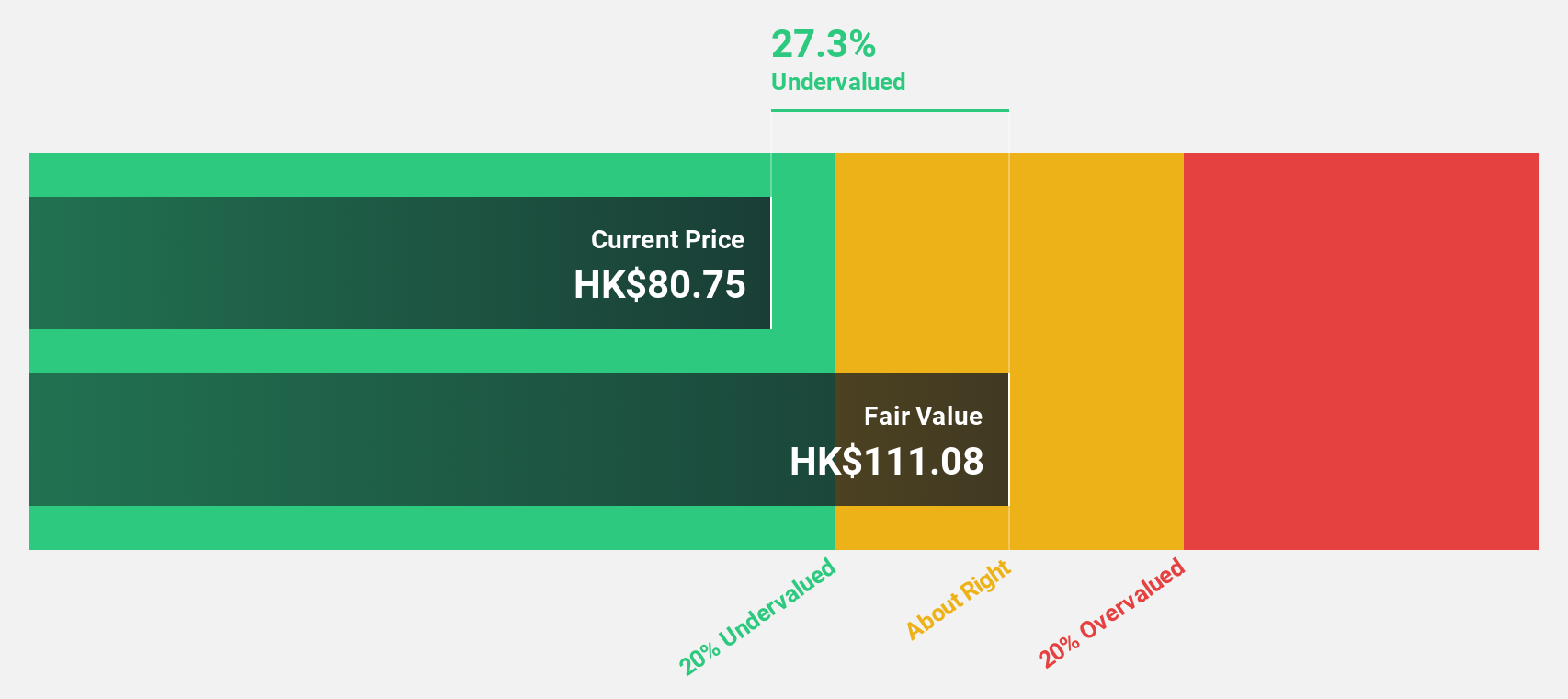

Estimated Discount To Fair Value: 31.5%

Innovent Biologics is trading at HK$84.6, significantly below its estimated fair value of HK$123.54, suggesting potential undervaluation based on cash flows. Despite a forecasted low return on equity of 13.5% in three years, the company anticipates revenue growth exceeding the Hong Kong market average and expects to achieve profitability within three years. Recent approval of mazdutide for weight management in China could enhance future cash flows amid increasing obesity-related health concerns.

- Insights from our recent growth report point to a promising forecast for Innovent Biologics' business outlook.

- Take a closer look at Innovent Biologics' balance sheet health here in our report.

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990)

Overview: Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of novel drugs in oncology and immunology, with a market cap of approximately HK$79.85 billion.

Operations: The company's revenue is primarily derived from its Pharmaceuticals segment, which generated approximately CN¥1.93 billion.

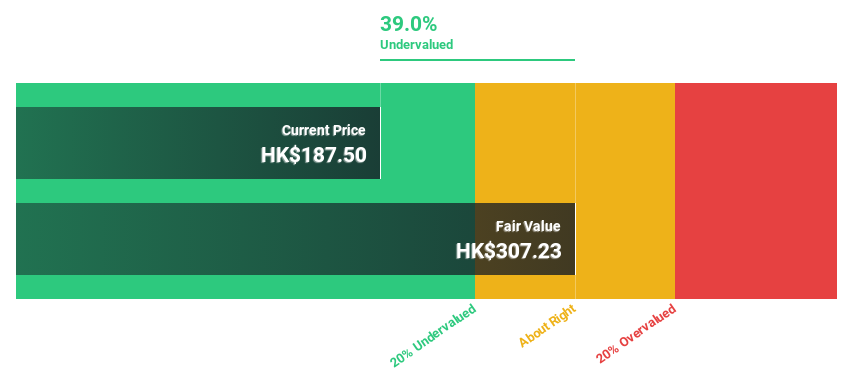

Estimated Discount To Fair Value: 37%

Sichuan Kelun-Biotech Biopharmaceutical is trading at HK$349.4, well below its estimated fair value of HK$554.89, reflecting potential undervaluation based on cash flows. The company anticipates becoming profitable within three years and forecasts revenue growth of 28.2% annually, outpacing the Hong Kong market. Despite recent share price volatility, advancements in antibody-drug conjugate therapies and successful equity offerings bolster its financial position and future growth prospects in the biopharmaceutical sector.

- Our comprehensive growth report raises the possibility that Sichuan Kelun-Biotech Biopharmaceutical is poised for substantial financial growth.

- Navigate through the intricacies of Sichuan Kelun-Biotech Biopharmaceutical with our comprehensive financial health report here.

Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266)

Overview: Suzhou Zelgen Biopharmaceuticals Co., Ltd. is a company engaged in the research, development, and commercialization of biopharmaceutical products, with a market cap of CN¥30.72 billion.

Operations: The company's revenue is primarily derived from its pharmaceuticals segment, totaling CN¥592.35 million.

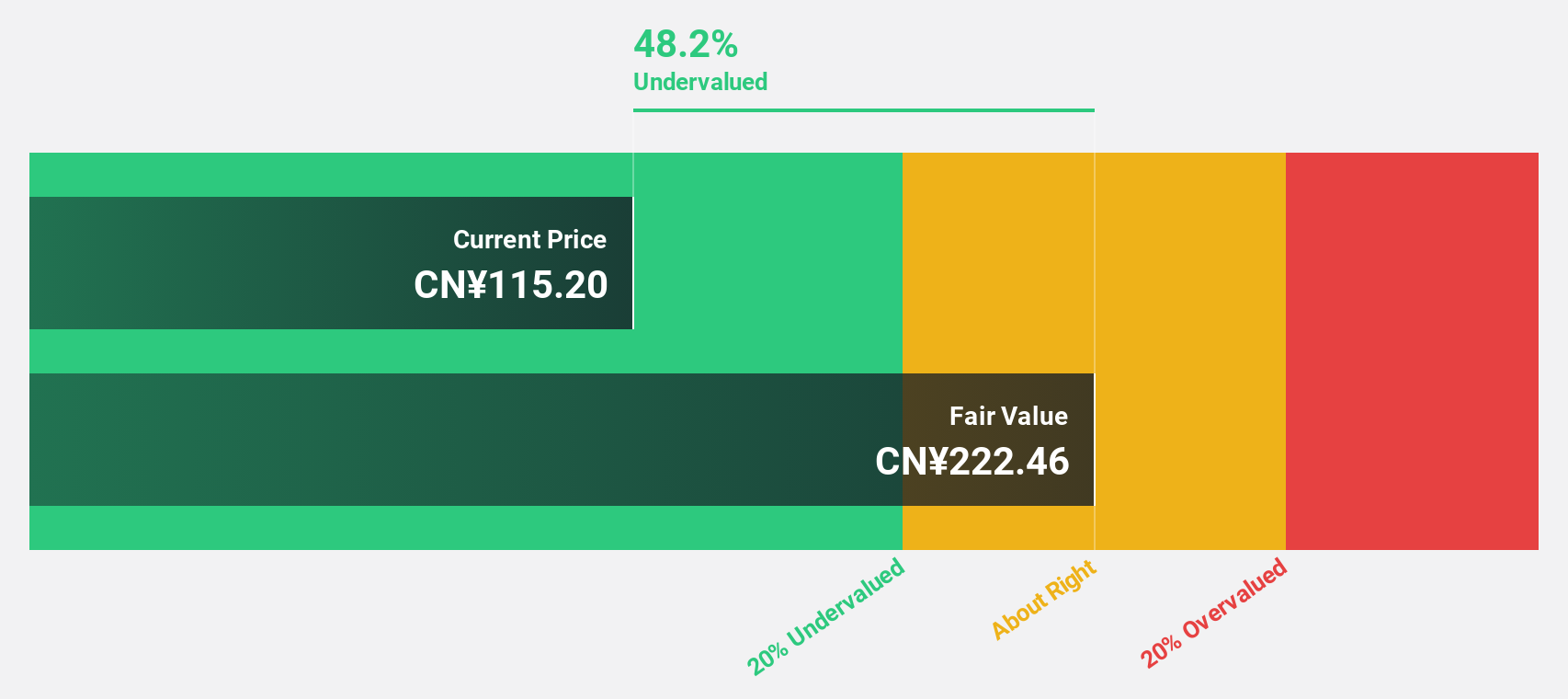

Estimated Discount To Fair Value: 47.8%

Suzhou Zelgen Biopharmaceuticals, trading at CN¥116.05, is significantly undervalued compared to its estimated fair value of CN¥222.46. The company forecasts robust annual revenue growth of 45.4%, surpassing the broader Chinese market's expectations, and aims for profitability within three years. Despite recent share price volatility, its addition to the Shanghai Stock Exchange Health Care Sector Index enhances visibility and potential investor interest in this biopharmaceutical firm focused on innovative treatments.

- Upon reviewing our latest growth report, Suzhou Zelgen BiopharmaceuticalsLtd's projected financial performance appears quite optimistic.

- Dive into the specifics of Suzhou Zelgen BiopharmaceuticalsLtd here with our thorough financial health report.

Make It Happen

- Click here to access our complete index of 268 Undervalued Asian Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1801

Innovent Biologics

A biopharmaceutical company, engages in the research and development of antibody and protein medicine products in the People’s Republic of China, the United States, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives