As global markets navigate a complex landscape of economic indicators and geopolitical tensions, Asia's stock markets have shown resilience, with China's recent gains reflecting hopes for governmental stimulus. In this environment, dividend stocks can offer investors a way to generate income while potentially benefiting from the region's economic dynamics.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.48% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.08% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.10% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.41% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.58% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.29% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.19% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.35% | ★★★★★★ |

| Daicel (TSE:4202) | 4.91% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.83% | ★★★★★★ |

Click here to see the full list of 1240 stocks from our Top Asian Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

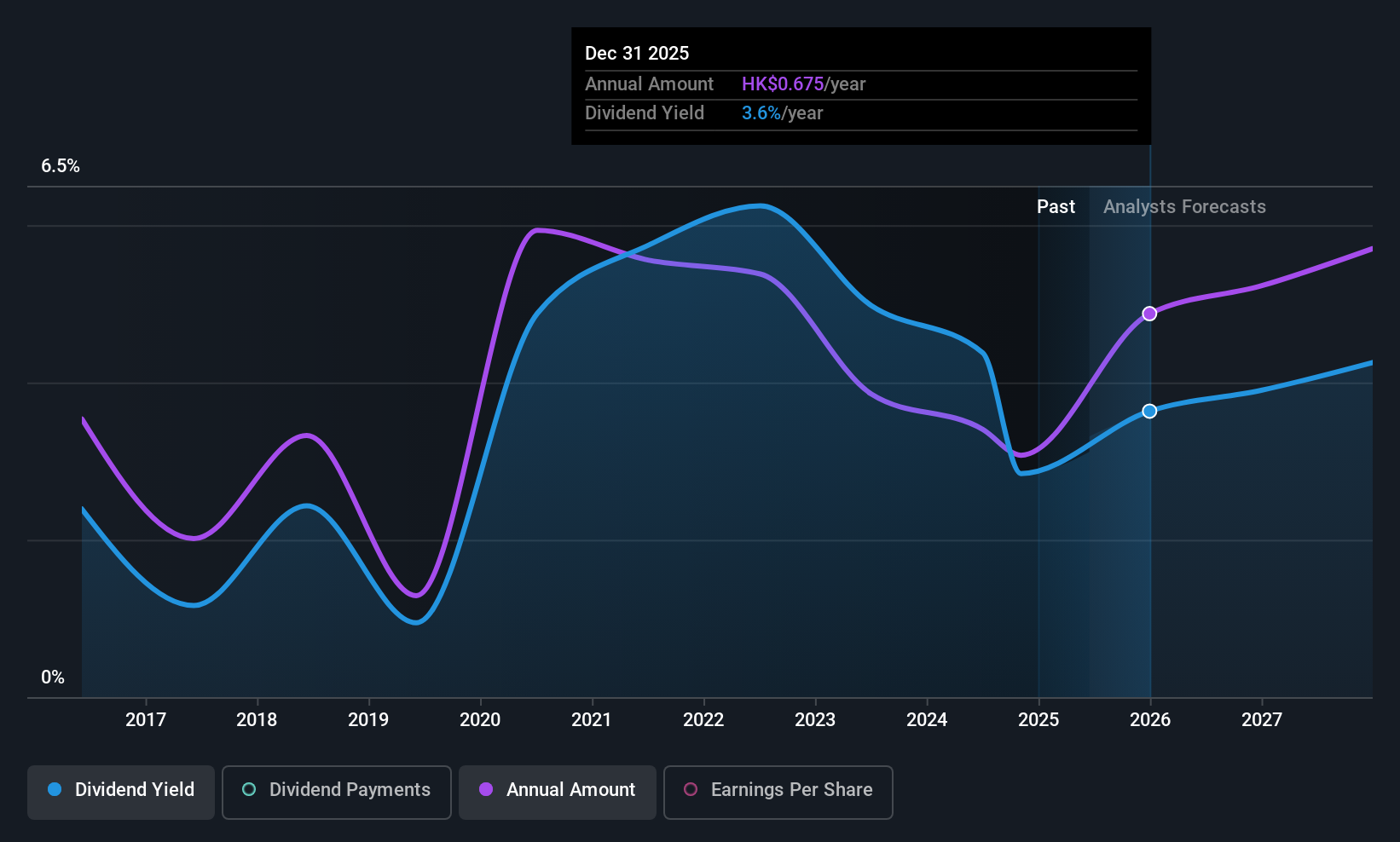

China Life Insurance (SEHK:2628)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Life Insurance Company Limited, along with its subsidiaries, operates as a life insurance company in the People’s Republic of China and has a market cap of approximately HK$1.06 trillion.

Operations: China Life Insurance Company Limited generates its revenue primarily from life insurance operations in the People’s Republic of China.

Dividend Yield: 4%

China Life Insurance's dividend payments are well-covered by both earnings and cash flows, with a low payout ratio of 16% and a cash payout ratio of 4.8%. Despite recent earnings growth, the company's dividend track record is unstable and has been unreliable over the past decade. Although trading below estimated fair value, its dividend yield of 3.99% is modest compared to top-tier payers in Hong Kong. Recent Q1 net income rose significantly to CNY 28.80 billion from CNY 20.64 billion last year, indicating robust financial performance despite volatility concerns in dividends.

- Click here to discover the nuances of China Life Insurance with our detailed analytical dividend report.

- Our valuation report unveils the possibility China Life Insurance's shares may be trading at a discount.

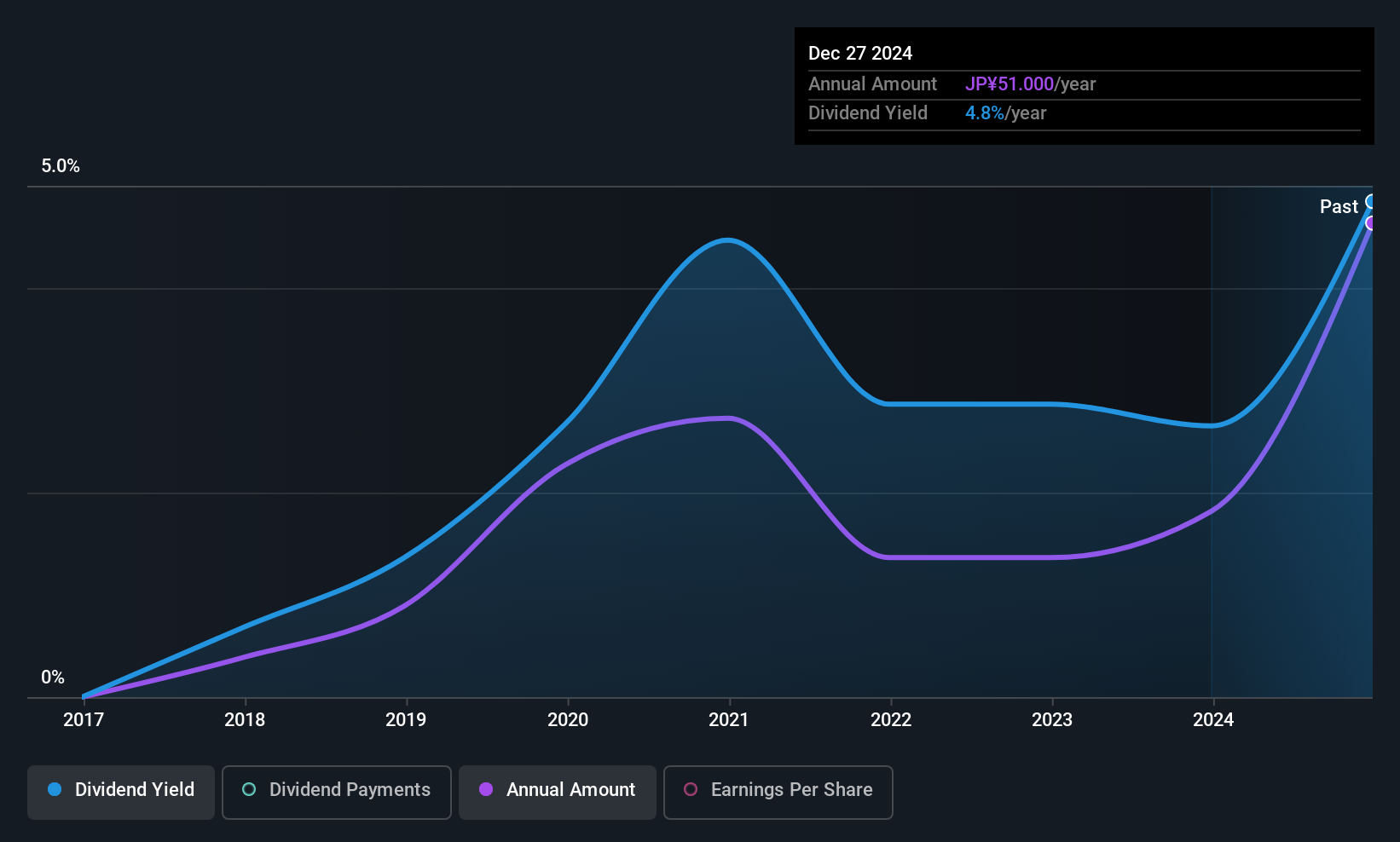

B-Lot (TSE:3452)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: B-Lot Company Limited operates in Japan's real estate and financial consulting sectors with a market capitalization of approximately ¥24.76 billion.

Operations: B-Lot Company Limited generates revenue through its operations in the real estate and financial consulting sectors within Japan.

Dividend Yield: 4.5%

B-Lot's dividend yield of 4.5% places it in the top 25% of Japanese market dividend payers, yet its track record is unreliable with volatile payments over eight years. Despite this, dividends are well-covered by earnings and cash flows with payout ratios of 28.2% and 19.2%, respectively. The company recently completed a share buyback for ¥1.20 billion, aiming to secure management rights and enhance capital partnerships, indicating strategic financial maneuvers despite debt concerns.

- Get an in-depth perspective on B-Lot's performance by reading our dividend report here.

- According our valuation report, there's an indication that B-Lot's share price might be on the cheaper side.

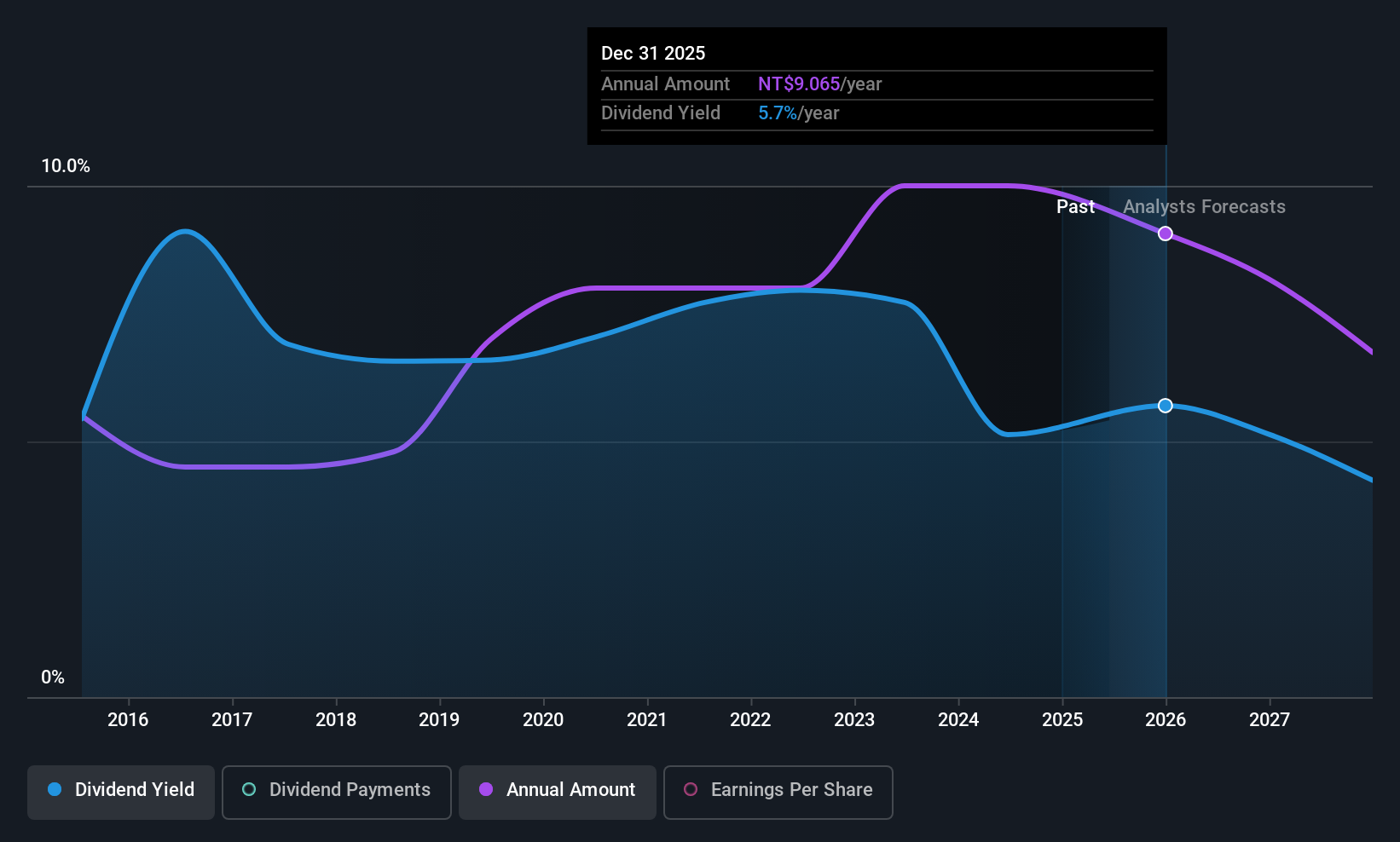

Radiant Opto-Electronics (TWSE:6176)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Radiant Opto-Electronics Corporation manufactures and sells backlight modules and light guide plates for LCD panels across Asia, Europe, and the United States with a market cap of NT$74.10 billion.

Operations: Radiant Opto-Electronics Corporation's revenue is primarily derived from its Mainland District operations, contributing NT$39.64 billion, followed by the Taiwan Regional segment at NT$30.48 billion.

Dividend Yield: 6.5%

Radiant Opto-Electronics offers a dividend yield of 6.52%, ranking it among the top 25% in Taiwan, but its dividends have been volatile and unreliable over the past decade. The company recently announced a cash dividend totaling TWD 4.88 billion, with an ex-dividend date set for June 20, 2025. Despite this increase, high payout ratios suggest dividends are not well-covered by cash flows or earnings, raising sustainability concerns despite strategic share buybacks amounting to TWD 706.49 million completed recently.

- Click here and access our complete dividend analysis report to understand the dynamics of Radiant Opto-Electronics.

- Our comprehensive valuation report raises the possibility that Radiant Opto-Electronics is priced higher than what may be justified by its financials.

Make It Happen

- Access the full spectrum of 1240 Top Asian Dividend Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2628

China Life Insurance

Operates as a life insurance company in the People’s Republic of China.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives