Last Update 02 Dec 25

Fair value Decreased 1.17%AVAV: Expanding Defense Demand And New Markets Will Drive Long-Term Upside

AeroVironment’s analyst price target has been modestly lowered by approximately $5 to around $404, as analysts cite continued optimism regarding growth prospects and recent product developments, balanced against updated valuation and profitability assumptions.

Analyst Commentary

Recent analyst reports reflect continued confidence in AeroVironment's long-term growth trajectory, strategic positioning, and expanding market opportunities. However, several nuanced risks and reservations are also noted amid upward momentum in analyst price targets.

Bullish Takeaways- Bullish analysts highlight AeroVironment's agility in developing innovative products across rapidly growing defense and unmanned systems markets. This supports sustained earnings and revenue growth potential.

- Strategic acquisitions, particularly BlueHalo, are seen as expanding the company's total addressable market into high-value segments such as next-generation counter-UAS and SATCOM. These moves are viewed as accelerating future growth prospects.

- Multiple upward price target revisions have been attributed to compelling demonstrations of new technologies, like the LOCUST counter-UAS laser weapon. Additionally, management's explicit forecasts of large future market opportunities through 2030 have contributed to greater optimism.

- The company is perceived as increasingly diversified beyond traditional product lines. This diversification is thought to position it to benefit from heightened demand for drone and electronic warfare solutions among defense customers worldwide.

- Bullish analysts acknowledge that recent valuation increases now reflect a high degree of optimism. As a result, some analysts have tempered price targets to account for updated profitability and execution assumptions.

- There are ongoing questions about AeroVironment's ability to consistently translate a growing backlog and high demand into improved margins and sustained earnings growth.

- Visibility into long-term revenue realization remains a key watch point. Execution risk is heightened as the company integrates acquisitions and pursues ambitious expansion goals.

- Some skepticism persists regarding the competitive landscape and whether AeroVironment can maintain its technological leadership in a market attracting significant investor and industry attention.

What's in the News

- President Trump is moving to ease restrictions on U.S. military drone exports, which may enable AeroVironment and other manufacturers to access new international markets. (Reuters)

- AeroVironment, Inc. amended its corporate bylaws by implementing new procedures for director nominations and expanding the board's ability to manage stockholder meetings.

- AV was selected to deliver the U.S. Army's Next-Generation Counter-UAS Missile and was awarded a $95.9 million contract for the Long-Range Kinetic Interceptor program, contributing to its defense technology portfolio.

- AeroVironment announced a collaboration with OpenJAUS, LLC to enhance AV_Halo Command and create a more unified and interoperable software platform for controlling a wide array of uncrewed systems.

- AV signed a Memorandum of Understanding with Korean Air to jointly adapt and manufacture its JUMP 20 uncrewed aircraft, increasing its presence in the Korean defense market.

Valuation Changes

- Fair Value has decreased modestly from $408.77 to $404.00.

- Discount Rate has risen slightly from 7.61% to 7.61%.

- Revenue Growth projection has increased minimally from 41.79% to 41.86%.

- Net Profit Margin estimate has improved from 9.56% to 9.68%.

- Future P/E ratio forecast has declined from 103.28x to 100.65x.

Key Takeaways

- Expansion into advanced defense technologies and international markets is driving sustained revenue growth, backlog visibility, and long-term earnings stability.

- Modular, AI-powered platforms and recent acquisitions enable margin expansion, diversification, and operational leverage as defense demands accelerate.

- Heavy reliance on U.S. defense contracts, intensifying competition, margin pressures from acquisitions, underdeveloped international markets, and rapid tech shifts threaten future growth and profitability.

Catalysts

About AeroVironment- Designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses in the United States and internationally.

- AeroVironment's recent contract wins and rapid expansion into advanced areas like space-based laser communications and directed energy weapons position the company to capitalize on the persistent global shift toward defense modernization, addressing urgent demands among the U.S. and allied militaries-likely supporting sustained top-line revenue growth and backlog visibility over multiple years.

- The company's strategic focus on developing modular, interoperable, and software-defined platforms-including the newly launched AV Halo open software ecosystem-directly aligns with the accelerating adoption of AI-powered autonomy and network-centric warfare, enabling future premium pricing, increased service revenues, and gross margin expansion as these high-value platforms are deployed at scale.

- Successful integration of the BlueHalo acquisition materially expands AeroVironment's addressable markets, diversifies its competitive portfolio, and enables operational leverage as the company increases manufacturing capacity, which should support bottom-line EBITDA and net margin improvement as production volumes ramp.

- AeroVironment's growing list of large, multi-year government contracts (funded and unfunded backlog), as well as its positioning as a sole-source or leading provider in next-generation missile defense, Counter-UAS, and space comms, offers long-term revenue visibility and reduces downside risk associated with individual program delays-further enhancing future earnings stability.

- Driven by rising geopolitical tensions, cross-border threats, and persistent ISR needs, AeroVironment is successfully expanding internationally through key partnerships and certifications, which should drive both revenue growth and higher-margin international sales beyond its historical domestic concentration, positively impacting both top-line and profit growth trajectories.

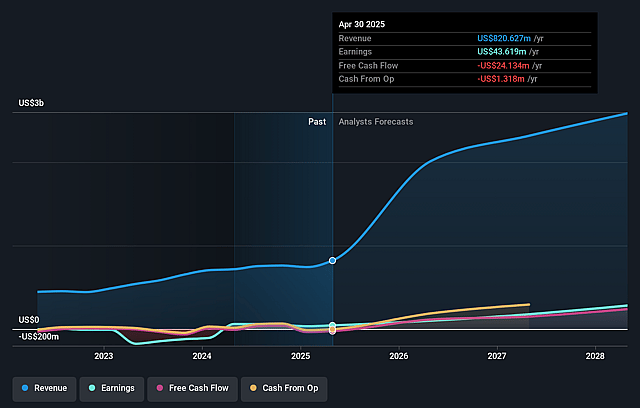

AeroVironment Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AeroVironment's revenue will grow by 47.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.3% today to 10.1% in 3 years time.

- Analysts expect earnings to reach $264.5 million (and earnings per share of $6.26) by about September 2028, up from $43.6 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $348.3 million in earnings, and the most bearish expecting $135.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 84.4x on those 2028 earnings, down from 263.2x today. This future PE is greater than the current PE for the US Aerospace & Defense industry at 34.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.6%, as per the Simply Wall St company report.

AeroVironment Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- AeroVironment's substantial dependence on U.S. government and DoD contracts (with 78% of revenue domestic and only 22% international) makes it highly vulnerable to U.S. budget cycles, congressional delays, or shifting defense priorities, increasing the risk of revenue volatility if funding or priorities change.

- Long-term competitive risks are amplified by the increasing number of entrants and established players in the UAS and Counter-UAS markets, raising the likelihood of price competition, margin compression, and potentially lower long-term net earnings on flagship products like Switchblade.

- The company's gross margin profile has seen a significant decline post-BlueHalo acquisition (from 43% GAAP/45% adjusted to 21% GAAP/29% adjusted), driven by a higher services mix and costs associated with integration, which may persist or worsen, pressuring long-term net margins and profitability.

- While AeroVironment highlights international opportunities, underinvestment or limited traction in expanding international sales and after-sales support could restrain revenue diversification and long-term growth, leaving the business exposed to regional policy changes or geopolitical headwinds.

- Accelerating technological advances in AI, large-scale drone autonomy, and counter-UAS solutions pose a risk that AeroVironment's current platforms could be leapfrogged if R&D investment or innovation pace lags behind larger or more nimble competitors, threatening future contract wins and eroding revenue and margins over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $298.727 for AeroVironment based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $335.0, and the most bearish reporting a price target of just $225.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.6 billion, earnings will come to $264.5 million, and it would be trading on a PE ratio of 84.4x, assuming you use a discount rate of 7.6%.

- Given the current share price of $230.99, the analyst price target of $298.73 is 22.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on AeroVironment?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.