Key Takeaways

- AeroVironment is strategically positioned to surpass growth expectations due to unique capabilities, broadened portfolio, and early investments in emerging defense technologies.

- Expanding international demand and enhanced manufacturing capacity support sustained revenue acceleration, margin expansion, and robust cash flow generation.

- AeroVironment faces revenue risks from defense budget pressures, intensifying competition, export controls, and reliance on major U.S. government contracts amid rising operating expenses.

Catalysts

About AeroVironment- Designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses in the United States and internationally.

- While analyst consensus highlights AeroVironment's record backlog and contract wins, they may vastly underappreciate the company's unique capability and readiness to capitalize on a generational surge in U.S. and allied drone procurement-AeroVironment's manufacturing scale, battle-proven solutions, and sole-source IDIQ contracts could enable revenue growth well ahead of expectations, particularly if U.S. Army modernization and NATO's 5% GDP defense spending pledges are actualized.

- Analysts broadly agree the BlueHalo acquisition brings portfolio expansion and efficiency, but the market may be underestimating the magnitude and speed of revenue acceleration: high-margin integration of space, cyber, and directed energy technologies positions AeroVironment to capture multiple multi-billion-dollar program wins across all defense domains, making a step-change in both net margins and TAM possible within two years.

- The shift toward autonomous and AI-driven defense solutions is accelerating globally, but AeroVironment's early, large R&D investments and proprietary platforms (AI-enabled P550, Red Dragon, AVACORE) uniquely position it to dominate the next technology supercycle, with significant upside to recurring software and systems revenues supporting margin expansion and durable earnings growth.

- International demand is at an inflection point due to rapid increases in defense budgets and heightened threat perceptions; AeroVironment's proven, rapidly deployable, export-friendly platforms (especially Switchblade and Red Dragon, with fewer export restrictions), supported by an expanding global presence, can drive revenue compounding as adoption broadens across NATO, Asia-Pacific, and other U.S.-aligned markets.

- AeroVironment's strategic investments in manufacturing capacity and vertical integration, including new Utah facilities and global partnerships, will convert record bookings and pipeline into accelerating free cash flow and improved working capital efficiency, potentially enabling above-trend cash generation alongside double-digit revenue growth.

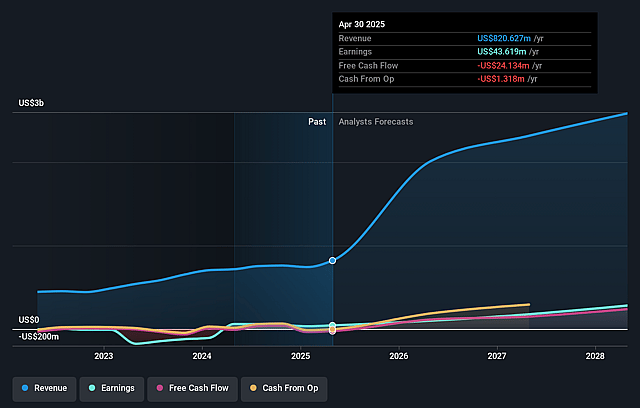

AeroVironment Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on AeroVironment compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming AeroVironment's revenue will grow by 52.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 5.3% today to 13.0% in 3 years time.

- The bullish analysts expect earnings to reach $380.8 million (and earnings per share of $7.58) by about September 2028, up from $43.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 65.7x on those 2028 earnings, down from 258.4x today. This future PE is greater than the current PE for the US Aerospace & Defense industry at 34.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.57%, as per the Simply Wall St company report.

AeroVironment Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Growing pressure on defense budgets and unpredictable timing of U.S. DoD funding and congressional appropriations may delay or reduce new program awards, increasing the risk of revenue volatility and missed growth targets in future years.

- The long-term trend toward indigenous drone development by international customers, combined with rising regulatory scrutiny and stricter export controls, could erode AeroVironment's international sales pipeline and constrain future revenue growth.

- Intensifying competition and ongoing commoditization in the tactical drone and loitering munitions markets threaten AeroVironment's pricing power and gross margins, which is already visible as adjusted product gross margins remained flat and adjusted service gross margins declined in fiscal 2025.

- AeroVironment's business remains heavily reliant on a concentrated set of U.S. government contracts, making them vulnerable to program delays, reallocations, or cancellations, which could lead to significant fluctuations in annual earnings and net income, as evidenced by the shifting composition of their backlog and guidance ranges.

- Substantial investments in R&D, manufacturing capacity, and acquisition integration, especially following the BlueHalo acquisition, heighten the risk of increased operating expenses and dilution of net margins if new product lines (like Red Dragon or P550) or synergies do not scale as anticipated.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for AeroVironment is $335.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of AeroVironment's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $335.0, and the most bearish reporting a price target of just $157.27.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $2.9 billion, earnings will come to $380.8 million, and it would be trading on a PE ratio of 65.7x, assuming you use a discount rate of 7.6%.

- Given the current share price of $226.76, the bullish analyst price target of $335.0 is 32.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.