Key Takeaways

- Shifting government budgets and increased regulation threaten future demand, market access, and revenue diversification for AeroVironment.

- Rising competition, technology risks, and dependency on a few contracts could erode margins and make earnings highly unpredictable.

- Diversification, technological innovation, and expanding global demand are strengthening AeroVironment's market position and supporting sustained, resilient growth and profitability across multiple sectors.

Catalysts

About AeroVironment- Designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses in the United States and internationally.

- As global government priorities shift, rising political and public scrutiny over defense spending could result in pressure to redirect budgets away from military technology and towards pressing social and climate-related programs, leading to a potential slowdown or reversal in long-term demand for AeroVironment's products and directly threatening forward revenue growth.

- Increasing international regulation and restrictions on the export of drones and advanced autonomous systems could impede AeroVironment's access to key foreign markets, limiting both international sales expansion and the ability to diversify revenues away from its core U.S. customer base, which may ultimately cap revenue growth and hinder earnings stability.

- Accelerated development and deployment of counter-UAS and anti-drone technologies by both state and non-state actors threaten to undermine the battlefield effectiveness and perceived value of AeroVironment's offerings, risking product obsolescence, lost contracts, and declining gross margins over time.

- AeroVironment's heavy reliance on a few large government contracts-particularly from the U.S. Department of Defense and agencies with volatile funding cycles-exposes its revenue to material downside risk from contract delays, shifting procurement priorities, or cancellations, which could translate into unpredictable earnings and cash flow in future periods.

- The rapid proliferation of low-cost drone solutions and the continued commoditization in the drone and unmanned systems market, especially driven by international competitors, can erode AeroVironment's pricing power and margin structure, resulting in long-term compression of net margins and sustained downward pressure on profitability.

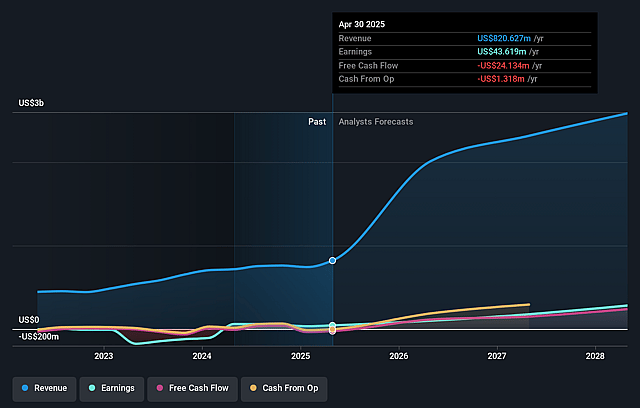

AeroVironment Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on AeroVironment compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming AeroVironment's revenue will grow by 47.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 5.3% today to 5.7% in 3 years time.

- The bearish analysts expect earnings to reach $148.2 million (and earnings per share of $6.27) by about September 2028, up from $43.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 96.4x on those 2028 earnings, down from 271.5x today. This future PE is greater than the current PE for the US Aerospace & Defense industry at 34.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.58%, as per the Simply Wall St company report.

AeroVironment Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing proliferation of global security threats and rising NATO defense budgets are increasing international demand for AeroVironment's products, which may drive sustained double-digit revenue growth and support robust earnings beyond current expectations.

- Rapid advancements in autonomy and AI technologies are being leveraged by AeroVironment through significant R&D investment, enabling the company to launch disruptive products like the P550, JUMP 20-X, and Red Dragon, which should expand the addressable market and enhance margins over the long term.

- Expansion into adjacent markets such as space, cyber, electronic warfare, and directed energy via the BlueHalo acquisition diversifies AeroVironment's portfolio, providing new high-growth, high-margin revenue streams and reducing dependency on any single product line or customer, thereby supporting stable long-term earnings.

- Strong execution in scaling manufacturing capacity, with new facilities supporting billion-dollar production volumes, allows the company to rapidly fulfill large contracts and capitalize on demand spikes, which can translate into improved operational leverage and sustained margin expansion.

- Increasing adoption of UAVs by civil agencies, combined with a shift toward recurring SaaS and service-based offerings (data analytics, training, maintenance), is expected to create new ongoing revenue sources and bolster gross and net margins, making long-term earnings more resilient to cyclical defense spending patterns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for AeroVironment is $191.14, which represents two standard deviations below the consensus price target of $286.94. This valuation is based on what can be assumed as the expectations of AeroVironment's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $335.0, and the most bearish reporting a price target of just $157.27.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $2.6 billion, earnings will come to $148.2 million, and it would be trading on a PE ratio of 96.4x, assuming you use a discount rate of 7.6%.

- Given the current share price of $238.23, the bearish analyst price target of $191.14 is 24.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.