Last Update 10 Dec 25

Fair value Decreased 1.61%GQG: Index Additions Will Drive Future Demand Despite Slightly Softer Outlook

Analysts have slightly lowered their price target on GQG Partners, trimming fair value by about 2 percent as they factor in a marginally higher discount rate, slightly softer revenue growth expectations, and a modest uptick in projected valuation multiples.

What's in the News

- Board declares an ordinary quarterly dividend of USD 0.037 per share for the quarter ended September 30, 2025, payable on December 7, 2025, to shareholders on record as of October 22, 2025 (company announcement)

- GQG Partners is added to the S&P/ASX 300 Index, expanding its presence in broader Australian equity benchmarks (index reconstitution notice)

- Company joins the S&P/ASX Small Ordinaries Index, increasing visibility among small cap focused investors (index reconstitution notice)

- GQG Partners is included in the S&P/ASX 200 Index, marking its entry into a key institutional benchmark for Australian equities (index reconstitution notice)

Valuation Changes

- Fair Value Estimate has edged down about 2 percent, from A$2.35 to A$2.31 per share, reflecting slightly softer fundamental assumptions.

- Discount Rate has risen slightly, from 8.11 percent to 8.18 percent, modestly increasing the required return applied in the valuation model.

- Revenue Growth Assumption has been trimmed marginally, from 1.84 percent to 1.77 percent, indicating a slightly more cautious topline outlook.

- Net Profit Margin Forecast has softened fractionally, from 50.62 percent to 50.55 percent, suggesting only a minimal change to expected profitability.

- Future P/E Multiple has increased modestly, from 13.31x to 13.48x, implying a slightly higher valuation being ascribed to the company’s forward earnings.

Key Takeaways

- Expanding into emerging markets and diversifying distribution channels strengthens future growth opportunities, business resilience, and scalable margins.

- Institutional strength and a strong performance record support stable, recurring revenue and make GQG attractive amid demographic and industry shifts.

- GQG Partners faces structural headwinds from passive investing, fee compression, reliance on key personnel, earnings instability, and disruptive technological and client preference shifts.

Catalysts

About GQG Partners- Operates as a boutique asset management company worldwide.

- Rapid expansion in emerging global wealth and the firm's growing penetration in markets like Asia and the Middle East (including recent investments in the Gulf states) create significant future opportunities for new asset inflows, directly underpinning long-term revenue and earnings growth.

- Demographic shifts, including aging populations in developed countries, are expected to drive consistent demand for retirement and pension products, aligning with GQG's strengths in institutional channels and supporting stickier, larger mandates-bolstering visibility for recurring management fee revenue.

- Continued institutionalization of wealth, with GQG already enjoying broad support from top-tier asset consultants and sub-advisory partners, positions the firm well to capture additional, stable institutional flows; this should improve revenue resilience and margin consistency even amid short-term market volatility.

- Ongoing expansion into new distribution channels-specifically the rapid success in retail SMAs, actively managed ETFs, and international wholesale platforms-leverages existing infrastructure and drives organic growth without significant incremental expense, supporting scalable improvement in operating margins.

- The firm's proven long-term track record of risk-adjusted outperformance and persistency in delivering alpha is likely to remain attractive to investors seeking downside protection, especially if passive trends moderate, raising the potential for a reversal in net flows and providing upside to assets under management, revenues, and ultimately earnings.

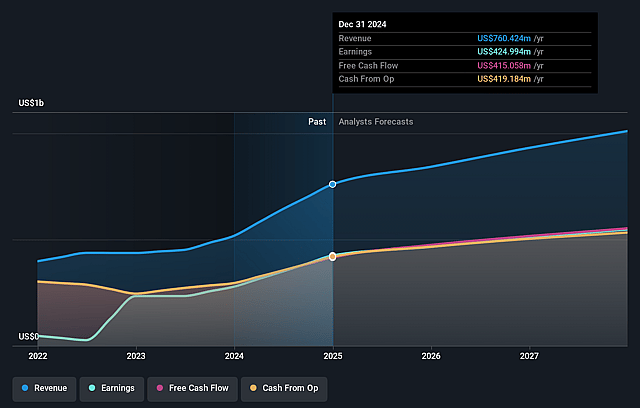

GQG Partners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming GQG Partners's revenue will grow by 4.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 56.7% today to 50.6% in 3 years time.

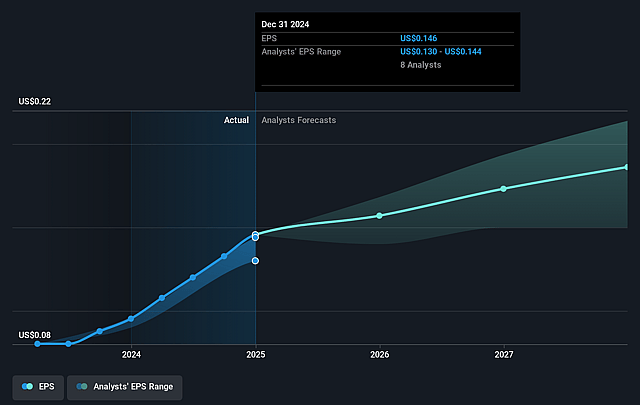

- Analysts expect earnings to reach $462.4 million (and earnings per share of $0.16) by about September 2028, up from $454.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $566.2 million in earnings, and the most bearish expecting $389.4 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.1x on those 2028 earnings, up from 7.4x today. This future PE is lower than the current PE for the AU Capital Markets industry at 21.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.02%, as per the Simply Wall St company report.

GQG Partners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing shift from active to passive investment strategies poses a risk to GQG Partners, as continued industry-wide movement towards low-cost passive products could slow asset growth or lead to outflows, negatively impacting long-term revenue and earnings.

- Fee compression is evident in the asset management industry and is reflected in GQG's declining average management fees (48.2 bps vs. 49.6 bps YoY); if this trend persists due to competitive pressure or product mix, it could lead to shrinking net margins and pressure on earnings.

- A significant proportion of GQG's revenue is tied to management fees (96.6% of net revenue), and recent outflows-particularly in the institutional channel due to structural client changes and short-term performance-highlight the risk of earnings instability if asset inflows stall or reverse for extended periods.

- Key-person risk remains material, given the firm's dependence on CIO and Chairman Rajiv Jain's investment philosophy and reputation; any unexpected departure or reduced involvement could erode client confidence, potentially triggering redemptions and decreased revenues.

- The rise of AI, automated platforms, and increased client demand for customised or ESG-centric investment solutions represent disruptive forces; failure by GQG to further diversify its product offerings and adapt to rapidly evolving client and regulatory preferences may limit organic growth opportunities, revenue diversification, and long-term industry positioning.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$2.495 for GQG Partners based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$2.99, and the most bearish reporting a price target of just A$1.77.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $913.7 million, earnings will come to $462.4 million, and it would be trading on a PE ratio of 13.1x, assuming you use a discount rate of 8.0%.

- Given the current share price of A$1.74, the analyst price target of A$2.5 is 30.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on GQG Partners?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.