Key Takeaways

- GQG is positioned to accelerate growth through rapid product scaling and expansion into high-potential geographic regions, leveraging operational advantages for outsized gains.

- Strong investment performance and industry shifts favor GQG, enabling disproportionate asset and earnings growth as competitors struggle with consolidation and compliance barriers.

- Reliance on active management faces structural headwinds from passive competition, key-man risk, and limited reinvestment capacity, heightening earnings vulnerability and constraining long-term profitability.

Catalysts

About GQG Partners- Operates as a boutique asset management company worldwide.

- Analyst consensus expects meaningful growth from GQG's product expansion into actively managed ETFs and retail separate accounts, but this vastly understates the true upside: GQG has demonstrated an ability to scale new products to billions in AUM within years, and with extensive untapped distribution 'greenfield,' these vehicles could drive an unprecedented acceleration of both AUM and high-margin management fees over the medium and long term.

- While consensus sees geographic expansion as a long-term revenue driver, the scale of opportunity is dramatically greater: the early traction in GCC/Abu Dhabi provides a launchpad into ultra-high-net-worth and family-office assets in a region experiencing explosive wealth creation, positioning GQG to secure several multibillion-dollar mandates that could shift the company's AUM and fee base higher in step-change fashion, with very limited incremental cost due to existing operational leverage.

- GQG's persistently top-quintile risk-adjusted returns and 'northwest quadrant' performance on multi-year horizons have made the firm one of the most-watched by global allocators; as growing awareness and visibility coincide with mean-reverting markets, even a modest normalization in performance could catalyze a rush of inflows from institutional and intermediary platforms, rapidly expanding both revenues and net income.

- The accelerating global proliferation of investable wealth-particularly in emerging markets-intersects perfectly with GQG's highly adaptable global product range and operational footprint, making it a likely disproportionate beneficiary of structural asset pool growth and professionalization, fueling outsized AUM and revenue expansion for the next decade.

- Industry consolidation and mounting compliance complexity are driving clients and platforms toward a shrinking pool of scalable, risk-aware managers; GQG's demonstrated capital discipline, robust margins, and low-cost structure position it to expand net margins materially even as it absorbs rapid AUM growth, increasing the delta between earnings and peers as smaller competitors exit or stagnate.

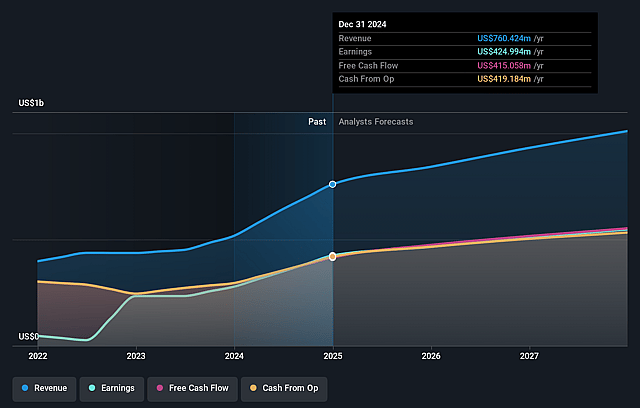

GQG Partners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on GQG Partners compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming GQG Partners's revenue will grow by 9.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 56.7% today to 54.5% in 3 years time.

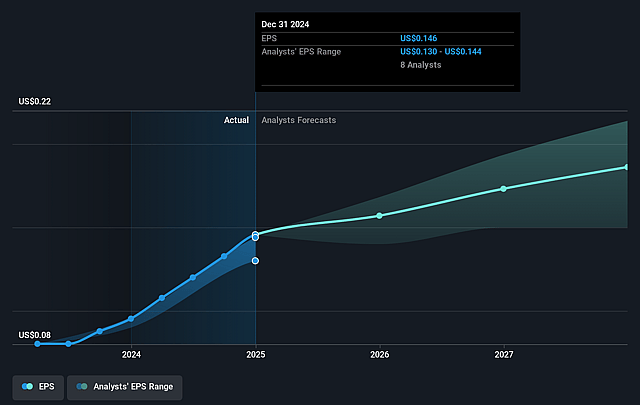

- The bullish analysts expect earnings to reach $566.3 million (and earnings per share of $0.19) by about September 2028, up from $454.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.0x on those 2028 earnings, up from 7.4x today. This future PE is lower than the current PE for the AU Capital Markets industry at 21.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.07%, as per the Simply Wall St company report.

GQG Partners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The persistent shift toward passive investment products and ETFs is likely to erode fee pools for active asset managers like GQG Partners, as evidenced by their declining average management fee from 49.6 basis points to 48.2 basis points, which may pressure long-term revenue growth and margins.

- The company's heavy emphasis on the long-term track record of key individuals, particularly Rajiv Jain, highlights ongoing key-man risk; any loss of his leadership or reputation could undermine client trust and lead to significant asset outflows, lowering assets under management and impacting future revenues.

- GQG's growing exposure to retail separately managed accounts, active ETFs, and U.S. equities increases sensitivity to market volatility, and as their FUM is heavily concentrated in public equities with some focus on emerging markets, cyclic drawdowns or regulatory risks in these regions can create instability in revenue and earnings across cycles.

- The company's high dividend payout ratio above 90 percent of distributable earnings suggests limited retained capital for reinvestment, potentially constraining the ability to invest in technology, compliance, or scale, which may reduce operating leverage and hurt long-term net margin expansion.

- Rising industry regulatory complexity and fee transparency requirements, coupled with mounting competition from lower-cost, algorithmic, and consolidated large-scale asset management offerings, may structurally compress GQG's revenues and net margins as they face elevated compliance costs and pressure to lower fees.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for GQG Partners is A$2.98, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of GQG Partners's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$2.98, and the most bearish reporting a price target of just A$1.77.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.0 billion, earnings will come to $566.3 million, and it would be trading on a PE ratio of 13.0x, assuming you use a discount rate of 8.1%.

- Given the current share price of A$1.72, the bullish analyst price target of A$2.98 is 42.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.