Key Takeaways

- Fee and revenue growth are threatened by shifts toward passive investing, regulatory pressures, and technological disruption reducing the appeal of active management.

- Heavy reliance on a key leader and concentration in few strategies heighten business risks and potential for client outflows affecting future earnings.

- Strong global client demand, scalable expansion into new channels, and disciplined financial management position GQG Partners for sustainable growth, resilient revenue, and robust shareholder returns.

Catalysts

About GQG Partners- Operates as a boutique asset management company worldwide.

- Accelerating adoption of passive investing and exchange-traded funds is likely to erode demand for active management and continue to put downward pressure on management fees, which currently account for over ninety-six percent of GQG's net revenue. This structural shift is expected to constrain both revenue growth and net margins going forward.

- Intensifying regulatory scrutiny and the resulting increase in global compliance costs threaten to reduce GQG's operating leverage and hamper its ability to expand profitably, ultimately impacting long-term earnings and margin expansion.

- GQG remains highly reliant on the reputation and continued presence of its key investment leader, Rajiv Jain, which represents a significant succession risk. Any change or departure could quickly drive client outflows, reduce assets under management, and sharply compress future fee-based revenues.

- The firm's focus on only a handful of core investment strategies creates a vulnerability such that sustained underperformance in any flagship product could prompt outsized client redemptions. This amplifies instability in both assets under management and future fee income, threatening overall earnings power.

- Growing technological disruption, particularly from robo-advisors and algorithmically driven portfolio solutions, is expected to further disintermediate traditional active managers. As a result, GQG's addressable market is poised to shrink, putting continued pressure on future revenue and margin potential.

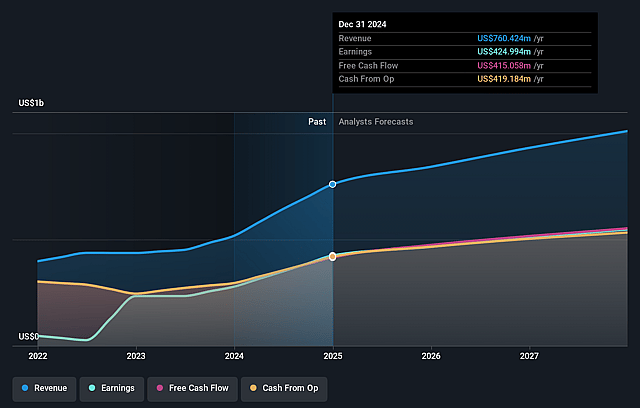

GQG Partners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on GQG Partners compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming GQG Partners's revenue will grow by 2.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 56.7% today to 45.2% in 3 years time.

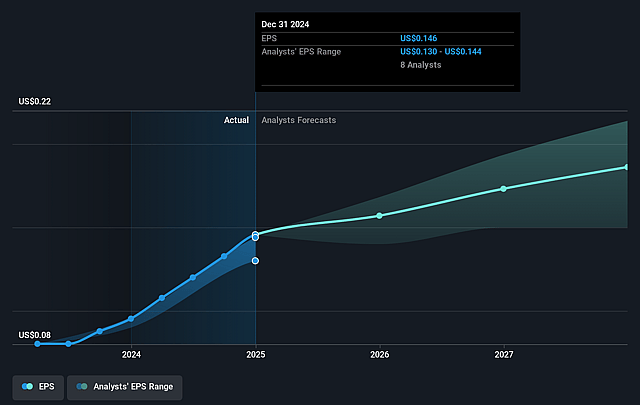

- The bearish analysts expect earnings to reach $389.5 million (and earnings per share of $0.13) by about September 2028, down from $454.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.1x on those 2028 earnings, up from 7.4x today. This future PE is lower than the current PE for the AU Capital Markets industry at 22.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.02%, as per the Simply Wall St company report.

GQG Partners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Record growth in funds under management, reaching over $172 billion and driven by $8 billion in net inflows, demonstrates strong client demand and asset growth that can underpin long-term revenue and earnings expansion.

- Persistent long-term outperformance by key strategies, recognized by top quintile Morningstar ratings and risk-adjusted alpha, fortifies GQG's reputation and supports both the retention of client assets and attraction of new mandates, which benefits fee-based revenue stability.

- Expansion into fast-growing channels such as separately managed accounts and active ETFs, accomplished without significant capital investment or increased cost base, opens scalable new growth paths, enhancing operating leverage and future margin expansion.

- Diversified, global distribution and wide institutional and sub-advisory support, including deep relationships with major asset consultants and platforms, provides resilience against isolated outflows and broadens the base for recurring and sticky management fee income.

- Continued investment in operational infrastructure, disciplined expense control yielding high operating margins, and a debt-free balance sheet with strong cash generation and high dividend payout capacity all position the company for robust long-term earnings and shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for GQG Partners is A$1.77, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of GQG Partners's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$2.99, and the most bearish reporting a price target of just A$1.77.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $861.0 million, earnings will come to $389.5 million, and it would be trading on a PE ratio of 11.1x, assuming you use a discount rate of 8.0%.

- Given the current share price of A$1.74, the bearish analyst price target of A$1.77 is 2.0% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that the bearish analysts believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.