Last Update 28 Nov 25

Fair value Increased 1.36%LUG: Recent Gold Price Rally Will Limit Further Upside For Shares

The analyst price target for Lundin Gold has increased from C$92.17 to C$93.42, as analysts cite a more favorable outlook due to rising gold price forecasts and improved financial projections.

Analyst Commentary

Recent analyst coverage has reflected notable shifts in sentiment towards Lundin Gold following adjustments to commodity price forecasts and company valuation.

Bullish Takeaways- Analysts have increased their price targets for Lundin Gold, reflecting a more optimistic outlook for gold and silver prices through 2026 and 2027.

- Upgraded forecasts for gold, now anticipated to reach $4,500 per ounce, and silver, expected at $55 per ounce, underpin these higher valuations.

- Year-to-date strength in gold prices and corresponding stock outperformance are viewed as supportive for further gains in company valuation.

- Improved sector sentiment, due to macroeconomic factors, enhances the growth outlook for Lundin Gold compared to broader market trends.

- Analysts maintain a neutral or market perform stance, indicating continued caution despite upward price target revisions.

- The recent increases in price targets are seen partly as a response to catching up with rapid moves in commodity prices, rather than a shift in company fundamentals.

- Strong performance so far may be limiting further upside, with valuation reflecting much of the anticipated benefit from higher gold prices.

What's in the News

- Announced strong results from exploration drilling at Fruta del Norte, advancing toward an initial Mineral Reserve estimate in early 2026 and achieving Reserve replacement in both 2023 and 2024 (Key Developments).

- Reported positive near-mine drilling results at Sandia, Trancaloma, and Castillo targets, including discovery of new high-grade mineralized zones and expansion potential in all directions (Key Developments).

- Reported third quarter and year-to-date 2025 production with higher ore processed and gold recovery rates, while average head grade and doré output slightly decreased compared to the previous year (Key Developments).

- Announced planned leadership transition as Ron Hochstein will step down as President, CEO and Director, and Jamie Beck will be appointed as new CEO effective November 7, 2025 (Key Developments).

- Lundin Gold was added to the FTSE All-World Index, reflecting its increased market profile (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has risen slightly from CA$92.17 to CA$93.42. This reflects a modest increase in perceived fair value.

- Discount Rate increased marginally from 7.04% to 7.06%. This indicates a small upwards adjustment to the risk premium applied.

- Revenue Growth estimate has increased significantly from 8.72% to 13.18%. This points to higher expected topline expansion.

- Net Profit Margin is projected to improve from 39.0% to 48.4%. This shows increased profitability expectations.

- Future Price to Earnings (P/E) ratio is projected to decline from 26.55x to 17.77x. This suggests anticipated earnings growth or a change in valuation approach.

Key Takeaways

- Investor optimism may be overlooking risks from volatile gold prices, expansion assumptions, and reliance on a single asset, exposing future revenue and earnings to downside.

- High ESG ratings and strong cash flow could mask rising regulatory costs and operational pressures that threaten long-term margins and shareholder returns.

- Strong gold prices, operational efficiency, exploration success, and robust local partnerships position Lundin Gold for resilient earnings, expanded resources, and sustainable long-term growth.

Catalysts

About Lundin Gold- Operates as a mining company in Canada.

- Market expectations appear to reflect high conviction that record gold prices will persist and continue to drive Lundin Gold's revenues and margins at current exceptional levels, neglecting the risk that gold's function as an inflation/geopolitical hedge could soften with evolving macroeconomic or technological trends, potentially exposing a downside to future revenue and earnings.

- The current valuation seems to price in a seamless and rapid expansion of the company's resource base and mine life, particularly through ongoing drilling at FDNS, FDN East, and the new porphyry corridor. This optimism assumes material reserve additions and life extension, which, if not realized, could lead to future revenue disappointment post-2030.

- High confidence is being assigned to the company's industry-leading ESG profile and local community relationships, with an assumption these will insulate it from tightening global decarbonization standards and regulatory pressures that are likely to raise compliance and operating costs-potentially compressing long-term net margins.

- The strong operational performance and record free cash flow are leading investors to extrapolate current dividend payouts and cash flows far into the future, overlooking that cost pressures (e.g., higher profit sharing, royalties scaling with gold price, and rising sustaining capex) may erode free cash flow and limit future returns to shareholders.

- Investors appear to be underestimating longer-term risks tied to Lundin Gold's heavy reliance on a single Ecuadorian asset, including potential for political instability, resource nationalism, and social license challenges as the mine footprint expands-factors that could drive earnings volatility and higher cost of capital.

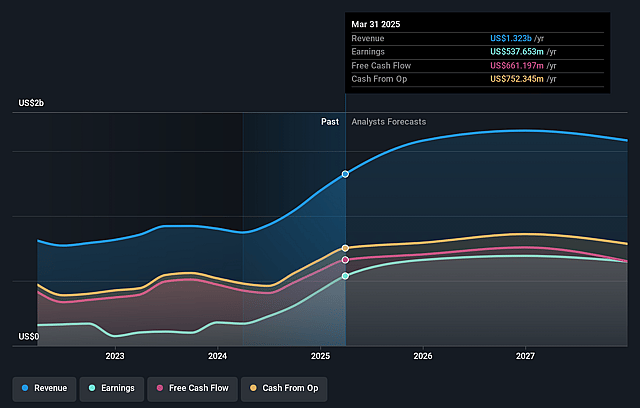

Lundin Gold Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Lundin Gold's revenue will decrease by 2.8% annually over the next 3 years.

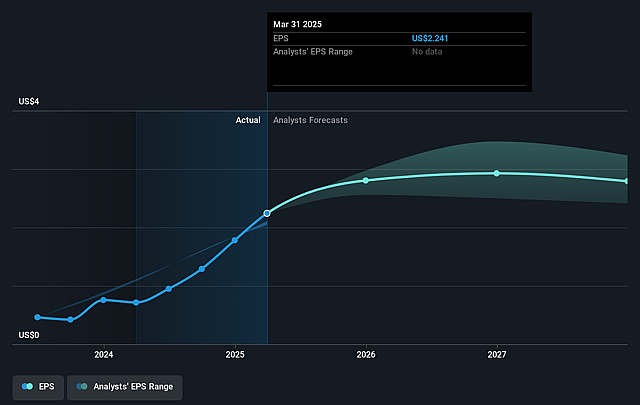

- Analysts assume that profit margins will increase from 41.7% today to 56.0% in 3 years time.

- Analysts expect earnings to reach $758.8 million (and earnings per share of $2.94) by about September 2028, up from $615.1 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $628.4 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.4x on those 2028 earnings, down from 25.7x today. This future PE is greater than the current PE for the CA Metals and Mining industry at 18.0x.

- Analysts expect the number of shares outstanding to grow by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.42%, as per the Simply Wall St company report.

Lundin Gold Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained record gold prices, combined with higher production and ongoing operational efficiency improvements, have driven double-digit growth in revenue, free cash flow, and net margins, suggesting that if these trends persist, Lundin Gold could continue to produce strong earnings and shareholder returns.

- The company is actively expanding its resource base through major exploration successes at FDNS, FDN East, Trancaloma, and Sandia, increasing the potential for extended mine life and scaled-up future production, which would support stable or growing long-term revenues and earnings power.

- Lundin Gold demonstrates disciplined cost controls and operational optimization, maintaining low cash costs and all-in sustaining costs even in the face of cost inflation tied to higher gold prices, which enhances resilience and protects operating margins over time.

- Strong relationships with local communities and a supportive government in Ecuador, coupled with an ongoing focus on ESG and sustainability, lower the likelihood of major social or permitting disruptions and could translate into fewer unexpected costs or revenue interruptions.

- Exploration-driven "blue sky" potential in the newly discovered porphyry copper-gold corridor adjacent to current operations may unlock substantial new reserves, providing optionality for future production growth and higher long-term free cash flows and underlying asset value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$68.667 for Lundin Gold based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$85.0, and the most bearish reporting a price target of just CA$50.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $758.8 million, and it would be trading on a PE ratio of 19.4x, assuming you use a discount rate of 6.4%.

- Given the current share price of CA$90.23, the analyst price target of CA$68.67 is 31.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.