Key Takeaways

- Profitability is heavily dependent on high gold prices and faces significant exposure to commodity volatility, operational risks in Ecuador, and structural demand shifts toward alternative assets.

- Escalating ESG requirements, rising input costs, and local scrutiny will increase expenses, regulatory burdens, and the risk of delays, threatening long-term growth and earnings stability.

- Successful exploration, operational efficiencies, financial strength, and supportive stakeholder relations position Lundin Gold for stable growth and resilience amid favorable gold price trends.

Catalysts

About Lundin Gold- Operates as a mining company in Canada.

- The company's record financial performance is almost entirely attributable to extremely high gold prices, which are far above historical averages and may not be sustainable; any normalization in gold prices would sharply reduce both revenue and margins, leaving Lundin Gold's profitability exposed to commodity price volatility over the long term.

- Rising global decarbonization efforts and tightening ESG requirements are poised to restrict capital flows to gold mining, driving up Lundin Gold's future financing costs and regulatory burden, which will negatively impact free cash flow and long-term net income as compliance and remediation expenses rise.

- Lundin Gold remains acutely vulnerable to rising operational risks in Ecuador, where ongoing political, tax, and environmental regime uncertainty could increase costs, deter expansion, and erode margins, particularly given the company's heavy reliance on the Fruta del Norte asset for nearly all cash generation.

- Long-term demand for gold faces structural risks from an accelerated shift toward digital and alternative assets such as cryptocurrencies, undermining sustained price support and threatening Lundin Gold's top-line growth and ability to fund new development initiatives as jewelry and investment demand softens.

- Industry-wide inflation in input materials, labor, and energy-along with intensifying scrutiny from local communities and NGOs-will raise costs and heighten the risk of permitting delays or operational shutdowns, resulting in compressed margins and lower earnings resilience for Lundin Gold in future years.

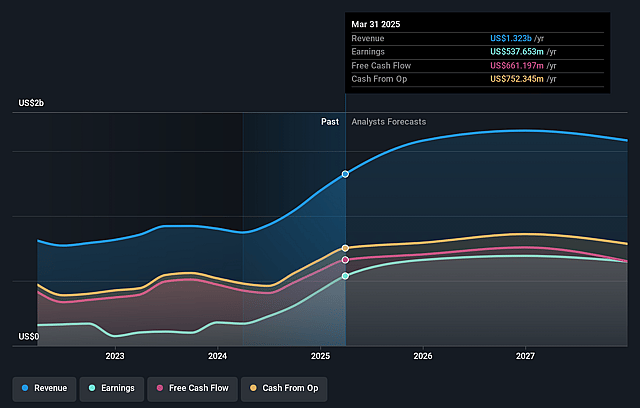

Lundin Gold Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Lundin Gold compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Lundin Gold's revenue will decrease by 2.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 41.7% today to 47.0% in 3 years time.

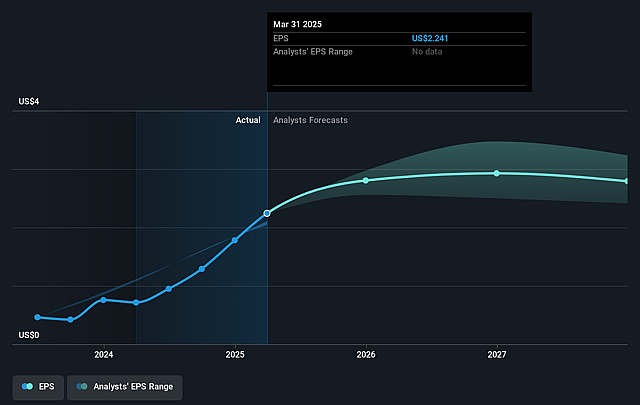

- The bearish analysts expect earnings to reach $648.3 million (and earnings per share of $2.7) by about September 2028, up from $615.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 16.5x on those 2028 earnings, down from 25.7x today. This future PE is lower than the current PE for the CA Metals and Mining industry at 17.8x.

- Analysts expect the number of shares outstanding to grow by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.42%, as per the Simply Wall St company report.

Lundin Gold Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Significant ongoing exploration success at FDNS, Trancaloma, and Sandia points to the likelihood of expanding resources and reserves at Fruta del Norte and adjacent prospects, increasing potential mine life and supporting sustained or growing revenues well into the future.

- Demonstrated ability to optimize operations and invest in plant expansions has enabled higher throughput and increased recoveries, which, combined with continuous process improvements, could enhance cost efficiencies and improve net margins over the long term.

- Robust balance sheet strength, as indicated by a strong and growing cash position and substantial free cash flow generation, positions the company to withstand gold price volatility and invest in future growth, underpinning resilient earnings and supporting ongoing dividend payments.

- Strong community relations and government support in Ecuador, along with a commitment to ESG best practices and sustainability strategies, reduce the risk of social or regulatory disruptions, helping ensure stable operations and consistent cash flow generation.

- A secular trend of high and potentially rising gold prices, driven by global geopolitical and economic instability, continues to provide strong top-line momentum for gold producers like Lundin Gold, amplifying revenues and profitability over the medium and long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Lundin Gold is CA$50.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Lundin Gold's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$85.0, and the most bearish reporting a price target of just CA$50.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $648.3 million, and it would be trading on a PE ratio of 16.5x, assuming you use a discount rate of 6.4%.

- Given the current share price of CA$90.23, the bearish analyst price target of CA$50.0 is 80.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.