Last Update 14 Dec 25

Fair value Increased 47%LUG: Rising Gold And Silver Price Forecasts Will Drive Stronger Outlook

Lundin Gold's analyst price target has been raised significantly, from about C$85 to roughly C$125, as analysts factor in sharply higher long term gold and silver price assumptions along with stronger expected revenue growth and profitability.

Analyst Commentary

Bullish analysts are highlighting Lundin Gold as a key beneficiary of structurally higher precious metal price assumptions, pointing to meaningful upside to both earnings and net asset value under revised scenarios.

Recent research notes emphasize that the company is well positioned to translate higher gold and silver prices into stronger free cash flow generation, supporting a higher valuation range even after the stock's strong year to date performance.

Bullish analysts also flag that, while part of the recent target price revisions reflects a catch up to the rapid move in gold, the underlying thesis is increasingly supported by resilient operational execution and robust margins at current commodity prices.

Bullish Takeaways

- Multiple bullish analysts have raised their price targets into the low C$100s, signaling growing conviction that Lundin Gold's valuation has room to expand as higher long term gold and silver price decks are incorporated.

- Upward revisions are being driven by sharply increased gold price forecasts, including expectations for prices approaching $4,500 per ounce in 2026 and 2027, which materially enhance projected revenue, cash flow, and net asset value.

- Higher assumed silver prices, with forecasts moving toward $55 per ounce in 2026 and 2027, provide an additional earnings tailwind and support a more robust multi year growth profile.

- Despite notable share price outperformance year to date, bullish analysts view the latest target hikes as evidence that the market is still catching up to Lundin Gold's improved earnings power and long term growth outlook.

What's in the News

- Issued multi year production guidance for Fruta del Norte, targeting 475,000 to 525,000 ounces of gold annually from 2026 through 2028, with higher grades and lower unit costs expected in the second half of 2026 (Corporate guidance).

- Reported strong conversion and near mine exploration drilling results at Fruta del Norte, including some of the highest grade intercepts ever recorded at FDN East. These results support potential resource growth and mine life extension (Product related announcement).

- Announced positive near mine exploration results at the Sandia, Trancaloma, and Castillo targets. The results outline large, open mineral envelopes and confirm new shallow high grade zones that could add future porphyry centers (Product related announcement).

- Delivered higher throughput and improved recoveries in third quarter 2025 operating results, with year to date gold production rising to 378,832 ounces versus 366,788 ounces a year earlier (Operating results).

- Added to the FTSE All World Index, increasing Lundin Gold's visibility and potential ownership by global index tracking investors (Index constituent add).

Valuation Changes

- Consensus Analyst Price Target has risen significantly from CA$85.00 to CA$125.00, which reflects a materially higher assessed fair value for Lundin Gold.

- Discount Rate has increased modestly from 6.51% to 7.14%, which implies a slightly higher required return and risk adjustment in valuation models.

- Revenue Growth assumptions have been revised sharply higher from 6.84% to 19.81%, which indicates a significantly more optimistic outlook for top line expansion.

- Net Profit Margin expectations have increased meaningfully from 47.36% to 60.35%, which suggests improved operating leverage and profitability at higher metal prices.

- Future P/E has fallen moderately from 21.33x to 16.43x, which signals a lower multiple being applied even as earnings expectations rise.

Key Takeaways

- New plant optimization, ongoing productivity gains, and exploration successes could drive production and revenues well above current forecasts, boosting long-term cash flows and asset value.

- Exceptional gold grades, major new copper-gold discoveries, strategic M&A potential, and strong ESG performance position Lundin Gold for valuation upside and lower financing costs.

- Heavy reliance on a single aging asset and elevated gold prices makes Lundin Gold vulnerable to operational, market, and regulatory risks that threaten long-term profitability.

Catalysts

About Lundin Gold- Operates as a mining company in Canada.

- While analyst consensus views the plant expansion as resulting in moderate throughput and recovery improvements, Lundin Gold's relentless operational optimization, early delivery of the 5,500 tonnes per day goal, and proactive engineering hints at the real possibility of pushing throughput beyond 5,500-with early-stage studies on 6,000 tonnes daily-suggesting production levels and revenue potential could materially surpass expectations.

- Analysts broadly agree on the upside from exploration around Fruta del Norte, but ongoing discoveries-especially the game-changing copper-gold porphyry corridor adjacent to current operations and the rapid expansion in drill rigs-could transform the asset base into a multi-mine complex, unlocking multi-decade production and significant long-term EBITDA and free cash flow uplift.

- Lundin Gold's unique combination of high-grade, low-cost gold at Fruta del Norte, operational excellence, and continuous productivity enhancements positions it as a leading beneficiary from elevated gold prices fueled by global macroeconomic instability and currency debasement, supporting structurally higher margins and cash flows.

- The massive new porphyry discoveries, which remain in the early stages of delineation, position Lundin Gold for a step-change in valuation as resource scarcity in the industry intensifies and majors face dwindling reserves, greatly increasing the company's attractiveness for strategic partnerships or blockbuster M&A at premium multiples, driving valuation re-rating.

- With an exceptional ESG track record and strong local community support in tandem with Ecuador's increasing openness to mining investment, Lundin Gold could gain further access to capital from global ESG-focused funds, supporting higher valuation multiples and lowering cost of capital, directly benefiting net income and shareholder returns.

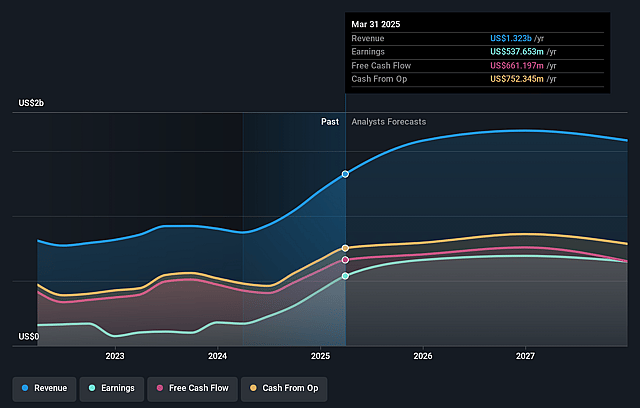

Lundin Gold Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Lundin Gold compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Lundin Gold's revenue will grow by 6.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 41.7% today to 47.4% in 3 years time.

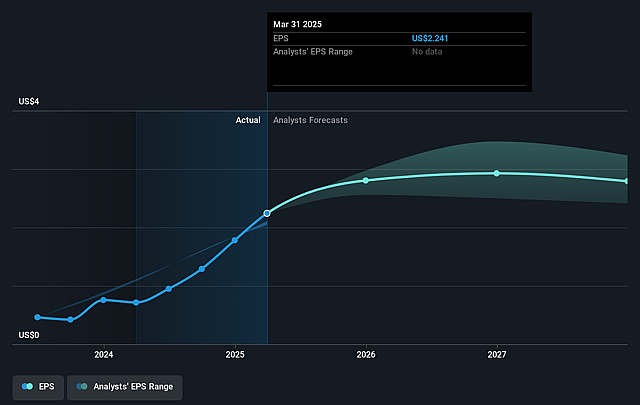

- The bullish analysts expect earnings to reach $851.5 million (and earnings per share of $3.55) by about September 2028, up from $615.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 21.3x on those 2028 earnings, down from 26.5x today. This future PE is greater than the current PE for the CA Metals and Mining industry at 18.6x.

- Analysts expect the number of shares outstanding to grow by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.51%, as per the Simply Wall St company report.

Lundin Gold Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Lundin Gold's financial performance is currently heavily reliant on record-high gold prices, and any secular decline in investor demand for gold driven by a global shift toward decarbonization, renewable energy, or rising interest rates could put significant downward pressure on gold prices, reducing both revenues and earnings over the long term.

- The company's operational base is concentrated in a single asset, the Fruta del Norte mine in Ecuador, which exposes it to heightened operational and jurisdictional risks, such as potential disruptions from political, regulatory, or technical issues that could undermine long-term revenue stability.

- Sustaining and development capital expenditures are expected to increase as the mine infrastructure ages and as the ore grade moderates, which could lead to compressing margins and greater cash outflows, negatively impacting future net profits.

- Heightened global regulatory pressure and ESG scrutiny, including increasing demands related to water usage, tailings management, and environmental standards, may drive up compliance and remediation costs, increasing both capital and operating expenditures and reducing future net margins.

- As Fruta del Norte ages and industry-wide ore grades decline, Lundin Gold faces the risk of reduced operational efficiency and higher costs, which combined with rising competition for skilled labor and equipment across the gold mining sector, may erode its profitability and compress earnings over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Lundin Gold is CA$85.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Lundin Gold's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$85.0, and the most bearish reporting a price target of just CA$50.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.8 billion, earnings will come to $851.5 million, and it would be trading on a PE ratio of 21.3x, assuming you use a discount rate of 6.5%.

- Given the current share price of CA$93.67, the bullish analyst price target of CA$85.0 is 10.2% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Lundin Gold?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.