Last Update26 Sep 25Fair value Increased 1.31%

Analysts have raised Lundin Gold's price target to CA$71.08, citing improved gold production, higher realized prices, and reserve upgrades, while some caution remains due to cost and regulatory risks.

Analyst Commentary

- Bullish analysts are increasing price targets due to improved gold production outlook and strong operational results at Lundin Gold’s flagship mine.

- Adjustments reflect higher realized gold prices and a supportive commodity price environment benefitting near-term cash flows.

- Recent target hikes incorporate upgrades to reserve estimates and life-of-mine extensions supporting higher medium-term valuation.

- Some analysts remain cautious with neutral or hold recommendations, pointing to balanced risk-reward after recent share price appreciation.

- One bearish adjustment notes ongoing cost inflation and regulatory uncertainties, leading to modest target reductions and a less constructive outlook.

What's in the News

- Lundin Gold added to the FTSE All-World Index.

- CEO Ron Hochstein to step down; Jamie Beck, former CEO of Filo Corp., appointed as successor effective November, following Beck’s strong track record in the sector and within the Lundin Group.

- Updated 2025 production guidance to 490,000–525,000 oz, reflecting strong H1 performance but anticipating lower average head grades in H2 due to mine sequencing.

- Near-mine exploration at Fruta del Norte confirmed and expanded copper-gold porphyry systems at Trancaloma and established a new system at Sandia, highlighting an emerging exploration corridor.

- Exploration and conversion drilling at Fruta del Norte and FDN East delivered positive results, confirming resource growth and additional mineralized zones, supporting long-term mine plan extension.

Valuation Changes

Summary of Valuation Changes for Lundin Gold

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from CA$70.17 to CA$71.08.

- The Consensus Revenue Growth forecasts for Lundin Gold has risen from -2.1% per annum to -2.0% per annum.

- The Net Profit Margin for Lundin Gold has risen from 61.55% to 65.55%.

Key Takeaways

- Investor optimism may be overlooking risks from volatile gold prices, expansion assumptions, and reliance on a single asset, exposing future revenue and earnings to downside.

- High ESG ratings and strong cash flow could mask rising regulatory costs and operational pressures that threaten long-term margins and shareholder returns.

- Strong gold prices, operational efficiency, exploration success, and robust local partnerships position Lundin Gold for resilient earnings, expanded resources, and sustainable long-term growth.

Catalysts

About Lundin Gold- Operates as a mining company in Canada.

- Market expectations appear to reflect high conviction that record gold prices will persist and continue to drive Lundin Gold's revenues and margins at current exceptional levels, neglecting the risk that gold's function as an inflation/geopolitical hedge could soften with evolving macroeconomic or technological trends, potentially exposing a downside to future revenue and earnings.

- The current valuation seems to price in a seamless and rapid expansion of the company's resource base and mine life, particularly through ongoing drilling at FDNS, FDN East, and the new porphyry corridor. This optimism assumes material reserve additions and life extension, which, if not realized, could lead to future revenue disappointment post-2030.

- High confidence is being assigned to the company's industry-leading ESG profile and local community relationships, with an assumption these will insulate it from tightening global decarbonization standards and regulatory pressures that are likely to raise compliance and operating costs-potentially compressing long-term net margins.

- The strong operational performance and record free cash flow are leading investors to extrapolate current dividend payouts and cash flows far into the future, overlooking that cost pressures (e.g., higher profit sharing, royalties scaling with gold price, and rising sustaining capex) may erode free cash flow and limit future returns to shareholders.

- Investors appear to be underestimating longer-term risks tied to Lundin Gold's heavy reliance on a single Ecuadorian asset, including potential for political instability, resource nationalism, and social license challenges as the mine footprint expands-factors that could drive earnings volatility and higher cost of capital.

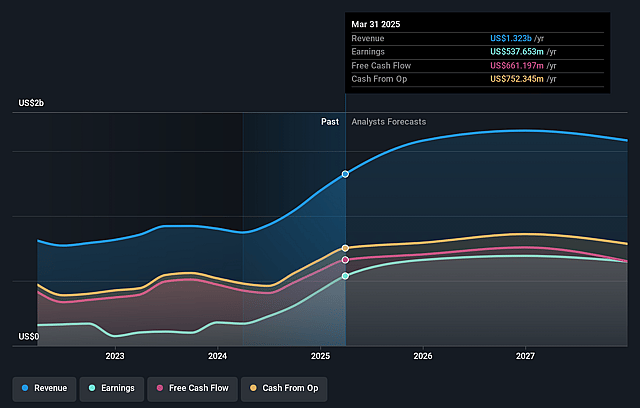

Lundin Gold Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Lundin Gold's revenue will decrease by 2.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 41.7% today to 56.0% in 3 years time.

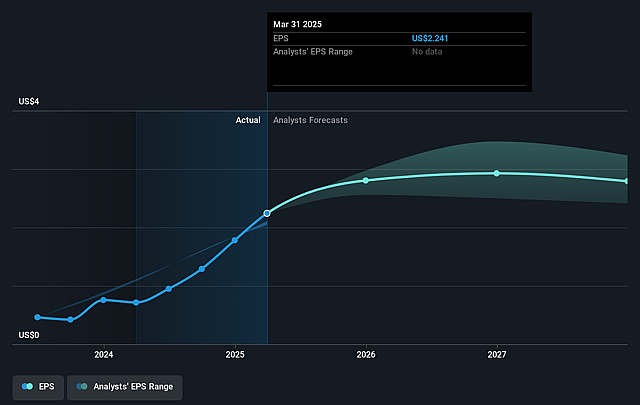

- Analysts expect earnings to reach $758.8 million (and earnings per share of $2.94) by about September 2028, up from $615.1 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $628.4 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.4x on those 2028 earnings, down from 25.7x today. This future PE is greater than the current PE for the CA Metals and Mining industry at 18.0x.

- Analysts expect the number of shares outstanding to grow by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.42%, as per the Simply Wall St company report.

Lundin Gold Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained record gold prices, combined with higher production and ongoing operational efficiency improvements, have driven double-digit growth in revenue, free cash flow, and net margins, suggesting that if these trends persist, Lundin Gold could continue to produce strong earnings and shareholder returns.

- The company is actively expanding its resource base through major exploration successes at FDNS, FDN East, Trancaloma, and Sandia, increasing the potential for extended mine life and scaled-up future production, which would support stable or growing long-term revenues and earnings power.

- Lundin Gold demonstrates disciplined cost controls and operational optimization, maintaining low cash costs and all-in sustaining costs even in the face of cost inflation tied to higher gold prices, which enhances resilience and protects operating margins over time.

- Strong relationships with local communities and a supportive government in Ecuador, coupled with an ongoing focus on ESG and sustainability, lower the likelihood of major social or permitting disruptions and could translate into fewer unexpected costs or revenue interruptions.

- Exploration-driven "blue sky" potential in the newly discovered porphyry copper-gold corridor adjacent to current operations may unlock substantial new reserves, providing optionality for future production growth and higher long-term free cash flows and underlying asset value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$68.667 for Lundin Gold based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$85.0, and the most bearish reporting a price target of just CA$50.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $758.8 million, and it would be trading on a PE ratio of 19.4x, assuming you use a discount rate of 6.4%.

- Given the current share price of CA$90.23, the analyst price target of CA$68.67 is 31.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.