Last Update 23 Nov 25

Fair value Increased 3.72%WTS: Guidance Increases And Sector Stability Will Support Balanced Performance Outlook

Analysts have raised their fair value estimate for Watts Water Technologies to $292.50 from $282, citing stronger revenue growth, improved profit margins, and increased guidance following a positive industry outlook.

Analyst Commentary

Recent research notes reflect both optimistic and cautious perspectives on the company's outlook, weighing positive earnings momentum against broader sector challenges.

Bullish Takeaways- Bullish analysts cite the company’s robust Q3 and Q4 outlook as a key driver behind increased price targets and improved sentiment.

- Upward revisions to full-year organic revenue guidance and margin expectations highlight strong execution and underlying demand.

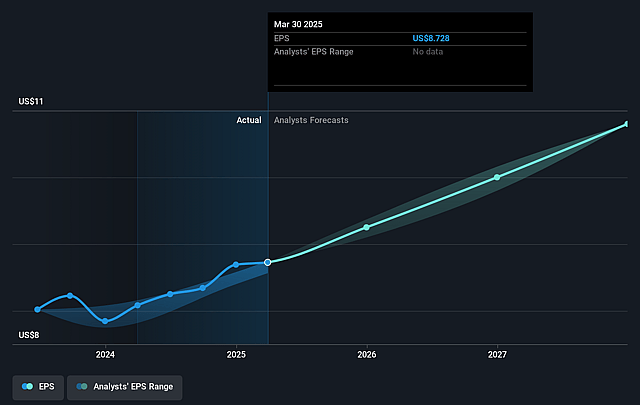

- Implied earnings per share guidance has been raised by approximately 5 percent, signaling enhanced profitability.

- The stable demand for water infrastructure, along with resilient end markets, are seen as supportive factors for long-term growth and valuation expansion.

- Some analysts have maintained a more neutral stance, initiating coverage with a rating that reflects balanced risk and reward at current valuation levels.

- Recent strength in share price following sector pullbacks may limit short-term upside potential.

- While demand is viewed as resilient, competitive pressures and the pace of consolidation in the sector could impact growth trajectory and execution risks.

What's in the News

- Ryan Lada has stepped down as Chief Financial Officer. Diane McClintock, previously Senior Vice President of FP&A and Investor Relations, has been appointed CFO, bringing operational and financial continuity to the company (Key Developments).

- Watts Water Technologies completed a buyback tranche, repurchasing 14,593 shares for $3.88 million. The company has now bought back a total of 76,167 shares for $16.9 million under its ongoing program (Key Developments).

- The company has raised its guidance for 2025, now projecting reported sales growth of 7% to 8%, organic sales growth of 4% to 5%, and an operating margin of 18.1% to 18.2%. This reflects the positive impact of recent acquisitions and tariff adjustments (Key Developments).

Valuation Changes

- The Fair Value Estimate has increased from $282 to $292.50, reflecting increased confidence in future performance.

- The Discount Rate has declined slightly from 8.33% to 8.22%, indicating lower perceived risk.

- Revenue growth assumptions have risen from 4.59% to 6.18%, projecting stronger sales momentum.

- The Net Profit Margin forecast has improved from 14.94% to 15.70%, supporting expectations of higher profitability.

- The future P/E ratio has decreased from 29.42x to 27.66x, making the valuation more attractive based on the revised earnings outlook.

Key Takeaways

- Accelerating growth in intelligent water management and regulatory-driven demand is boosting recurring revenue, margins, and Watts' pricing power across key sectors and acquisitions.

- Strategic investments in automation, supply chain, and integration of acquisitions are increasing operational efficiency, supporting profitability and resilience against global cost pressures.

- European weakness, tariff risks, fading pricing benefits, slow digital growth, and declining segment volumes threaten revenue stability, margin expansion, and long-term growth expectations.

Catalysts

About Watts Water Technologies- Supplies systems, products and solutions that manage and conserve the flow of fluids and energy into, though, and out of buildings in the commercial, industrial, and residential markets in the Americas, Europe, the Asia-Pacific, the Middle East, and Africa.

- The accelerating rollout and success of Nexa, Watts' intelligent water management platform, positions the company to capture the growing demand for advanced, data-driven water conservation, efficiency, and regulatory compliance solutions-expected to drive higher-margin, recurring revenue and support long-term earnings and margin expansion.

- Ongoing global urbanization and the need for water infrastructure upgrades-especially in fast-growing segments like data centers and across verticals such as hospitality and multifamily-are expected to sustain revenue growth by increasing the addressable market and demand for Watts' portfolio, including through new acquisitions.

- Growing sustainability and regulatory requirements around water quality, conservation, and carbon reduction are increasing demand for Watts' differentiated solutions (e.g., energy-efficient, compliant, and safe products), likely supporting resilient end-market demand and enabling continued pricing power, supporting topline growth and profitability.

- Strategic investments in automation, supply chain resilience, and proactive tariff management have improved operational flexibility and cost efficiency, positioning Watts to defend and potentially expand net margins even in the face of ongoing global trade and input cost volatility.

- Integration of recent acquisitions (I-CON, EasyWater, Bradley, Josam) is delivering faster-than-expected revenue and cost synergies, providing a catalyst for further operating leverage and supporting both revenue and earnings per share growth in future periods.

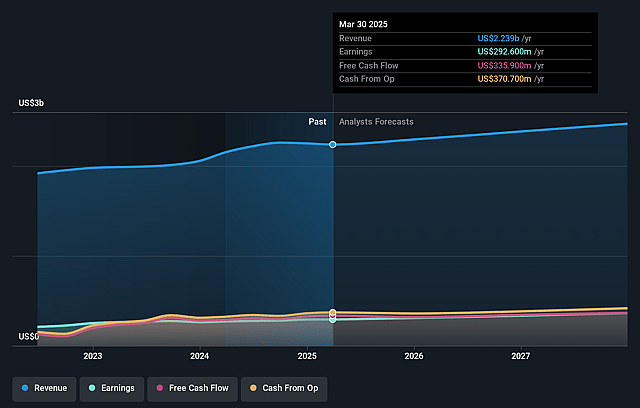

Watts Water Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Watts Water Technologies's revenue will grow by 4.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.6% today to 15.0% in 3 years time.

- Analysts expect earnings to reach $395.5 million (and earnings per share of $11.79) by about September 2028, up from $311.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.2x on those 2028 earnings, down from 29.6x today. This future PE is greater than the current PE for the US Machinery industry at 24.7x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.95%, as per the Simply Wall St company report.

Watts Water Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent weakness and uncertainty in the European market, with continued volume declines and soft construction activity, poses a risk to international revenue diversification and could result in longer-term revenue stagnation or even contraction.

- Significant exposure to tariff fluctuations, including unpredictable new tariffs on copper and products sourced globally, increases input cost volatility and could compress net margins if further price increases become unsustainable in the face of customer resistance or competitive pricing pressures.

- The positive impact of recent price/cost dynamics is largely nonrecurring (e.g., pull-forward demand and low-cost inventory), so gross and operating margins may decline toward historical levels, limiting sustained earnings growth and potentially disappointing future expectations.

- Growth in digital and smart water offerings (such as Nexa) is slow, with long sales cycles (1–2 years), small current revenue contribution, and uncertainty about the pace of adoption; this could result in underwhelming revenue and margin expansion from digital initiatives relative to long-term projections.

- Volumes in certain segments (notably residential and, at times, APMEA) are declining, and much of the recent outperformance in Americas was partly driven by pull-forward demand, which will reverse in subsequent quarters, risking future revenue and profit volatility if organic demand does not rebound.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $277.8 for Watts Water Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $300.0, and the most bearish reporting a price target of just $250.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.6 billion, earnings will come to $395.5 million, and it would be trading on a PE ratio of 29.2x, assuming you use a discount rate of 7.9%.

- Given the current share price of $276.13, the analyst price target of $277.8 is 0.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.