Key Takeaways

- Heavy reliance on mature Western markets and vulnerability to new efficient technologies threaten sustained revenue and growth prospects.

- Heightened competition, regulatory costs, and unpredictable infrastructure spending may compress margins and destabilize future earnings.

- Strategic focus on U.S. manufacturing, successful acquisitions, and recurring revenue streams position Watts Water for stable growth and market share gains despite industry volatility.

Catalysts

About Watts Water Technologies- Supplies systems, products and solutions that manage and conserve the flow of fluids and energy into, though, and out of buildings in the commercial, industrial, and residential markets in the Americas, Europe, the Asia-Pacific, the Middle East, and Africa.

- Demand for Watts Water Technologies' core products faces risk of long-term erosion as new, more water-efficient building technologies and alternative construction methods reduce the need for traditional plumbing and water flow control, which is likely to pressure top-line revenue over time.

- Persistent overreliance on North American and European markets exposes the company to saturated, slow-growing geographies, making sustained organic revenue expansion challenging as emerging markets remain a smaller part of the business mix.

- Intensifying competitive pressures from low-cost foreign manufacturers and innovative IoT-focused rivals could force Watts to increase R&D spending and lower prices, compressing net margins and restricting EPS growth across future years.

- The growing wave of ESG regulation and demand for comprehensive sustainability reporting is expected to raise compliance costs and introduce operational complexity, weighing on profitability and undermining long-term operating margins.

- Delays in infrastructure funding in developed markets and the risk of governments deferring water system upgrades may slow the replacement cycle, creating lumpy, unpredictable revenues that will make it difficult for Watts to achieve consistent earnings growth.

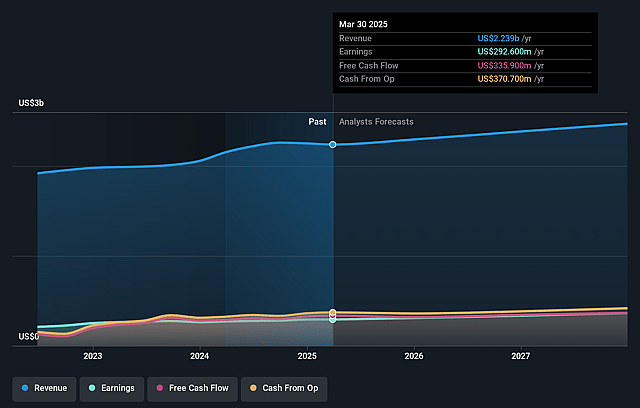

Watts Water Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Watts Water Technologies compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Watts Water Technologies's revenue will grow by 3.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 13.1% today to 15.3% in 3 years time.

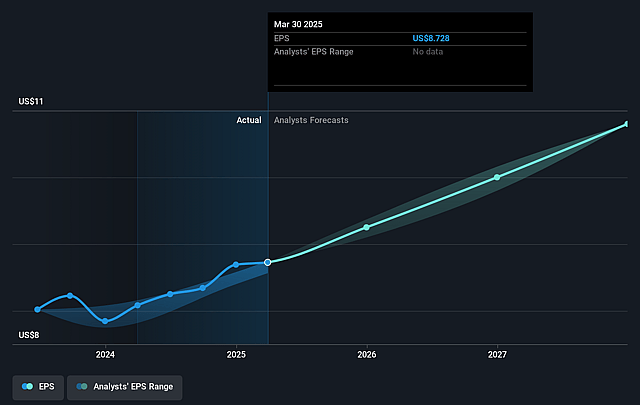

- The bearish analysts expect earnings to reach $373.9 million (and earnings per share of $11.12) by about July 2028, up from $292.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 24.7x on those 2028 earnings, down from 28.7x today. This future PE is greater than the current PE for the US Machinery industry at 22.9x.

- Analysts expect the number of shares outstanding to grow by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.51%, as per the Simply Wall St company report.

Watts Water Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's record-high adjusted operating income, margin, and earnings per share, along with a 21% dividend increase and solid free cash flow, demonstrate robust ongoing profitability that could support share price growth if these trends persist.

- Watts Water's strategic U.S. and local manufacturing footprint enables it to benefit from tariff and supply chain shifts, allowing it to gain market share from competitors more reliant on Chinese imports, which may drive revenue and margin expansion.

- Integration of recent acquisitions such as I-CON, Bradley, and Josam is progressing ahead of schedule, with expected accretive contributions to EBITDA margins and earnings per share, suggesting higher long-term earnings potential.

- The company's business model is anchored by a large repair and replacement component, providing a stable base of recurring revenue and insulating financial performance from new construction volatility, which may limit downside risk to revenue and cash flow.

- Ongoing productivity improvements, automation, and lean initiatives-supported by an experienced management team-position Watts Water to maintain or expand operating margins, enhancing long-term earnings growth and investor returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Watts Water Technologies is $225.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Watts Water Technologies's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $290.0, and the most bearish reporting a price target of just $225.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $2.5 billion, earnings will come to $373.9 million, and it would be trading on a PE ratio of 24.7x, assuming you use a discount rate of 7.5%.

- Given the current share price of $251.3, the bearish analyst price target of $225.0 is 11.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.