Key Takeaways

- Strategic integration and digital innovation are set to boost recurring, high-margin revenues, with potential for accelerated growth beyond analyst expectations.

- Strong manufacturing footprint and supply chain resilience should enhance market share, pricing power, and margin stability, positioning the company as a long-term industry consolidator.

- Reliance on traditional products in mature markets, rising competition, and disruptive technology trends threaten growth, margins, and long-term market relevance.

Catalysts

About Watts Water Technologies- Supplies systems, products and solutions that manage and conserve the flow of fluids and energy into, though, and out of buildings in the commercial, industrial, and residential markets in the Americas, Europe, the Asia-Pacific, the Middle East, and Africa.

- Analysts broadly agree that the integration of I-CON Systems will be accretive to EBITDA margins and EPS, but this likely underestimates the upside given Watts' track record of realizing synergy targets ahead of schedule and the potential for I-CON's digital platform to accelerate both top-line growth and recurring high-margin service revenues across multiple regions.

- While the consensus expects productivity savings and margin expansion from initiatives like the One Watts Performance System and manufacturing exits, the company's rapid vertical integration, ample unused US manufacturing capacity and automation investments could enable sustained annual margin expansion of 30 to 50 basis points, even in a challenging demand environment.

- The company is positioned to gain significant market share and pricing power in North America due to an advantaged domestic manufacturing footprint and supply chain resilience, as competitors struggle with high tariffs and supply constraints; this could drive above-trend revenue growth and further margin gains over several years.

- Watts' ongoing innovation in IoT-enabled and intelligent water management solutions not only taps into rising demand for digitalized, sustainable water systems but also supports higher-margin, recurring revenue streams, driving long-term uplift to net margins and earnings stability.

- With global urbanization and aging infrastructure creating a multi-decade upgrade cycle, Watts' strong balance sheet, disciplined capital allocation, and deep capabilities in water safety and quality position it to be a long-term consolidator, accelerating topline growth and consistently enhancing shareholder value through both organic and inorganic expansion.

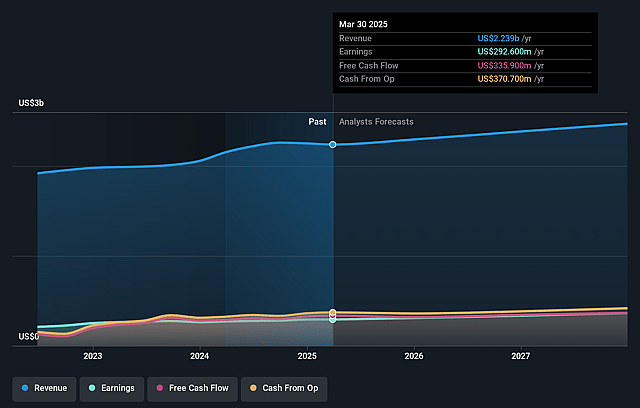

Watts Water Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Watts Water Technologies compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Watts Water Technologies's revenue will grow by 4.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 13.1% today to 14.7% in 3 years time.

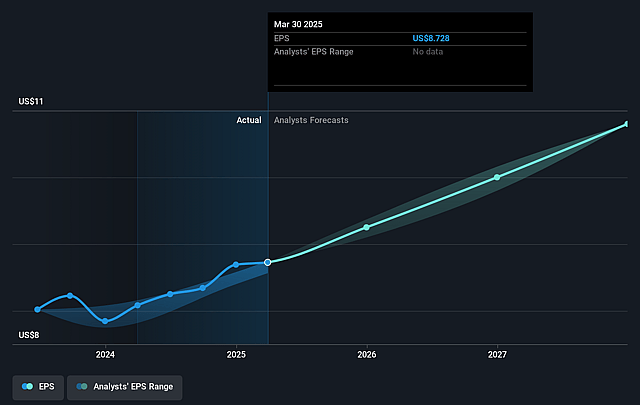

- The bullish analysts expect earnings to reach $378.4 million (and earnings per share of $11.22) by about July 2028, up from $292.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 31.4x on those 2028 earnings, up from 28.5x today. This future PE is greater than the current PE for the US Machinery industry at 22.9x.

- Analysts expect the number of shares outstanding to grow by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.51%, as per the Simply Wall St company report.

Watts Water Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's core markets are mature, and their product portfolio remains focused on traditional plumbing and flow control products, restricting meaningful organic growth and likely leading to slower long-term revenue expansion.

- Intensifying global competition, particularly from lower-cost regional manufacturers and large-scale industry consolidators, could increase pricing pressure and erode gross and net profit margins over time.

- Geopolitical factors and trade barriers, such as fluctuating tariffs and possible supply chain disruptions, pose ongoing risks to input costs and can compress operating margins and impact bottom line earnings.

- Secular trends toward increasing water efficiency and conservation, along with stagnant or declining construction activity in key developed markets due to demographic shifts, may reduce demand for new installations and replacement products, leading to downward pressure on long-term revenues.

- Accelerating technological disruption in smart building and water management sectors, led by larger or more tech-focused competitors, threatens Watts Water Technologies' market share and could undermine both revenue growth and pricing power over the long run.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Watts Water Technologies is $289.49, which represents two standard deviations above the consensus price target of $247.2. This valuation is based on what can be assumed as the expectations of Watts Water Technologies's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $290.0, and the most bearish reporting a price target of just $225.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $2.6 billion, earnings will come to $378.4 million, and it would be trading on a PE ratio of 31.4x, assuming you use a discount rate of 7.5%.

- Given the current share price of $249.84, the bullish analyst price target of $289.49 is 13.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.