Last Update 05 Nov 25

IPGP: Business Recovery and Expanding Margins Will Drive Measured Opportunity Ahead

IPG Photonics' analyst price target has risen sharply from $68 to $105. This reflects analysts' optimism following signs of business recovery, improved revenue growth, and expanding margins.

Analyst Commentary

Bullish analysts have expressed renewed confidence in IPG Photonics, citing improving fundamentals and positive forward indicators. The recent upgrades and raised price targets reflect constructive sentiment based on both near-term recovery and long-term growth prospects.

Bullish Takeaways- Bullish analysts highlight a notable turnaround in revenue growth after a lengthy period of declines, signaling underlying business recovery.

- Expanding margins are viewed as evidence of strong operational execution and strategic initiatives beginning to pay off.

- Analysts anticipate ongoing demand improvements, especially in markets such as welding and micromachining, providing further upside for the company.

- Leadership in fast-growing sectors, like urology and directed energy applications, is expected to support sustained top-line growth and offer new avenues for value creation.

- Some believe targets for future revenue growth may prove conservative, pointing to further potential for positive revisions if current momentum continues.

- Bearish analysts remain cautious about the sustainability of the recent business recovery, noting prior periods of underperformance.

- Concerns persist regarding the company's ability to achieve consistent double-digit revenue growth, especially as competition intensifies within core laser markets.

- There is some skepticism about whether margin expansion can be maintained in the face of potential market volatility and supply chain pressures.

- Execution risks remain, particularly as IPG Photonics seeks to diversify into new markets. This expansion may require additional investment and could impact short-term profitability.

What's in the News

- The company issued earnings guidance for Q4 2025, projecting revenue between $230 million and $260 million (Company Guidance).

- The company unveiled the patent-pending CROSSBOW MINI 3 kW high-energy laser system at DSEI UK, designed to counter drone threats with advanced tracking and rapid deployment features (Product Announcement).

- The CROSSBOW MINI 3 kW HEL system has been proven in the field, successfully neutralizing over 100 drones in realistic operational scenarios (Product Announcement).

- The company expanded its CROSSBOW product line to include the available MINI 500 W Dazzler and the forthcoming MINI 8 kW HEL system, supporting scalable and cost-effective counter-UAS protection for military and private uses (Product Announcement).

Valuation Changes

- The discount rate has declined slightly from 8.23% to 8.19%, reflecting a modest decrease in perceived risk or required return.

- The revenue growth estimate has risen from 8.08% to 9.02%, signaling greater optimism in the company’s future sales expansion.

- Net profit margin is essentially unchanged, moving marginally higher from 11.21% to 11.21%.

- The future P/E ratio has fallen from 30.60x to 28.47x, indicating a lowered valuation multiple on projected earnings.

- Fair value remains consistent at $82.83, with no change in the latest assessment.

Key Takeaways

- Expanding applications in automation, electric vehicles, and new verticals like medical and defense are driving diversified growth and increasing IPG's long-term revenue potential.

- Operational efficiencies, flexible manufacturing, and innovative product launches are expected to further support margin expansion and stronger profitability.

- Rising geopolitical and competitive pressures, combined with core business softness and high investment risk in emerging segments, threaten IPG's revenue stability, margins, and earnings growth.

Catalysts

About IPG Photonics- Develops, manufactures, and sells various high-performance fiber lasers, fiber amplifiers, and diode lasers used in materials processing, medical, and advanced applications worldwide.

- Demand for advanced lasers is expected to rise as manufacturers globally accelerate automation and reshore production, leading to increased local investment in IPG's offerings and creating a runway for future revenue growth.

- The rapid transition to electric vehicles and battery production, especially in China and other major markets, is already driving increased adoption of welding, cutting, and micromachining lasers-expanding IPG's addressable market and positioning the company for continued top-line growth.

- New growth initiatives in medical (e.g., thulium lasers for urology), semiconductor, and micromachining end-markets are gaining early traction, diversifying revenue streams and supporting higher margins over time as these higher-value verticals scale.

- Recent product innovations like the CROSSBOW directed energy system-validated with multiple unit deliveries and key partnerships (e.g., Lockheed Martin)-open up opportunities in defense and critical infrastructure, supporting both revenue acceleration and improved operating leverage.

- The company's flexibility to shift manufacturing across regions to mitigate tariffs, combined with operational improvements and cost reduction actions, should drive margin expansion and eventually boost both net income and free cash flow as revenues ramp.

IPG Photonics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming IPG Photonics's revenue will grow by 8.1% annually over the next 3 years.

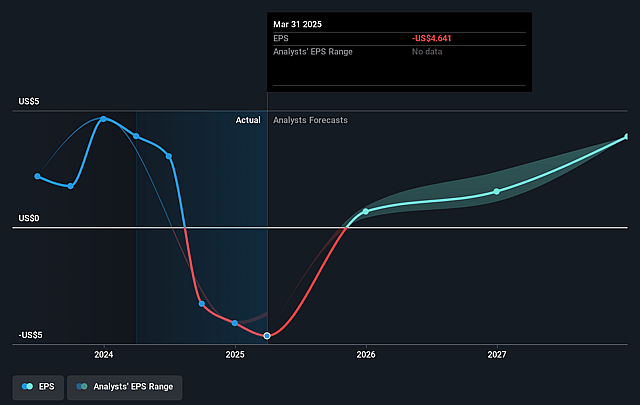

- Analysts assume that profit margins will increase from -22.8% today to 11.2% in 3 years time.

- Analysts expect earnings to reach $133.9 million (and earnings per share of $3.15) by about September 2028, up from $-215.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.6x on those 2028 earnings, up from -16.1x today. This future PE is greater than the current PE for the US Electronic industry at 23.9x.

- Analysts expect the number of shares outstanding to decline by 2.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.16%, as per the Simply Wall St company report.

IPG Photonics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing tariff pressures and geopolitical uncertainties-especially new tariffs and long customs processing in key markets-create a volatile demand environment that management themselves characterize as having only cautious optimism, potentially leading to unpredictable revenues and reduced gross margins.

- Materials processing revenue, which has historically been IPG's core business, declined 6% year-over-year (factoring out divestitures), with management noting softness in cutting, welding, and additive manufacturing in several regions-exposing the company to the risk of long-term revenue stagnation if core markets do not recover robustly.

- Elevated operating expenses driven by heavy R&D spend, high CapEx ($100 million forecast for 2025), strategic M&A, and expansion of the organization could suppress free cash flow and net margins if new initiatives do not achieve strong growth or encounter slower-than-anticipated market adoption.

- While innovative advanced applications (e.g., medical, micromachining, defense) are showing growth, these markets are described as nascent and hard to size; over-reliance on new, unproven segments brings execution risk and may not offset margin erosion or declines in legacy businesses, impacting long-term earnings stability.

- Competitive forces-from low-cost Asian manufacturers, potential commoditization of fiber lasers, and alternative technological advances-threaten IPG's pricing power and market share in both legacy and emerging applications, with possible downward pressure on long-term gross margins and the sustainability of earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $80.2 for IPG Photonics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $97.0, and the most bearish reporting a price target of just $65.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $133.9 million, and it would be trading on a PE ratio of 29.6x, assuming you use a discount rate of 8.2%.

- Given the current share price of $81.93, the analyst price target of $80.2 is 2.2% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.