Key Takeaways

- Increasing competitive pressure, regulatory costs, and technological shifts threaten profitability and could undermine revenue growth in IPG's core industrial laser business.

- Tariffs, supply chain issues, and global deglobalization trends may hinder international expansion and lead to stagnation or decline in key overseas markets.

- Success in diversification, defense innovation, operational agility, and strong financial discipline position IPG Photonics for sustained growth and resilience against macroeconomic and industry risks.

Catalysts

About IPG Photonics- Develops, manufactures, and sells various high-performance fiber lasers, fiber amplifiers, and diode lasers used in materials processing, medical, and advanced applications worldwide.

- The rapid global adoption of automation and smart manufacturing may lead to the commoditization of fiber lasers, which could drive down average selling prices significantly and destroy IPG's gross and net margins over time, resulting in sustained margin compression and lower earnings growth.

- Persistent tariff escalations, supply chain disruptions, and intensifying deglobalization-particularly between the U.S. and China-could severely limit IPG's ability to penetrate key international markets, causing future revenue growth in Asia and Europe to stagnate or decline.

- Escalating competition from low-cost Asian manufacturers, especially in China, is likely to intensify pricing pressure and erode market share in IPG's core industrial markets, leading to decreased revenues and potentially negative operating leverage as fixed costs remain elevated.

- High and rising regulatory requirements on environmental sustainability and energy efficiency for industrial laser manufacturers may result in structurally higher compliance and operational costs, further squeezing profitability and limiting effective free cash flow generation.

- The ongoing emergence and adoption of alternative material processing technologies, such as ultrafast lasers and additive manufacturing, threaten to cannibalize demand for traditional high-power fiber lasers, posing a significant long-term risk to IPG's addressable markets and top-line growth.

IPG Photonics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on IPG Photonics compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming IPG Photonics's revenue will grow by 4.2% annually over the next 3 years.

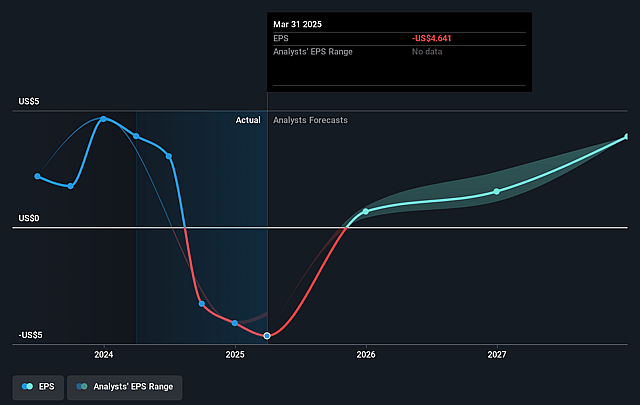

- The bearish analysts assume that profit margins will increase from -22.8% today to 15.8% in 3 years time.

- The bearish analysts expect earnings to reach $169.4 million (and earnings per share of $3.98) by about September 2028, up from $-215.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 18.9x on those 2028 earnings, up from -16.0x today. This future PE is lower than the current PE for the US Electronic industry at 23.9x.

- Analysts expect the number of shares outstanding to decline by 2.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.16%, as per the Simply Wall St company report.

IPG Photonics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- IPG Photonics is experiencing early success from its strategy to diversify beyond traditional materials processing into high-growth areas such as medical, micromachining, and advanced applications, which is already driving higher revenue in these segments and could provide multi-year margin and earnings expansion.

- The company's strong position and innovation in directed energy for defense (including the CROSSBOW anti-drone system) are opening potentially large new addressable markets with interest from major customers like Lockheed Martin, offering long-term revenue growth uncorrelated to cyclical industrial demand.

- IPG's ability to flexibly shift global manufacturing and minimize the impact of tariffs demonstrates strong operational agility, helping the company maintain stable gross margins and revenue resilience even amid trade disruptions, which could support steady earnings.

- Recent improvements in industrial demand, book-to-bill ratios around 1 across all regions, and the normalization of OEM inventories suggest a stabilizing and potentially improving demand environment, which may translate to top-line growth and support for share price over time.

- The company's robust balance sheet, with $900 million in cash and no debt, along with a disciplined capital allocation strategy focused on growth investment, M&A, and ongoing share repurchases, positions IPG exceptionally well to navigate macro uncertainty, drive future revenue, and support shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for IPG Photonics is $65.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of IPG Photonics's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $97.0, and the most bearish reporting a price target of just $65.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $169.4 million, and it would be trading on a PE ratio of 18.9x, assuming you use a discount rate of 8.2%.

- Given the current share price of $81.58, the bearish analyst price target of $65.0 is 25.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.