Key Takeaways

- Rapid adoption of new high-power laser platforms and vertical integration are driving early margin expansion and positioning IPG for outsized growth in high-demand sectors.

- Accelerating global automation and manufacturing recovery are creating immediate, sustained demand tailwinds, shortening the cycle between R&D investment and revenue gains.

- Persistent supply chain and regulatory pressures, end-market concentration, and increasing competition threaten IPG's growth, margins, and diversification prospects despite efforts to expand beyond core markets.

Catalysts

About IPG Photonics- Develops, manufactures, and sells various high-performance fiber lasers, fiber amplifiers, and diode lasers used in materials processing, medical, and advanced applications worldwide.

- Analysts broadly agree that new product launches, such as the high-power fiber laser platform, will help defend market share and modestly improve margins, but these platforms are coming to market much faster than expected and are already securing significant wins in EV manufacturing and advanced applications, suggesting near-term revenue inflection that is likely to outpace consensus expectations.

- Analyst consensus expects initial returns from strategic R&D in 2025 with bigger gains further out, but tangible early successes-including having achieved record revenue in advanced applications, commercial traction for the CROSSBOW system through Lockheed Martin, and rapid customer adoption in medical-indicate that the drag between R&D and revenue is shortening, setting the stage for an outsized acceleration in top line and high-margin product mix.

- The accelerating shift toward automation in global manufacturing is becoming an immediate tailwind for IPG as OEM inventories normalize and PMIs recover globally, pointing to a broad-based, sustained increase in demand for their lasers and systems that should enable multi-year double-digit revenue growth and operating leverage.

- Surging demand for electronics, semiconductors, and EV batteries-including capacity investments in China for battery manufacturing-is translating into robust growth for IPG's micromachining, welding, and other precision segments, directly expanding IPG's TAM and positioning the company for outsized revenue share in fast-expanding, high-growth verticals.

- IPG's deep vertical integration and new leadership bench are already reducing costs and improving manufacturing yields-examples include automation in consumables and higher-output product lines-suggesting margin expansion will happen more quickly than the market expects, with free cash flow and net income poised for a step change even before full macro recovery.

IPG Photonics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on IPG Photonics compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming IPG Photonics's revenue will grow by 8.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -22.8% today to 13.9% in 3 years time.

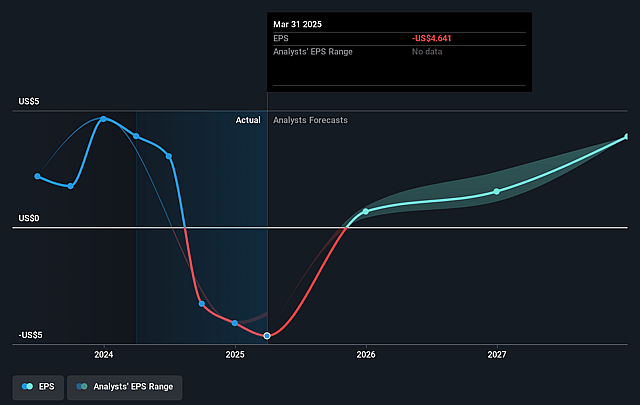

- The bullish analysts expect earnings to reach $169.4 million (and earnings per share of $3.98) by about September 2028, up from $-215.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 28.3x on those 2028 earnings, up from -16.1x today. This future PE is greater than the current PE for the US Electronic industry at 23.9x.

- Analysts expect the number of shares outstanding to decline by 2.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.16%, as per the Simply Wall St company report.

IPG Photonics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Long-term relocation of global manufacturing and continued geopolitical tensions are leading to supply chain de-risking and tariff unpredictability, which may reduce demand for sophisticated laser systems in China and Europe and cause persistent pressure on international revenue growth and future earnings.

- Increased legislative focus on environmental regulation and energy efficiency could accelerate customer adoption of alternative, eco-friendlier material processing technologies, gradually cannibalizing high-power fiber laser demand and constraining IPG Photonics' total addressable market as well as long-term revenue growth.

- Intensifying competition from lower-cost Asian manufacturers and technological commoditization are already resulting in price erosion, which is likely to squeeze IPG's gross and operating margins over time, as reflected in recent flat and modestly improving margins despite revenue gains.

- Heavy dependence on the industrial materials processing market, especially automotive and consumer electronics, exposes IPG to end-market cyclicality and structural decline risk, which may lead to lower and less predictable revenue and earnings if demand from these sectors remains soft or trends downward.

- Despite investments in medical and advanced applications, IPG's limited diversification beyond core industrial processing increases concentration risk, meaning that failure to achieve meaningful scale in new markets could lead to long-term revenue stagnation and heightened volatility in earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for IPG Photonics is $97.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of IPG Photonics's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $97.0, and the most bearish reporting a price target of just $65.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $169.4 million, and it would be trading on a PE ratio of 28.3x, assuming you use a discount rate of 8.2%.

- Given the current share price of $81.93, the bullish analyst price target of $97.0 is 15.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.