Last Update 07 Jan 26

Fair value Decreased 0.57%ULVR: Margin Resilience And Q4 Volume Support A More Constructive Outlook

Narrative Update

The updated analyst price target for Unilever reflects a shift from £40.00 to £41.00 per share, as analysts weigh contained earnings growth, pressure on pricing and operating margins, and potential sentiment risks around FY26 margin guidance and U.S. growth contributions.

Analyst Commentary

Recent research reflects a slightly higher price target of £41.00 per share, but with a cautious tone around earnings quality, valuation and medium term guidance.

Bullish Takeaways

- Bullish analysts point to the raised price target as recognition that current pricing still captures some support for Unilever's brand portfolio and global footprint, even with constrained earnings growth.

- Expectations for Q4 volume and mix around 2% suggest to some that underlying demand remains reasonably steady, which can help underpin revenue execution if pricing power is limited.

- The focus on operating margin dynamics into FY26 highlights potential room for management to fine tune cost control and mix over time, which bullish analysts see as a lever for earnings resilience.

Bearish Takeaways

- Bearish analysts highlight that, despite the higher target, the rating remains cautious as pricing and operating margin pressures are seen as keeping earnings growth contained and limiting upside for the equity story.

- Questions around FY26 operating margin guidance introduce uncertainty on medium term profitability, which can weigh on how investors assess the risk and reward in the current valuation.

- Concerns about a possible slowing contribution from U.S. growth in 1H26 add another layer of risk to Unilever's top line profile, especially given how important U.S. performance can be to investor sentiment.

- The combination of earnings constraints and sentiment risk around guidance leads more cautious analysts to see potential downside risk relative to where the shares are currently priced.

What's in the News

- Unilever completed the spin off of The Magnum Ice Cream Company with an Amsterdam listing valued above $9b, following earlier plans to separate the ice cream business that also includes Ben & Jerry's (Barron's, company announcement).

- Deutsche Bank initiated coverage of The Magnum Ice Cream Company with a Hold rating and a target price of €14.50, versus trading levels around €13.30 in Amsterdam (Barron's).

- Unilever previously delayed the Magnum demerger timing due to the U.S. government shutdown. The company indicated it was still confident about launching the deal later in the year (Reuters).

- Dove, part of Unilever, partnered with Netflix and Shondaland on a limited edition Dove x Bridgerton collection tied to the Season 4 global premiere, extending the brand into themed fragrances and personal care products (company announcement).

- Alcoa, Ball Corporation and Unilever announced first use of ELYSIS carbon free aluminum in personal and home care aerosol packaging, aiming for lower greenhouse gas emissions in packaging materials (company announcement).

Valuation Changes

- The Fair Value Estimate has edged down slightly, from 53.37 to 53.07.

- The Discount Rate has moved marginally lower, from 8.22% to 8.11%, which slightly reduces the required return used in the model.

- The Revenue Growth assumption now reflects a steeper implied decline, shifting from about a 1.52% decline to roughly a 2.94% decline.

- The Net Profit Margin assumption has ticked up modestly, from 12.63% to 13.06%, implying a slightly higher share of revenue expected to convert to profit.

- The Future P/E has inched higher, from 22.74x to 22.97x, indicating a small uplift in the multiple applied to projected earnings.

Key Takeaways

- Shifting focus to premium, science-led products and divesting non-core brands is streamlining operations, boosting margins, and enhancing long-term profitability.

- Emphasis on digital expansion, emerging markets, and brand investment is fueling sustained revenue growth and stronger competitive positioning.

- Intensifying competition, regional underperformance, input cost pressures, portfolio streamlining, and elevated regulatory scrutiny threaten sustainable revenue growth, margin expansion, and brand stability.

Catalysts

About Unilever- Operates as a fast-moving consumer goods company in the Asia Pacific, Africa, the Americas, and Europe.

- Acceleration of volume growth in key emerging markets (India, China, Indonesia), supported by rising disposable incomes, urbanization, and rapid expansion in digital/e-commerce channels, is expected to drive sustained top-line revenue growth as these markets recover and Unilever gains market share.

- Portfolio transformation with a sharper focus on premium and science-led Personal Care and Beauty & Wellbeing products, coupled with bolt-on acquisitions of fast-growing digitally native brands, is increasing exposure to higher-margin categories and supporting long-term margin and earnings expansion.

- Strategic divestitures, including the demerger of Ice Cream and continued disposal of non-core food brands, are simplifying the business model and structurally raising the gross and operating margin profile of the remaining company, directly improving profitability and ROIC.

- Improved productivity via supply chain digitization, procurement efficiencies, and disciplined cost management (targeted cost savings of €650 million in 2025) are enhancing gross margins, providing additional fuel for competitive brand investment, and supporting higher sustainable earnings growth.

- Increased investment in brand marketing (15–16% of revenue, notably in Power Brands and digital commerce) is driving innovation, strengthening brand equity, and enabling Unilever to better capture evolving consumer demand in wellness, health, and premiumization, likely resulting in higher revenue growth and maintained or expanded market share.

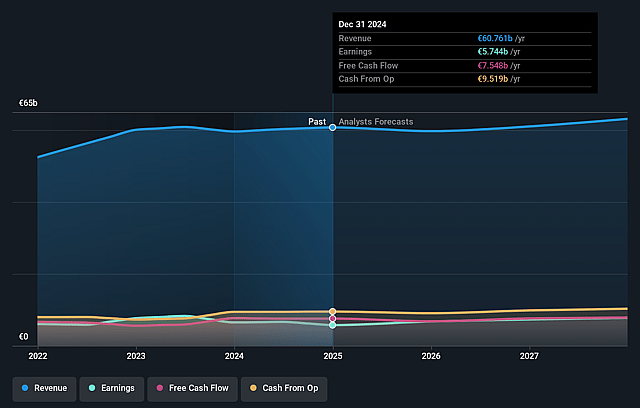

Unilever Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Unilever's revenue will grow by 2.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.3% today to 12.5% in 3 years time.

- Analysts expect earnings to reach €8.1 billion (and earnings per share of €3.27) by about September 2028, up from €5.6 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.1x on those 2028 earnings, down from 24.6x today. This future PE is greater than the current PE for the US Personal Products industry at 18.7x.

- Analysts expect the number of shares outstanding to decline by 0.96% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.38%, as per the Simply Wall St company report.

Unilever Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition from private label and local/niche brands-especially in personal care and food-in key markets like the US and Europe threatens Unilever's long-term pricing power and could erode market share, undermining revenue growth and margin expansion.

- Weak emerging market performance, particularly chronic volume declines in Latin America and flat or negative trends in China and Indonesia, exposes the company to ongoing regional underperformance, creating persistent drag on group revenue and structural headwinds for growth.

- Ongoing input cost inflation (commodities, packaging, transport) and adverse currency movements, especially pronounced in 2025, have pressured operating margins and led to reliance on price increases that may not be sustainable, risking future profitability and earnings.

- The company's continuing portfolio rationalization-including divestitures like the Ice Cream unit and underperforming food brands-could reduce overall scale benefits and increase business concentration, potentially leading to revenue volatility, reduced diversification, and uneven margin trajectory if not offset by sufficient growth in premium categories.

- Heightened regulatory, environmental, and consumer scrutiny around sustainability, ingredient transparency, and global tax regimes-increasing compliance costs and reputational risks-may constrain long-term margin improvement and require ongoing heavy investment to maintain brand equity and customer trust.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £50.35 for Unilever based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £59.26, and the most bearish reporting a price target of just £38.97.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €64.8 billion, earnings will come to €8.1 billion, and it would be trading on a PE ratio of 22.1x, assuming you use a discount rate of 8.4%.

- Given the current share price of £47.62, the analyst price target of £50.35 is 5.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Unilever?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.