Last Update 05 Nov 25

Fair value Increased 29%IVVD: FDA Clearance and REVOLUTION Program Launch Signal Strong Upside Ahead

Narrative Update: Invivyd Analyst Price Target Increased

Invivyd's analyst price target has been raised from $5.67 to $7.33 per share. Analysts cite strengthened commercial and regulatory prospects following the launch of the REVOLUTION clinical program.

Analyst Commentary

Bullish Takeaways

- Bullish analysts have raised their price targets for Invivyd, reflecting increased optimism about future share performance.

- The launch of the REVOLUTION clinical program for VYD2311 is seen as a meaningful inflection point that could drive regulatory approvals and commercial uptake.

- Continued progress in clinical development strengthens confidence in Invivyd's ability to address unmet needs in COVID-19 prevention with innovative monoclonal antibody therapies.

- Improved commercial prospects and a clearer regulatory pathway are expected to support both near-term execution and long-term revenue growth for the company.

Bearish Takeaways

- Bearish analysts remain cautious about the competitive landscape and the challenges in differentiating VYD2311 from other COVID-19 prevention options.

- Uncertainties around clinical trial outcomes and the timing of regulatory milestones may impact valuation and investor confidence.

- Execution risk associated with launching a new program in a rapidly evolving market environment remains a consideration for some analysts.

- Long-term commercial success will depend on continued positive data and the company's ability to gain traction with prescribers and payers.

What's in the News

- The U.S. FDA has cleared Invivyd's IND application and provided feedback to advance the REVOLUTION clinical program. This includes two pivotal trials evaluating the VYD2311 monoclonal antibody for COVID-19 prevention, with trial initiation targeted by year-end 2025 and top-line data expected mid-2026 (Key Developments).

- The SPEAR Study Group issued a consensus recommendation to study the effects of monoclonal antibody therapy, including Invivyd's VYD2311, on Long COVID. This follows Invivyd receiving emergency use authorization in March 2024 for a mAb in its pipeline (Key Developments).

- Invivyd announced positive in vitro neutralization data for PEMGARDA (pemivibart) against the XFG variant of SARS-CoV-2, supporting its use for pre-exposure prophylaxis of COVID-19 in certain immunocompromised patients (Key Developments).

- Invivyd has aligned with the U.S. FDA on a rapid pathway to potential BLA approval for VYD2311, with plans for a single Phase 2/3 trial that could support licensure for prevention of COVID-19 in Americans aged 12 and older (Key Developments).

- The company recently completed a $49.99 million follow-on equity offering, strengthening its balance sheet to support ongoing clinical development (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has risen from $5.67 to $7.33 per share, reflecting an upward adjustment in fair value estimates.

- Discount Rate has fallen slightly, from 6.84% to 6.83%. This suggests a marginally lower perceived risk or cost of capital.

- Revenue Growth expectations remain virtually unchanged and hold steady at approximately 79.9%.

- Net Profit Margin is forecast to improve modestly, increasing from 16.16% to 16.28%.

- Future P/E (Price-to-Earnings) multiple has risen from 19.23x to 24.70x. This indicates increased expectations for future earnings growth or valuation expansion.

Key Takeaways

- Expansion of a skilled commercial team and new therapeutic programs positions Invivyd for broader market adoption, revenue growth, and reduced product concentration risk.

- Financial discipline and evolving regulatory support enhance sustainability, lower risk, and may fast-track product approvals and recurring revenue opportunities.

- Heavy reliance on a narrow COVID-19 product line, regulatory and competitive risks, and slow diversification threaten Invivyd's long-term revenue growth and financial stability.

Catalysts

About Invivyd- A biopharmaceutical company, focuses on the discovery, development, and commercialization of antibody-based solutions for infectious diseases in the United States.

- The transition to a fully internalized, best-in-class commercial sales team is driving broader adoption of PEMGARDA, as indicated by accelerating commercial metrics and institutional orders, which is likely to drive near-term revenue growth and improve efficiency, potentially expanding net margins as the commercial footprint matures.

- Invivyd’s proprietary antibody discovery platform is enabling the rapid addition of programs for RSV and measles, diversified beyond COVID-19, which positions the company to benefit from sustained global demand for innovative infectious disease therapies, supporting long-term top-line revenue growth and reducing concentration risk.

- Enhanced regulatory engagement and the shift in FDA and public health leadership toward accelerated and transparent approval pathways for critical infectious disease therapies may expedite time-to-market for Invivyd’s next-generation products, raising the probability of earlier revenue realization and improved earnings visibility.

- The global persistence and rising awareness of infectious diseases, alongside declining vaccination rates and ongoing threats such as COVID-19 and measles, ensure a large addressable patient population for Invivyd’s antibody therapeutics, underpinning recurring revenue opportunities and potential for market share expansion.

- Financial discipline, as evidenced by significant reductions in quarterly operating expenses and a focus on non-dilutive funding, improves the outlook for sustainable profitability and reduces dilution risk, which directly benefits potential future earnings and per-share value.

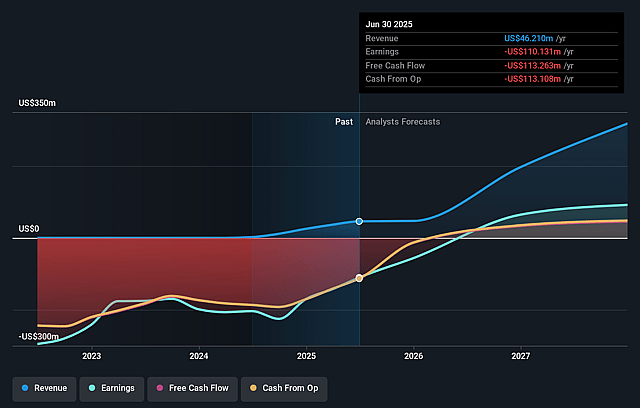

Invivyd Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Invivyd's revenue will grow by 96.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from -238.3% today to 28.6% in 3 years time.

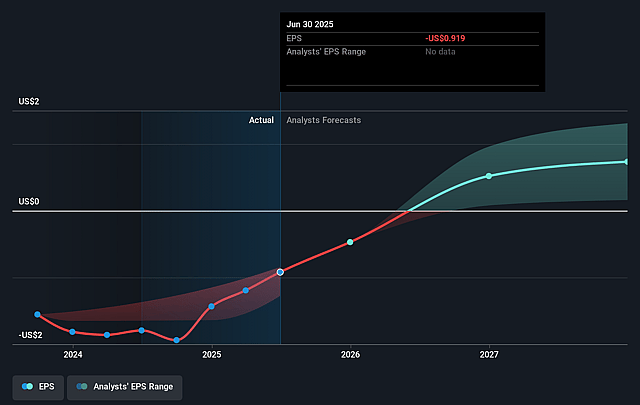

- Analysts expect earnings to reach $100.0 million (and earnings per share of $0.45) by about September 2028, up from $-110.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $158.4 million in earnings, and the most bearish expecting $19 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.2x on those 2028 earnings, up from -1.8x today. This future PE is lower than the current PE for the US Biotechs industry at 15.5x.

- Analysts expect the number of shares outstanding to grow by 0.44% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Invivyd Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Invivyd’s heavy current reliance on PEMGARDA and a limited COVID-19-focused product portfolio exposes it to significant product concentration risk; if demand for COVID-19 monoclonal antibodies declines due to improved public health measures, increasing vaccine uptake, or competing therapies, long-term revenues may fluctuate or shrink.

- Ongoing regulatory headwinds—exemplified by the FDA’s declining of an expanded EUA for treatment and persistent ambiguity around requirements for full product approvals—raise the risk of delayed or restricted market access for current and pipeline candidates, which could constrain revenue growth or delay margin improvement.

- Accelerating competition from large pharmaceutical companies and alternative modalities (such as evolving oral antivirals or mRNA vaccines for infectious diseases) may erode Invivyd’s ability to capture and maintain market share in both COVID-19 and future pipeline indications, negatively impacting long-term top-line growth and earnings.

- The company’s strategy of broadening into RSV and measles monoclonal antibodies remains very early stage; uncertain and potentially slow clinical development, coupled with reliance on disciplined capital deployment and outside partnerships, may limit the diversification of revenue streams and increase the risk of ongoing net losses or shareholder dilution if near-term commercial success is not achieved.

- Secular and industry trends toward increased governmental scrutiny around drug pricing and healthcare reimbursement—as well as the company’s recent price increases on PEMGARDA—may compress net profit margins and restrict Invivyd’s ability to fully capitalize on its current and future therapeutics.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $3.0 for Invivyd based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $5.0, and the most bearish reporting a price target of just $1.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $349.7 million, earnings will come to $100.0 million, and it would be trading on a PE ratio of 7.2x, assuming you use a discount rate of 6.8%.

- Given the current share price of $1.04, the analyst price target of $3.0 is 65.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.