Key Takeaways

- Invivyd's COVID-19 and next-generation antibody products are primed for durable, expanding revenue streams, potentially outpacing market expectations through breakthrough clinical benefits and guideline inclusion.

- The company's diversified pipeline, pandemic readiness focus, and operational efficiency position it for higher growth, stronger margins, and sustained earnings in a shifting healthcare landscape.

- Heavy reliance on a narrow antibody portfolio, regulatory uncertainty, high costs, and intense competition undermine long-term revenue stability and risk shareholder dilution.

Catalysts

About Invivyd- A biopharmaceutical company, focuses on the discovery, development, and commercialization of antibody-based solutions for infectious diseases in the United States.

- Analyst consensus sees pemivibart as a steady generator of revenue, but this view understates just how structurally durable and defensible Invivyd's COVID-19 franchise may be given the remarkable long-term stability of the drug's epitope, ongoing real-world medical need, and emerging guideline inclusion, pointing to potentially multi-year, compounding revenue growth well above current street models.

- While the street expects next-generation antibody VYD2311 to merely drive incremental gains, Invivyd's leading preclinical and early clinical data indicate the molecule could deliver a step-change in potency, flexible administration, and new treatment indications-positioning it not just for wider market reach but for breakthrough product status that could materially expand revenue and gross margin upside.

- Invivyd's expanding platform beyond COVID-19, with rapid pipeline additions in high-profile viral threats like RSV and measles, positions the company to capitalize on intensifying global investment in pandemic preparedness and infectious disease, opening recurring revenue streams from governments and large payors-potentially transforming the growth profile and supporting much higher future earnings.

- With population aging and rising vulnerability to infectious disease, Invivyd's focus on antibody-driven prevention gives it a front-row seat to a demographic wave that could drive a sustained, secular expansion in the company's addressable market and annual product sales.

- Operational excellence-marked by a nimble, metrics-driven in-house commercial team, disciplined cost reductions, and strategic use of non-dilutive capital-sets the stage for Invivyd to achieve not just near-term profitability but long-term operating leverage, enabling accelerated EPS growth as revenue scales.

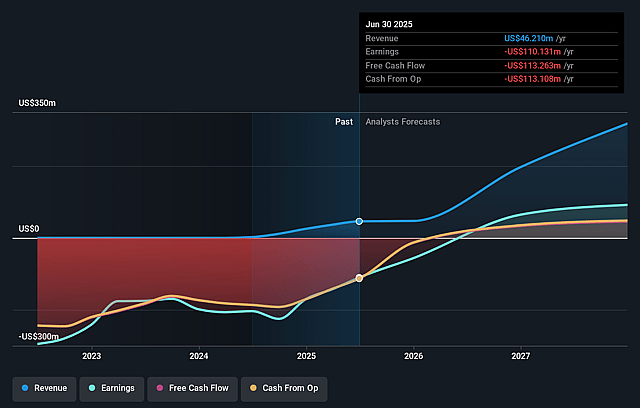

Invivyd Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Invivyd compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Invivyd's revenue will grow by 112.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -238.3% today to 48.5% in 3 years time.

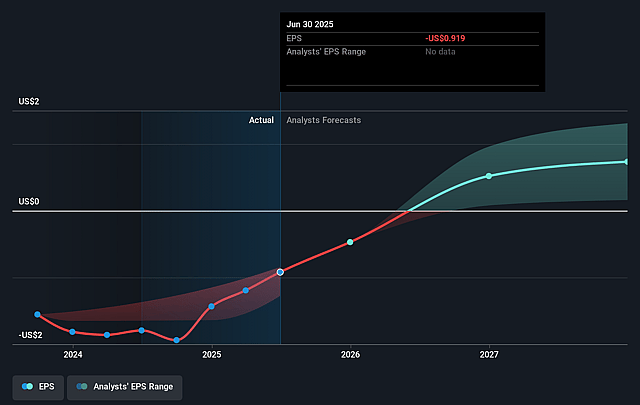

- The bullish analysts expect earnings to reach $213.7 million (and earnings per share of $0.94) by about September 2028, up from $-110.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 5.6x on those 2028 earnings, up from -2.2x today. This future PE is lower than the current PE for the US Biotechs industry at 15.3x.

- Analysts expect the number of shares outstanding to grow by 0.44% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Invivyd Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company remains dependent on Emergency Use Authorization rather than full regulatory approval for its key monoclonal antibody product, creating significant uncertainty and potential delays in moving to a BLA pathway as regulatory scrutiny intensifies, which could depress revenue and elongate the path to profitability.

- Invivyd's pipeline is narrowly focused on monoclonal antibodies for a limited range of infectious diseases, and early-stage efforts in areas like measles and RSV do not meaningfully diversify current revenue streams, magnifying risk if demand for COVID-19 monoclonals wanes or is disrupted, thereby impacting long-term revenue stability.

- The company is experiencing persistent high research and development costs without significant offsetting licensing or partnered revenue, compelling reliance on existing cash reserves and term loans in a climate where capital markets are tightening; this puts future earnings and shareholder value at risk due to possible dilutive fundraising.

- Competitive threats from established pharmaceutical players and potential new modalities, including antivirals and biosimilars, threaten to erode Invivyd's market share and pricing power, placing downward pressure on gross margins and net earnings.

- The rapid pace of viral mutation and emerging commoditization of antiviral therapies could result in shortened product lifecycles and pricing caps, especially as healthcare systems worldwide increase cost controls, which together may undercut long-term revenue growth and profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Invivyd is $5.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Invivyd's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $5.0, and the most bearish reporting a price target of just $1.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $441.0 million, earnings will come to $213.7 million, and it would be trading on a PE ratio of 5.6x, assuming you use a discount rate of 6.8%.

- Given the current share price of $1.22, the bullish analyst price target of $5.0 is 75.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.