Key Takeaways

- Heavy reliance on emergency authorizations, regulatory uncertainties, and a narrow late-stage pipeline threaten Invivyd's long-term revenue stability and growth prospects.

- Heightened pricing pressures, high R&D costs, and formidable competition may erode profitability despite strong product demand and innovative advances in antibody engineering.

- Invivyd faces significant regulatory, competitive, and financial pressures due to dependence on a single product, uncertain market demand, and challenging industry dynamics.

Catalysts

About Invivyd- A biopharmaceutical company, focuses on the discovery, development, and commercialization of antibody-based solutions for infectious diseases in the United States.

- While Invivyd benefits from a growing need for novel antiviral therapies and the company's internalization of its commercial team is beginning to drive adoption of PEMGARDA, persistent regulatory hurdles, including limited clarity around the path to a full BLA and heavy dependence on emergency authorizations, may constrain sustained top-line revenue growth and slow market expansion.

- Although global healthcare spending and willingness to pay for innovative therapies theoretically support the uptake of monoclonal antibodies, increasing global cost containment and pricing pressures-together with Invivyd's modest price increase on PEMGARDA-could limit pricing power, potentially putting downward pressure on net margins over time.

- Despite the company's strong recent cash position and successful access to non-dilutive funding, the high fixed costs associated with broad-spectrum monoclonal antibody R&D and the company's limited track record of consistent profitability create risk to future earnings, especially if new products or expansion programs fail to convert into recurring revenue streams.

- While Invivyd's pipeline expansion into RSV and measles theoretically diversifies future product offerings amidst rising pandemic risk, the company's reliance on a still-narrow late-stage pipeline creates an ongoing revenue concentration risk; failure of its lead products or slow development in new indications may sharply limit long-term revenue stability.

- Although rapid advances in antibody engineering theoretically enable Invivyd to generate potent, cost-effective biologics, increased competition from larger, established pharmaceutical companies-with greater manufacturing scale, marketing reach, and R&D resources-could erode Invivyd's future market share and restrict both top-line growth and operating leverage.

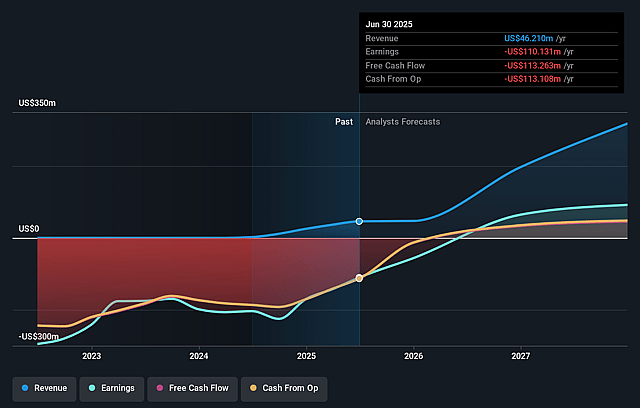

Invivyd Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Invivyd compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Invivyd's revenue will grow by 95.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -238.3% today to 7.4% in 3 years time.

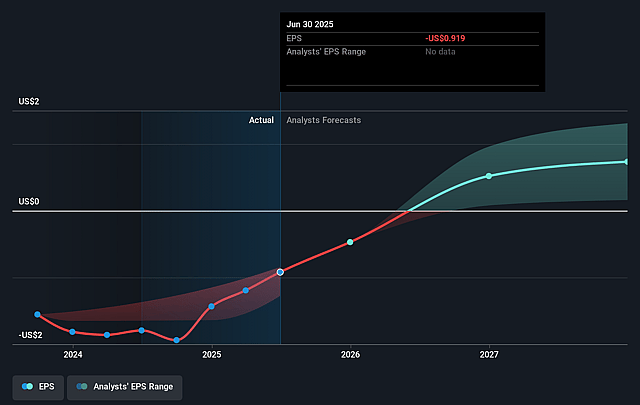

- The bearish analysts expect earnings to reach $25.4 million (and earnings per share of $0.16) by about September 2028, up from $-110.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 9.4x on those 2028 earnings, up from -1.8x today. This future PE is lower than the current PE for the US Biotechs industry at 15.4x.

- Analysts expect the number of shares outstanding to grow by 0.44% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Invivyd Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Regulatory uncertainty remains high as Invivyd's key COVID-19 product PEMGARDA is authorized only through Emergency Use Authorization, not full approval, and FDA feedback has been conservative and critical of clinical benefit durability; this uncertainty can limit long-term revenue and leave the company vulnerable to market or regulatory disruption.

- Invivyd faces a highly concentrated product pipeline, with near-term revenue driven almost exclusively by PEMGARDA, so any failure of future pipeline candidates or loss of EUA status could severely damage future revenues and overall earnings.

- Increased competition from large pharmaceutical companies and other biotech firms developing monoclonal antibodies, vaccines, and antivirals for COVID-19, RSV, and measles could erode market share, restrict pricing power, and limit Invivyd's top-line growth and gross margins over time.

- The industry environment of tightening capital markets, higher costs of equity, and investor caution is forcing Invivyd into strict financial discipline, but persistent high R&D spending and headwinds from volatile or limited sales may prevent consistent profitability and put pressure on net margins and cash flow over the long-term.

- Shifting healthcare policy toward cost controls, reimbursement pressures, and potential declines in demand due to evolving public sentiment about infectious disease products and vaccines may restrict future pricing power and limit the total addressable market, risking flat or declining long-term revenue.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Invivyd is $1.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Invivyd's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $5.0, and the most bearish reporting a price target of just $1.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $345.1 million, earnings will come to $25.4 million, and it would be trading on a PE ratio of 9.4x, assuming you use a discount rate of 6.8%.

- Given the current share price of $1.03, the bearish analyst price target of $1.0 is 3.0% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.