Last Update 27 Sep 25

Fair value Decreased 32%The sharp reduction in PSQ Holdings’ analyst price target primarily reflects a notable reversal from robust revenue growth forecasts to anticipated revenue decline, alongside a much higher future P/E ratio, resulting in the fair value estimate dropping from $5.50 to $3.75 per share.

What's in the News

- Partnered with IDX Advisors to launch cryptocurrency Treasury as a Service, enabling merchants to integrate crypto and stablecoins, and offering OCIO services led by IDX's Ben Millan.

- Hosted an Analyst/Investor Day to discuss fintech strategies, digital assets initiatives, and business outlook.

- Formed a strategic alliance with Silencer Shop to integrate bundled payments and credit solutions for firearms retailers, enhancing payment processing and supporting values-aligned financial services.

- Teamed with Atrius Development Group to restore payment services after vendor cancellation, ensuring uninterrupted commerce for firearms component sales.

- Launched Apple Pay and Google Pay across the PSQ Payments platform, expanding digital wallet capabilities and entering new sectors such as travel, where mobile payments are vital.

- Introduced the PublicSquare Market, featuring domestically produced products in categories like health, food, home goods, apparel, and outdoor gear, to strengthen its marketplace offering.

Valuation Changes

Summary of Valuation Changes for PSQ Holdings

- The Consensus Analyst Price Target has significantly fallen from $5.50 to $3.75.

- The Consensus Revenue Growth forecasts for PSQ Holdings has significantly fallen from 33.9% per annum to -5.2% per annum.

- The Future P/E for PSQ Holdings has significantly risen from 54.96x to 112.63x.

Key Takeaways

- Focus on specialized fintech solutions and AI-driven credit processes boosts user growth, efficiency, and positions the company for revenue and margin expansion.

- Streamlining operations through divestitures and cost controls enhances profitability and allows concentration on high-growth business areas.

- Reliance on a single fintech segment, narrow customer focus, rising competition, regulatory risks, and potential capital constraints threaten long-term stability and profitability.

Catalysts

About PSQ Holdings- Operates an online marketplace through advertising and eCommerce in the United States.

- The company is capitalizing on increasing consumer demand for values-based commerce by sharply focusing its operations on fintech solutions that explicitly serve merchants and consumers who feel underserved by traditional financial institutions-this enhances potential for accelerated user acquisition, payment volume growth, and revenue expansion.

- Their evolving product suite-with an imminent rollout of crypto payments, private label card programs, and loyalty tools-caters to the growing migration toward digital, privacy-focused, and independent commerce platforms, likely increasing transaction volumes and enabling the entrance into new, high-margin revenue streams, driving future revenue and margin uplift.

- Early adoption and continued investment in AI-driven credit underwriting has already reduced default rates sharply and is expected to improve credit portfolio performance and operational efficiency going forward, supporting lower credit losses and expanding earnings.

- Strategic divestiture of non-core segments (EveryLife, Marketplace) is set to generate non-dilutive capital, reduce operating complexity, and allow a laser focus on high-growth fintech operations, all contributing to improved net margins and earnings.

- Ongoing operating expense reductions and efficiency gains following last year's reorganization, paired with above-industry revenue growth, lay the foundation for sustainable margin expansion and progress toward profitability at scale.

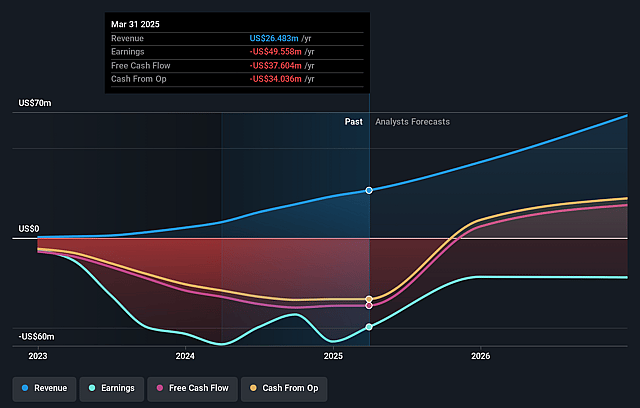

PSQ Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming PSQ Holdings's revenue will grow by 33.9% annually over the next 3 years.

- Analysts are not forecasting that PSQ Holdings will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate PSQ Holdings's profit margin will increase from -169.3% to the average US Interactive Media and Services industry of 11.0% in 3 years.

- If PSQ Holdings's profit margin were to converge on the industry average, you could expect earnings to reach $7.3 million (and earnings per share of $0.13) by about September 2028, up from $-46.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 55.0x on those 2028 earnings, up from -1.6x today. This future PE is greater than the current PE for the US Interactive Media and Services industry at 16.9x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.19%, as per the Simply Wall St company report.

PSQ Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The divestiture of both EveryLife and the Marketplace means PSQ Holdings will lose diversified revenue streams and will become entirely reliant on its fintech segment; this higher single-segment concentration could reduce long-term earnings stability and increase vulnerability to cyclical and industry-specific downturns.

- Heavy dependence on an ideologically targeted customer base ("values-aligned"/patriotic merchants and consumers) exposes the company to the risk of polarization fatigue, demographic shifts toward less ideologically engaged consumers, and ultimately lowers long-term scalability-potentially resulting in limited addressable market growth and revenue pressure.

- Increasing competition from mainstream financial and payments platforms-many of which may add "values-based" features-could compress PSQ's differentiators and require higher spending on customer acquisition and retention, eroding future net margins and profitability.

- The shift toward cryptocurrency payments and digital asset strategies introduces significant regulatory and technological risk; as privacy laws, crypto regulations, or DeFi standards evolve, unexpected compliance costs or technological challenges could negatively impact future earnings and operational margins.

- The company's recent share issuance via ATM offerings, balance-sheet retention of finance receivables, and reliance on lines of credit for credit product financing all point to potential long-term capital needs; if top-line growth or margin expansion stalls, future shareholder dilution or increased leverage may further pressure net income and shareholder value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.5 for PSQ Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $8.0, and the most bearish reporting a price target of just $3.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $66.2 million, earnings will come to $7.3 million, and it would be trading on a PE ratio of 55.0x, assuming you use a discount rate of 9.2%.

- Given the current share price of $1.65, the analyst price target of $5.5 is 70.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on PSQ Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.