Last Update 08 Nov 25

Fair value Increased 24%SSP: Expanding Live Sports Partnerships Will Improve Long-Term Market Position

Narrative Update on E.W. Scripps Price Target

Analysts have increased their price target for E.W. Scripps from $5.63 to $7.00. This change is attributed to improved revenue growth expectations and a modest adjustment to the company’s discount rate outlook.

What's in the News

- Scripps Sports secured an exclusive broadcast partnership with Major League Volleyball to bring the league's championship to ION in May 2026. This move expands its robust portfolio of women's sports. (Client Announcements)

- ION has been announced as the domestic linear broadcast partner for the Athlos NYC women's-only track and field event, with additional multi-year commitments to air the ATHLOS League. (Client Announcements)

- E.W. Scripps channels, including ION, ION Mystery, Court TV, Court TV Legendary Trials, Bounce, and Scripps News, are now available as part of Peacock's 24/7 channel offering. This expands their digital reach. (Client Announcements)

Valuation Changes

- Fair Value Estimate has increased from $5.63 to $7.00, reflecting higher expectations for the company's future market performance.

- Discount Rate has risen slightly from 12.32% to 12.5%, suggesting a modestly higher perceived risk or cost of capital.

- Revenue Growth forecast has improved, with expected contraction lessening from negative 2.52% to negative 1.39%.

- Net Profit Margin estimate has declined marginally from 10.13% to 9.95%.

- Future P/E ratio is now forecast to increase from 3.24 times to 4.28 times, indicating a higher market valuation relative to earnings.

Key Takeaways

- Strong growth in streaming and live sports is driving higher ad revenue and margins, offsetting declines in traditional TV advertising.

- Strategic consolidation and disciplined debt management are improving operational efficiency, profitability, and reducing financial risk.

- Ongoing declines in traditional TV revenues, high debt, and slow digital adaptation threaten Scripps' earnings stability, cash flow, and long-term competitiveness.

Catalysts

About E.W. Scripps- Operates as a media enterprise through a portfolio of local television stations, national news, and entertainment networks in the United States.

- The company is rapidly expanding its reach and revenue through connected TV (CTV) and ad-supported streaming platforms, as demonstrated by a 57% year-over-year increase in CTV revenue and rapid streaming viewership growth for its Networks division. This positions Scripps to capture a larger share of advertising budgets shifting away from traditional cable and into digital platforms, supporting top-line growth and potentially increasing EBITDA margins.

- Scripps' significant investments in live sports broadcasting (WNBA, NWSL, NHL, NBA Finals) across both local and national networks are commanding premium ad rates and attracting new advertisers, helping to offset traditional core advertising softness and stabilizing/growing revenues and margins, particularly for its Networks.

- Anticipated deregulation in broadcast ownership rules and industry consolidation, including Scripps' recent station swap with Gray and the creation of new duopolies, is expected to improve operating leverage and profitability by enabling greater scale, operational efficiencies, and enhanced local programming, positively impacting future net margins and cash flow.

- The company expects ongoing margin improvement in its retransmission line due to rising leverage in negotiations with networks, declining fees paid to major networks, and disciplined portfolio optimization-supporting net margin expansion even amidst moderate subscriber losses.

- Robust execution in reducing leverage and extending debt maturities, combined with a focus on using operating cash flow for further debt reduction, is expected to materially reduce interest expense and financial risk over time, improving net income and free cash flow available to equity holders.

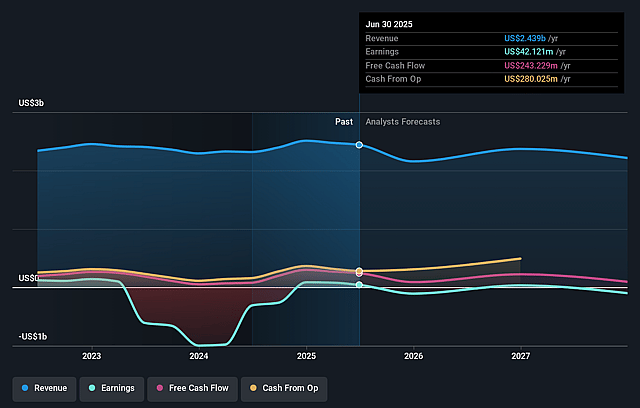

E.W. Scripps Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming E.W. Scripps's revenue will decrease by 2.5% annually over the next 3 years.

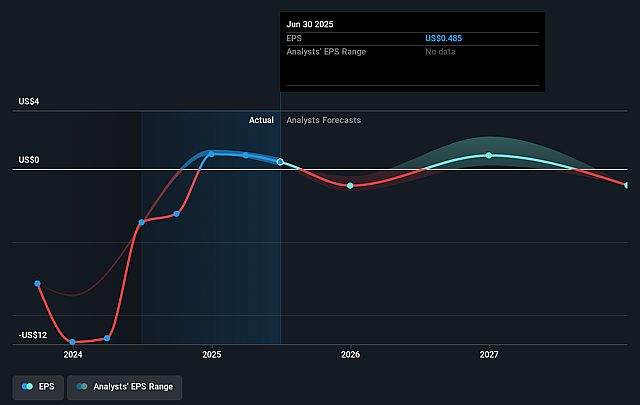

- Analysts are not forecasting that E.W. Scripps will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate E.W. Scripps's profit margin will increase from 1.7% to the average US Media industry of 10.1% in 3 years.

- If E.W. Scripps's profit margin were to converge on the industry average, you could expect earnings to reach $228.9 million (and earnings per share of $2.46) by about September 2028, up from $42.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 3.2x on those 2028 earnings, down from 6.3x today. This future PE is lower than the current PE for the US Media industry at 20.8x.

- Analysts expect the number of shares outstanding to grow by 2.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

E.W. Scripps Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued decline in linear TV viewership, combined with a consistent mid-single-digit percentage decline in pay TV subscribers as indicated in the call, puts sustained pressure on core advertising and distribution revenues, directly impacting E.W. Scripps' top-line growth and long-term revenue stability.

- Heavy reliance on cyclical political and sports advertising revenues, which provided offsetting boosts in off-years but have not been sufficient to reverse overall local media revenue declines (down 8% year over year), exposes Scripps to volatility and impedes core earnings growth outside of election/major event cycles.

- Elevated debt levels from prior acquisitions, the recent refinancing at a 9 7/8% interest rate, and ongoing preferred equity with a growing unpaid dividend further increase interest expense and put pressure on cash flow and net income, constraining financial flexibility and elevating refinancing/coverage risks.

- High fixed costs, particularly in the local broadcast segment, combined with advertising category weakness (especially automotive) and management's acknowledgment of only flat to slightly down expense projections, limit margin improvement opportunities and could compress operating margins if revenues continue to weaken.

- The secular shift of advertisers toward digital, programmatic, and large platform alternatives (as noted by the CEO regarding the transformation of search and digital traffic) risks further erosion of Scripps' traditional ad base, particularly among younger demographics, jeopardizing future revenue, profit, and market share.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.625 for E.W. Scripps based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $1.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.3 billion, earnings will come to $228.9 million, and it would be trading on a PE ratio of 3.2x, assuming you use a discount rate of 12.3%.

- Given the current share price of $3.04, the analyst price target of $5.62 is 46.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on E.W. Scripps?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.