Last Update 27 Nov 25

Fair value Increased 0.24%RL: Future Brand Momentum And Margin Expansion Will Offset Retail Market Challenges

Analysts have increased their price target for Ralph Lauren by nearly $1 to $366.75, citing robust brand momentum, improved sales growth, and expanding profit margins as key drivers supporting the positive outlook.

Analyst Commentary

Recent coverage from Wall Street has highlighted both the strengths and potential headwinds facing Ralph Lauren as price targets are updated across the sector.

Bullish Takeaways- Bullish analysts see robust brand momentum across all geographies, supporting higher earnings and improved valuation multiples.

- There is growing confidence in Ralph Lauren’s ability to expand profit margins, with recent quarterly performance driving upward revisions to longer-term earnings forecasts.

- The company’s multi-year brand elevation and growth strategy are viewed as effective and provide consistent top and bottom line opportunities for further expansion.

- Management’s messaging and recent investor meetings have conveyed broad-based demand momentum, particularly in North America, which increases confidence in execution capability.

- Bearish analysts remain cautious and describe the company’s multi-year growth and operating margin targets as conservative, which could potentially limit upside surprises.

- Some see the medium-term guidance as incorporating a degree of conservatism and raise questions regarding the pace of future growth acceleration.

- A recent downward adjustment to at least one price target indicates underlying concerns about the risk of execution in a competitive and unpredictable retail environment.

What's in the News

- Ralph Lauren launched the Polo Ralph Lauren x TOPA collection, the fourth project in its Artist in Residence program. The initiative celebrates cultural heritage through collaboration with Indigenous-led brand TOPA and supports Lakota language immersion efforts. (Key Developments)

- The company provided updated earnings guidance for Fiscal 2026. It expects revenue to increase 5% to 7% on a constant currency basis, with foreign currency providing an additional boost. (Key Developments)

- Between late September and early November 2025, Ralph Lauren repurchased 218,554 shares valued at $63.16 million. This completes a buyback that now totals 34.46% of outstanding shares since 2018. (Key Developments)

- Ralph Lauren will open The Polo Bar Ralph Lauren restaurant in London at 1 Hanover Square, scheduled for 2028. This continues the expansion of its hospitality offerings internationally. (Key Developments)

Valuation Changes

- Fair Value Estimate has risen slightly, moving from $365.87 to $366.75 per share.

- Discount Rate has increased marginally and is now at 8.92% compared to 8.91% previously.

- Revenue Growth projection has improved, with expectations rising from 4.64% to 5.14%.

- Net Profit Margin is projected to increase modestly, up from 12.60% to 12.72%.

- Future P/E Ratio is nearly unchanged, with a slight decrease from 24.20x to 24.15x.

Key Takeaways

- Accelerating global expansion, premium brand focus, and digital adoption enhance revenue growth, pricing power, and margin potential through greater efficiency and consumer demand.

- Investment in technology, supply chain automation, and new product categories diversifies growth opportunities and supports long-term operating and profit improvements.

- Uncertain macro conditions, inflation, and tariff risks threaten revenue and margin growth, with Europe slowing, DTC needing to offset wholesale exits, and rising inventories increasing markdown risk.

Catalysts

About Ralph Lauren- Designs, markets, and distributes lifestyle products in North America, Europe, Asia, and internationally.

- Accelerating international expansion, especially in Asia and Greater China where sales grew over 30% and now represent 9% of company revenue (up from 3-4% a few years ago), positions Ralph Lauren to benefit from rising global wealth and middle-class growth, supporting sustained top-line revenue gains.

- Strong digital adoption-including double-digit growth in direct-to-consumer (DTC) digital channels and expansion of live shopping in China-enables higher-margin online sales and greater global reach, which structurally bolsters net margins and future earnings growth.

- Premium brand positioning and reduced reliance on discounting continue to increase average unit retail (AUR) by 14% in the quarter, illustrating strengthened pricing power and value perception among consumers who desire quality and authenticity-factors that underpin future gross margin expansion.

- Significant investments in technology, AI-driven inventory management, and automated supply chain operations are driving greater operating efficiencies, setting the stage for improved operating margins and inventory turns as scale increases.

- Early-stage momentum in high-potential categories like handbags, women's apparel, and luxury accessories-paired with core product strength and expansion of flagship stores in key cities-provide diversified, multi-year growth drivers that can compound revenue and profit growth.

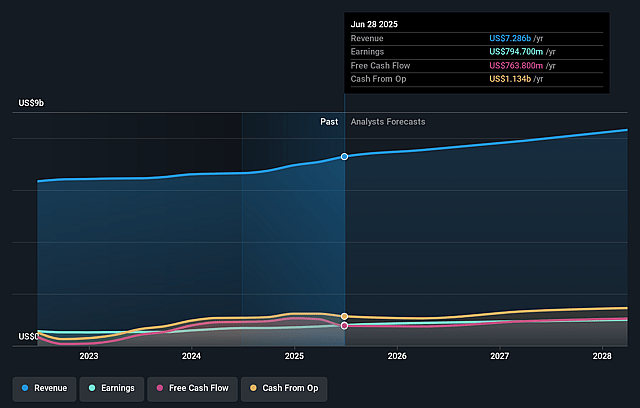

Ralph Lauren Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ralph Lauren's revenue will grow by 5.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.9% today to 12.1% in 3 years time.

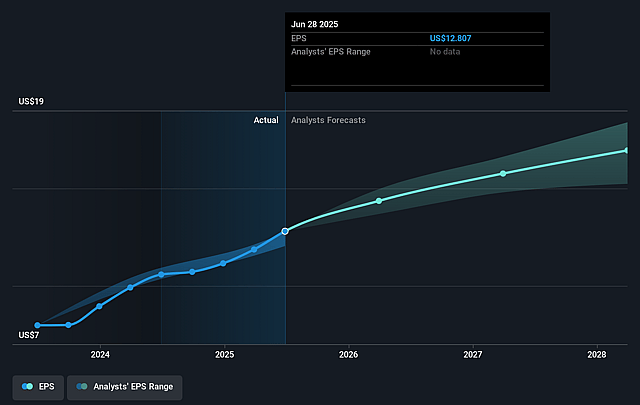

- Analysts expect earnings to reach $1.0 billion (and earnings per share of $17.51) by about September 2028, up from $794.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.0x on those 2028 earnings, up from 23.6x today. This future PE is greater than the current PE for the US Luxury industry at 19.8x.

- Analysts expect the number of shares outstanding to decline by 2.45% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.79%, as per the Simply Wall St company report.

Ralph Lauren Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Management repeatedly cited concerns about the uncertain and potentially inflationary macroeconomic environment (especially in the U.S.), highlighting risks that escalating tariffs and industry-wide price increases may dampen consumer demand and cause greater price sensitivity, which could negatively impact revenue and net margins in coming periods.

- The company anticipates a significant deceleration in growth in Europe and the back half of the fiscal year, due both to planned wholesale receipt shifts, lapping of prior year timing benefits, and general macro uncertainty, suggesting that recent growth rates may not be sustainable and posing a risk to long-term revenue growth.

- Although North America is currently showing resilience, management acknowledges the wholesale channel remains volatile and plans to exit up to 100 wholesale doors, which-if DTC and new store growth do not fully offset-could limit future revenue growth and expose the company to concentrated market risk.

- The company's inventory grew 18% year-over-year (above revenue growth), partly due to strategic pull-forwards in anticipation of tariffs, raising the risk of inventory markdowns or margin pressure if demand softens or macroeconomic conditions worsen.

- While recent gross margin gains are attributed to AUR growth and discount pullbacks, management emphasizes cost inflation and tariff pressure as the primary gross margin headwinds, noting that consumer reaction to higher pricing is the big unknown-if consumer price sensitivity increases, this could force higher discounting or limit further price increases, compressing gross margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $340.806 for Ralph Lauren based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $423.0, and the most bearish reporting a price target of just $185.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $8.4 billion, earnings will come to $1.0 billion, and it would be trading on a PE ratio of 24.0x, assuming you use a discount rate of 8.8%.

- Given the current share price of $309.79, the analyst price target of $340.81 is 9.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.