Last Update 07 May 25

Fair value Increased 15%Digital Competition And Fast Fashion Will Erode Luxury Margins

Key Takeaways

- Competition from digital-native brands and evolving consumer preferences weaken pricing power and challenge Ralph Lauren's growth amidst rising promotional activity.

- Economic headwinds, supply chain disruption, and wholesale dependency threaten margins and earnings as international investment and direct-to-consumer strategies remain vulnerable.

- Robust demand across regions, a younger customer base, and targeted category expansion are fueling sustainable growth, while strategic investments and full-price sales are driving margin improvement.

Catalysts

About Ralph Lauren- Designs, markets, and distributes lifestyle products in North America, Europe, Asia, and internationally.

- The ongoing rise of digital-native and direct-to-consumer brands is intensifying competition and diminishing traditional brand loyalty, which threatens Ralph Lauren's ability to sustain revenue growth and limits pricing power as younger consumers increasingly gravitate towards newer labels with stronger online engagement.

- Global economic inequality and stagnation, particularly in key emerging markets like China, may dampen discretionary spending among the aspirational upper middle class, directly restraining demand for premium products and curbing international revenue contributions just as the company is heavily investing in these regions for growth.

- Persistent dependency on wholesale channels exposes Ralph Lauren to the risk of margin compression and potential inventory buildups, especially as department stores consolidate or close and as price-sensitivity rises in an inflationary environment, potentially undermining net margins and eroding earnings even as direct-to-consumer growth remains uncertain.

- Accelerating shifts toward fast fashion, rental, and resale models are challenging the traditional luxury value proposition, putting pressure on Ralph Lauren's ability to maintain full-price sales and driving increased promotional activity, which could weigh on gross margins and dilute the impact of the company's brand elevation strategy.

- Geopolitical risks and tightening trade regulations, including ongoing tariffs and supply chain disruptions, are expected to increase operational costs and complexity, constraining operating margin expansion and threatening planned earnings growth even as the company attempts to leverage supply chain flexibility and automation.

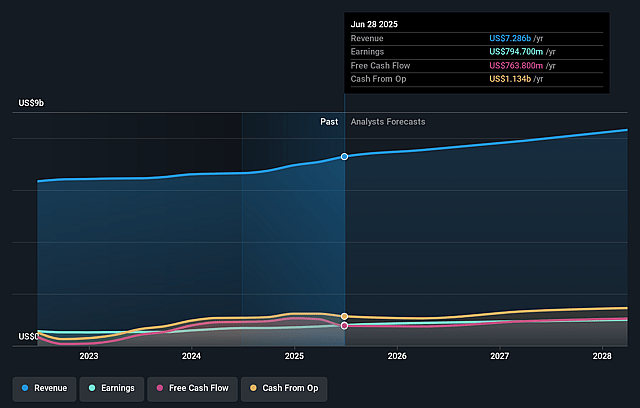

Ralph Lauren Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Ralph Lauren compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Ralph Lauren's revenue will grow by 4.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 10.9% today to 11.9% in 3 years time.

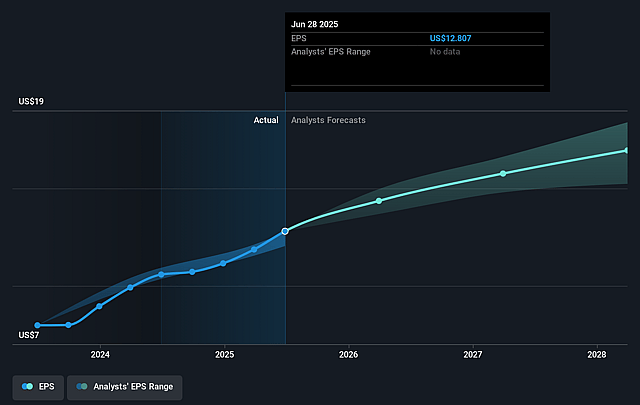

- The bearish analysts expect earnings to reach $977.1 million (and earnings per share of $16.74) by about September 2028, up from $794.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 18.0x on those 2028 earnings, down from 23.8x today. This future PE is lower than the current PE for the US Luxury industry at 19.8x.

- Analysts expect the number of shares outstanding to decline by 2.45% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.79%, as per the Simply Wall St company report.

Ralph Lauren Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ralph Lauren is continuing to deliver strong double-digit revenue growth in Asia and Europe and high single-digit growth in North America, with global comparable sales up 13 percent, demonstrating broad-based demand and potential for sustained revenue growth worldwide.

- The company is successfully recruiting new, younger customers (1.4 million added in the first quarter, particularly among women and luxury segments), suggesting brand relevance across generations and a durable long-term customer pipeline, which could support ongoing top line expansion.

- Strategic investments in digital channels, AI-driven inventory management, and supply chain automation are improving margins and operational efficiency, evidenced by an expanded adjusted operating margin to 16.6 percent and increased cash generation, which could drive higher long-term earnings and free cash flow.

- The business is intentionally shifting to higher-margin full-price sales, reducing discounting, and elevating brand positioning, as seen in increased average unit retail and decreased promotional activity, supporting robust gross margin expansion even amid cost inflation and tariff headwinds.

- Expansion into underpenetrated categories such as handbags, women's apparel, and luxury home, combined with a targeted key cities strategy and geographic diversification (notably in Greater China and other Asian markets), offers significant white space for revenue growth and increased market share, with strong early traction in these segments.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Ralph Lauren is $243.52, which represents two standard deviations below the consensus price target of $340.81. This valuation is based on what can be assumed as the expectations of Ralph Lauren's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $423.0, and the most bearish reporting a price target of just $185.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $8.2 billion, earnings will come to $977.1 million, and it would be trading on a PE ratio of 18.0x, assuming you use a discount rate of 8.8%.

- Given the current share price of $312.58, the bearish analyst price target of $243.52 is 28.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.