Key Takeaways

- Record-setting brand campaigns and digital success are driving a more premium, younger, and international consumer mix, supporting sustained gross margin and revenue quality gains.

- Expansion in Asia and strong digital capabilities, including AI-driven efficiencies, position Ralph Lauren for accelerated profitable growth and market share gains over peers.

- Shifting consumer trends, digital disruption, and rising ethical demands threaten Ralph Lauren's margins, brand relevance, and long-term growth, especially amid intensifying competition and evolving retail habits.

Catalysts

About Ralph Lauren- Designs, markets, and distributes lifestyle products in North America, Europe, Asia, and internationally.

- Analyst consensus recognizes the strength of DTC, but with Ralph Lauren's accelerating momentum-13% global comp growth and double-digit DTC gains in every region, coupled with the rapid success in digital-there is significant potential for even faster net margin expansion and revenue growth than expected, especially as international DTC overtakes North America in profitability mix.

- While analyst consensus points to effective brand elevation and consumer acquisition, Ralph Lauren's recent record-setting campaigns are driving not just acquisition but also significantly improved customer mix-skewing toward luxury, younger, and international consumers-suggesting long-term, compounding benefits for revenue quality and sustained gross margin gains above estimates.

- Ralph Lauren is at the inflection point of capturing outsized growth in fast-expanding Asian and emerging markets, as seen in China's growth from 3-4% to 9% of company sales in only a few years, indicating a long runway for rapid revenue growth and geographic diversification that could structurally uplift overall earnings.

- The company's deployment of advanced digital and AI capabilities-including supply chain automation and predictive buying-will unlock much greater operational efficiency and working capital optimization, creating step-changes in operating margin and cash flow conversion that are not fully recognized in current valuations.

- The early but accelerating success in underpenetrated high-potential categories (especially handbags, home, and womenswear), combined with alignment to global consumer appetite for quiet luxury and the power of Ralph Lauren's classic design, positions the company to capture market share from peers and generate multi-year, above-industry gross profit expansion.

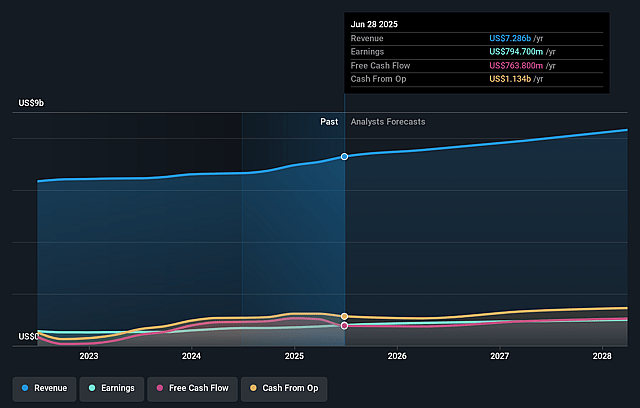

Ralph Lauren Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Ralph Lauren compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Ralph Lauren's revenue will grow by 6.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 10.9% today to 12.7% in 3 years time.

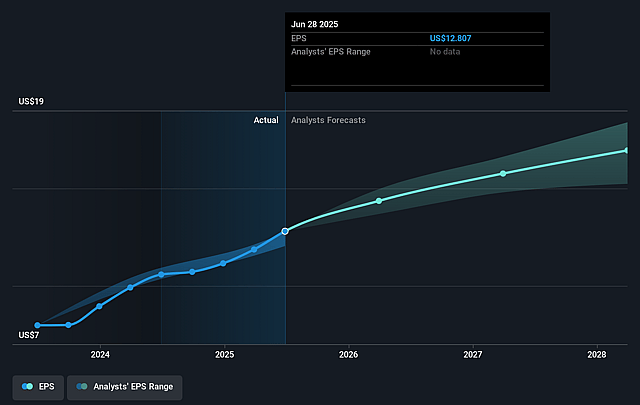

- The bullish analysts expect earnings to reach $1.1 billion (and earnings per share of $19.07) by about September 2028, up from $794.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 27.4x on those 2028 earnings, up from 23.6x today. This future PE is greater than the current PE for the US Luxury industry at 19.8x.

- Analysts expect the number of shares outstanding to decline by 2.45% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.79%, as per the Simply Wall St company report.

Ralph Lauren Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ralph Lauren's reliance on brick-and-mortar retail and the need for ongoing omnichannel investments to keep pace with the secular shift to e-commerce could erode in-store traffic and compress margins if digital initiatives do not sufficiently offset declines in physical store performance, negatively impacting both revenue growth and net margins over time.

- Evolving consumer preference for sustainability and ethical sourcing poses a risk to gross margins, as higher compliance and supply chain transparency costs may be needed to maintain brand reputation, particularly as the company's complex sourcing model faces increased scrutiny from environmentally conscious consumers.

- Long-term mass-market middle-class polarization and an uncertain outlook for premium consumer spending in key Western markets could restrict overall revenue growth, while increasing reliance on the more cyclical and unpredictable ultra-luxury segment may drive heightened earnings volatility for Ralph Lauren.

- Risks of brand aging and declining cultural relevance among Millennials and Gen Z remain, potentially leading to decreased brand heat and pricing power, which would directly put downward pressure on top-line revenue and gross margin expansion as younger consumers shift preferences to more agile or digital-first competitors.

- Accelerating market share gains by fast fashion, direct-to-consumer brands, and second-hand platforms threaten to undercut Ralph Lauren's aspirational positioning, potentially resulting in further pressure on revenue, difficulties in restoring full-price selling, and ongoing deterioration of net margins as promotional activity becomes harder to unwind.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Ralph Lauren is $423.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Ralph Lauren's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $423.0, and the most bearish reporting a price target of just $185.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $8.8 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 27.4x, assuming you use a discount rate of 8.8%.

- Given the current share price of $309.79, the bullish analyst price target of $423.0 is 26.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.