Last Update 06 Mar 26

AGCO: Future Precision Equipment Demand Will Test Europe Tariff Margin Resilience

AGCO's updated analyst price target has increased by a mid-teens dollar amount, as analysts point to modest tweaks in the discount rate, revenue growth, profit margin and future P/E assumptions to support their refreshed views.

Analyst Commentary

Recent research on AGCO clusters around updated price targets and refreshed assumptions, with most analysts fine tuning their models rather than completely rethinking the story. The changes you are seeing in targets generally link back to tweaks in discount rates, revenue trajectories, margin expectations and future P/E assumptions.

Bullish Takeaways

- Bullish analysts lifting price targets by single to mid teens dollar amounts see room for AGCO to support higher valuation multiples based on their updated earnings frameworks.

- Several of the recent target moves, including double digit adjustments, reflect confidence that AGCO can execute against current plans well enough for analysts to underwrite higher future P/E assumptions.

- The frequency of target increases over a short period suggests that, within models, small improvements in revenue and margin inputs together are meaningful enough to move implied equity value.

- Incremental upward revisions also indicate that bullish analysts are comfortable with AGCO’s current positioning in their coverage universe relative to other industrial and agriculture equipment names.

Bearish Takeaways

- Bearish analysts highlight margin risk from potential Europe tariffs, which they see as a direct threat to profitability and therefore to the earnings base that supports current targets.

- Some research flags tariffs as a factor that could pressure AGCO’s cost structure or pricing power, which, if reflected in models, would cap upside to both margins and valuation multiples.

- Where ratings remain Neutral alongside higher targets, cautious analysts are signaling that, even with updated assumptions, risk and reward appear more balanced than skewed to clear upside.

- The presence of tariff related concerns in recent commentary serves as a reminder that external policy developments could lead to future revisions in both earnings expectations and price targets.

What's in the News

- AGCO issued 2026 guidance, with net sales expected in the range of US$10.4b to US$10.7b and targeted earnings per share of approximately US$5.50 to US$6.00 (Corporate guidance).

- The company completed a share repurchase of 2,999,283 shares, representing 3.99% of shares, for US$300 million under the program announced on December 13, 2019. This followed the purchase of 279,593 shares for US$35 million between October 1 and November 30, 2025 (Buyback tranche update).

- AGCO also completed a separate buyback of 1,717,611 shares, representing 2.3% of shares, for US$215 million under the program announced on July 9, 2025. Repurchases were carried out between October 1 and December 31, 2025 (Buyback tranche update).

- AGCO plans to showcase its Fendt, Massey Ferguson and PTx brands at the 2026 Commodity Classic in San Antonio, highlighting precision ag equipment, retrofit technology and autonomy solutions across more than 24,000 square feet of exhibits (Product related announcement).

- The company is set to exhibit Fendt and Massey Ferguson equipment at the 2026 World Ag Expo in Tulare, including the North American debut of the Fendt e100 Vario battery powered tractor and the launch of the MF Always Running warranty program (Product related announcement).

Valuation Changes

- Fair Value: The model fair value remains unchanged at $128.57 per share, indicating no shift in the central value estimate.

- Discount Rate: The discount rate was reduced slightly from 8.99% to 8.92%, reflecting a modest adjustment to the required return used in the valuation.

- Revenue Growth: The revenue growth assumption was trimmed marginally from 5.21% to 5.21%, representing a very small change to the long term top line growth input.

- Net Profit Margin: The net profit margin was raised slightly from 7.19% to 7.20%, implying a minor uplift in expected profitability assumptions.

- Future P/E: The future P/E multiple eased slightly from 13.00x to 12.98x, signaling a very small reduction in the multiple applied to projected earnings.

Key Takeaways

- Investments in premium brands, precision agriculture, and digital solutions position AGCO for stronger growth, higher margins, and enhanced earnings quality.

- Structural improvements and aftermarket expansion support operational efficiency, stable earnings, and robust capital returns to shareholders.

- Prolonged weak demand, higher costs from tariffs, and elevated inventories threaten AGCO's profitability and undermine both market share gains and long-term margin targets.

Catalysts

About AGCO- Manufactures and distributes agricultural equipment and replacement parts worldwide.

- The global push for higher agricultural productivity due to population growth and rising food demand continues to drive AGCO's investments in premium brands (like Fendt) and expansion into underserved regions, positioning the company to outgrow industry demand and materially lift long-term revenue growth.

- Accelerating adoption of precision agriculture and digital solutions is expected to significantly increase demand for AGCO's retrofit technologies (e.g., Precision Planting and PTx), supporting the shift toward higher-margin software-driven revenue, which should enhance future margins and earnings quality.

- Recent structural improvements-including reduced fixed costs, lower dealer inventories, and dealer-focused initiatives like FarmerCore-are expected to deliver improved operational leverage and working capital efficiency, setting a foundation for higher free cash flow and increased net margins as demand recovers.

- AGCO's global parts and aftermarket expansion leverages both e-commerce and service innovation, capitalizing on the aging installed base and growing focus on recurring, high-margin revenues; this strategy is likely to drive more stable and resilient long-term earnings and margin expansion across cycles.

- With the resolution of the TAFE partnership, AGCO has greater capital allocation flexibility, enabling a $1 billion share buyback program; this buyback, combined with expected mid-cycle margin improvement targets, should accelerate EPS growth and return capital to shareholders.

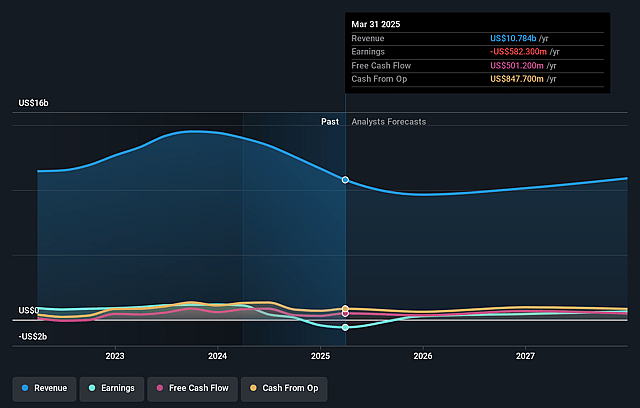

AGCO Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AGCO's revenue will grow by 5.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.0% today to 6.6% in 3 years time.

- Analysts expect earnings to reach $800.1 million (and earnings per share of $11.01) by about September 2028, up from $99.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.8x on those 2028 earnings, down from 80.6x today. This future PE is lower than the current PE for the US Machinery industry at 24.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.91%, as per the Simply Wall St company report.

AGCO Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged weak demand in North America and Western Europe, driven by cautious farmer sentiment, persistently high input costs, lower export demand, and ongoing policy uncertainty, risks suppressing AGCO's revenues and operating margins in its core markets over the long term.

- Tariffs and global trade conflicts-especially newly announced EU tariffs and continuing U.S. policy uncertainty-could further compress AGCO's margins by increasing costs and forcing delayed or diluted pricing actions, directly impacting net earnings and profitability.

- Elevated dealer inventories in North America and ongoing underproduction (down over 50% in Q3 and Q4) suggest a risk of continued negative operating margins in that region, which may weigh on consolidated company earnings if the inventory overhang and demand weakness persist longer than expected.

- AGCO's market share gains, particularly for premium brands like Fendt, could be undermined by increased costs relative to competitive products if tariffs lead to higher relative prices or if production footprint changes are not implemented in time, creating risk to both future revenue growth and margin expansion plans.

- Structural industry headwinds such as four consecutive years of industry decline in Europe, growing factory under-absorption costs during downturns, and potential for further cost inefficiencies from supply chain or production mismatches threaten AGCO's ability to achieve mid-cycle margin targets and sustainable cash flow growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $123.769 for AGCO based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $145.0, and the most bearish reporting a price target of just $97.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $12.1 billion, earnings will come to $800.1 million, and it would be trading on a PE ratio of 14.8x, assuming you use a discount rate of 8.9%.

- Given the current share price of $107.61, the analyst price target of $123.77 is 13.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on AGCO?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.