Key Takeaways

- Leadership in precision agriculture and smart farming solutions enables AGCO to boost recurring revenues and margins amid rising global demand for digital agricultural technology.

- Expansion in emerging markets and focus on next-generation, eco-friendly machinery set the stage for robust long-term revenue growth and increased market share.

- Weakened demand, rising global uncertainties, competitive disruption, and operational challenges threaten AGCO’s long-term revenue, profitability, and market position.

Catalysts

About AGCO- Manufactures and distributes agricultural equipment and replacement parts worldwide.

- AGCO’s accelerating investment and leadership in precision agriculture—highlighted by the growth of its PTx Trimble joint venture and rapid integration of advanced technology across its product lines—positions the company to capture higher-margin, recurring revenue streams from smart farming solutions as global demand for digital and autonomous equipment surges, supporting significant future earnings and net margin expansion.

- The company’s continued focus on launching next-generation, environmentally efficient machinery, including low-emission and autonomous models, directly benefits from farmers’ increasing adoption of climate-smart agriculture, which is being accelerated by both customer preference and regulatory pressures, setting the stage for robust top-line growth and improved market share as replacement cycles shorten globally.

- Expansion in rapidly mechanizing emerging markets such as Brazil, coupled with AGCO’s strong local presence and investment in regional dealer networks, positions the company to benefit disproportionately from rising food demand and a growing middle class, which drives steady long-term revenue growth as modern equipment penetration increases.

- Structural cost reductions and modular manufacturing initiatives, which have already delivered and are expected to further deliver $100–$125 million in annual savings, will provide meaningful operating leverage and enhance profitability when industry volumes recover, leading to higher incremental margins and improved free cash flow conversion.

- The globalization and full-line rollout of premium brands like Fendt, especially as AGCO captures share in North and South America, is expected to drive mix improvement and higher operating margins, contributing to the company’s long-term target of 14–15 percent mid-cycle operating margins by 2029 and underpinning bullish projections for sustained earnings per share growth.

AGCO Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on AGCO compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

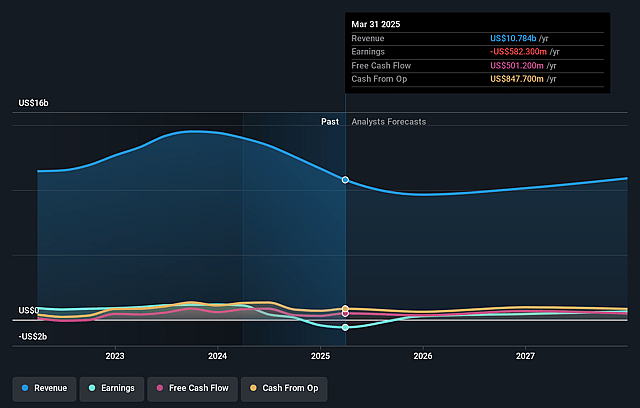

- The bullish analysts are assuming AGCO's revenue will grow by 5.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -5.4% today to 7.8% in 3 years time.

- The bullish analysts expect earnings to reach $980.5 million (and earnings per share of $13.22) by about July 2028, up from $-582.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.3x on those 2028 earnings, up from -14.0x today. This future PE is lower than the current PE for the US Machinery industry at 22.9x.

- Analysts expect the number of shares outstanding to decline by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.41%, as per the Simply Wall St company report.

AGCO Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- AGCO is experiencing a sharp decline in net sales across all major regions, driven by persistently weak farm equipment demand, continued dealer inventory destocking, and reduced production volumes, which could continue to pressure both revenue and earnings in the coming years.

- The company faces increased exposure to geopolitical and trade uncertainties, with new and potential retaliatory tariffs—particularly between the US, EU, and China—raising costs and creating demand uncertainty, which is already anticipated as a net negative for both revenue and earnings per share.

- There are structural and demographic headwinds in key developed markets, including an aging farmer population, tightening rural labor supplies, and changing dietary preferences, all of which could shrink long-term demand for large-scale agricultural equipment and negatively impact AGCO’s addressable market and revenues.

- The pace of industry transition toward precision agriculture, automation, and as-a-service models could outstrip AGCO’s innovation and go-to-market capacity, leaving it vulnerable to loss of market share to more agile competitors and tech-driven new entrants, resulting in revenue erosion and margin compression.

- Persistent supply chain vulnerabilities, input cost inflation, and heavy reliance on lower-margin emerging markets threaten AGCO’s ability to maintain operating margins, as evidenced by recent factory underabsorption, higher discounts, and ongoing profitability weakness in key geographies, all of which may reduce future net income and overall earnings growth potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for AGCO is $138.29, which represents two standard deviations above the consensus price target of $110.89. This valuation is based on what can be assumed as the expectations of AGCO's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $140.0, and the most bearish reporting a price target of just $84.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $12.5 billion, earnings will come to $980.5 million, and it would be trading on a PE ratio of 13.3x, assuming you use a discount rate of 8.4%.

- Given the current share price of $109.55, the bullish analyst price target of $138.29 is 20.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on AGCO?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.