Last Update 07 Nov 25

Fair value Decreased 5.37%PZZA: Ongoing Deal Speculation Will Drive Momentum Despite Withdrawn Take-Private Bid

Analysts have lowered their fair value estimate for Papa John's International to $49.30 from $52.10 per share. This adjustment is due to tempered assumptions for revenue growth, despite improvements in profit margins and ongoing deal speculation impacting the stock's outlook.

Analyst Commentary

Recent research commentary on Papa John's International has focused on mounting deal speculation, movements in price targets, and changing recommendations based on both fundamentals and potential corporate activity.

Bullish Takeaways

- Bullish analysts note that recent operating results have surpassed market expectations across several metrics. This underscores progress in the company’s strategic initiatives.

- Upward revisions to price targets from multiple sources suggest growing confidence that reinvestment in the business is delivering tangible improvements in performance and margin expansion.

- The company’s sustained operational momentum is viewed as a sign that management’s current strategies are starting to yield returns. This could underpin future growth and earnings stability.

- Renewed interest from strategic investors and persistent deal rumors have contributed to positive sentiment. Some expect that a potential take-private transaction could offer shareholders a premium.

Bearish Takeaways

- Bearish analysts caution that recent share price movements are increasingly being influenced by takeover speculation rather than underlying fundamentals. This introduces additional volatility and risk for investors focused on core business execution.

- Several research perspectives warn that slowing revenue growth assumptions are weighing on fair value estimates. Market participants are dialing back longer-term growth projections despite profitability gains.

- Not all analysts are convinced by the company’s pace of strategic execution. Some maintain neutral or hold ratings even as headline price targets rise modestly.

- Persistent uncertainty around the outcome of ongoing deal discussions and the company’s ability to meet or exceed elevated expectations could limit upside in the near term.

What's in the News

- Apollo Global has withdrawn its $64 per share offer to take Papa John's private, citing concerns over consumer spending and the quick-service restaurant sector. Shares dropped nearly 15% following the news (Reuters).

- Rumors of another potential suitor for a Papa John's buyout have surfaced, as highlighted in a merger and acquisition-focused Betaville blog alert (Betaville/The Fly).

- Papa John's recently launched The Grand Papa, its largest pizza ever, featuring an 18-inch hand-stretched crust and Italian-deli inspired flavors.

- The company announced a return to India and aims to open 650 stores by 2035 after exiting the market in 2017 (Reuters).

- A new dessert, the Salted Caramel Blondie, has been added to the Papa John's menu to complement recent pizza launches.

Valuation Changes

- Fair Value Estimate: Lowered from $52.10 to $49.30 per share, reflecting a more cautious outlook.

- Discount Rate: Marginally decreased from 10.14% to 10.01%, indicating a slight reduction in expected risk.

- Revenue Growth: Reduced significantly from 1.42% to 0.73%, which signifies more modest future expansion assumptions.

- Net Profit Margin: Increased from 3.10% to 6.21%, pointing to improved operational efficiency and profitability.

- Future P/E Ratio: Dropped sharply from 34.07x to 16.36x, suggesting more conservative earnings expectations.

Key Takeaways

- Strategic product innovation and enhanced menu offerings aim to boost revenue growth through increased customer engagement and sales.

- International expansion and cost efficiencies in restaurant operations are expected to drive revenue growth and improve net margins.

- Declines in sales and increased costs from strategic investments and marketing pressure margins, potentially hindering profit and cash flow growth.

Catalysts

About Papa John's International- Operates and franchises pizza delivery and carryout restaurants under the Papa Johns trademark in the United States, Canada, and internationally.

- Papa John's strategic focus on product innovation and enhancing the menu with new offerings is expected to boost revenue growth by increasing customer engagement and driving higher ticket sales.

- The investment of up to $25 million in marketing, including CRM capabilities and the Papa Rewards loyalty program, aims to drive greater customer loyalty and frequency, which should positively impact revenue.

- Efforts to reduce restaurant build costs and refranchise company-owned locations to growth-oriented franchisees are expected to improve net margins by enhancing operational efficiency and scale.

- The international expansion with emphasis on key growth markets, such as the Middle East and Latin America, aims to generate higher average unit volumes, contributing to revenue growth and increased earnings.

- The review of the North American commissary and distribution network to improve supply chain efficiency is likely to enhance franchisee profitability and support net margins through cost savings.

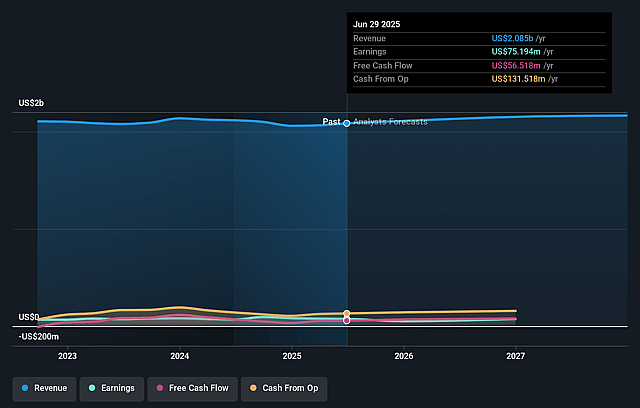

Papa John's International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Papa John's International's revenue will grow by 1.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 3.6% today to 3.1% in 3 years time.

- Analysts expect earnings to reach $67.4 million (and earnings per share of $2.0) by about September 2028, down from $74.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.1x on those 2028 earnings, up from 21.4x today. This future PE is greater than the current PE for the US Hospitality industry at 23.9x.

- Analysts expect the number of shares outstanding to grow by 0.36% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.14%, as per the Simply Wall St company report.

Papa John's International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The global system-wide restaurant sales declined by approximately 8% due to the additional week of operations in the prior year, indicating a lack of growth in actual sales, which can affect revenue and earnings.

- North America comparable sales were down 4% in the fourth quarter, impacted by strategic pricing decisions and a focus on value offerings, potentially affecting net margins negatively due to increased pressure on tickets.

- International comparable sales were cautiously projected to be flat to up 2% due to a dynamic operating environment, indicating potential risks in achieving meaningful growth, impacting overall revenue and earnings.

- The guidance for adjusted EBITDA projects a decrease from $227 million in 2024 to between $200 million and $220 million in 2025, due to continued strategic investments, which could strain profit margins and earnings.

- An increased marketing spend of up to $25 million and high commodity prices are expected to pressure operating margins, and if not offset by revenue growth, they could negatively impact net margins and cash flows.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $52.1 for Papa John's International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $67.0, and the most bearish reporting a price target of just $42.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.2 billion, earnings will come to $67.4 million, and it would be trading on a PE ratio of 34.1x, assuming you use a discount rate of 10.1%.

- Given the current share price of $48.76, the analyst price target of $52.1 is 6.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.