Price: $138.52 (7/2/25)

Willing To Pay: <= $195

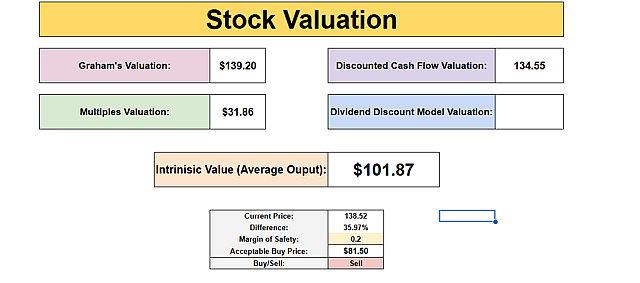

As of right now I am incredibly bullish; AMD is actually my largest position in my portfolio right now so take that into consideration. Now when you look at AMD in value not considering its growth potential you would probably find its value to land between $130-$100 with its intrinsic value roughly coming to $101.87. However in the next year to two AMD's growth is going to start running off the charts. For the valuation I have it tied to a growth of about 31%, PE following their 10 year at 34.27 and a profit margin of 8.03% . Now I feel like however that this stock will in the next couple of years will grow to a larger profit margin with how the CEO , Lisa Sue has been talking about how they are wanting to work towards being more efficient. They have a 10 year AVG Gross Profit Ratio of 39.76% and a 5 year one at 47.86% and currently from 2024 they have a 49.65% Gross Profit ratio. With that their ratio had seen steady growth from 2016 - 2022 where it then took a little dip in 2023 with it then continuing to rise in 2024. Along with that their revenue has been looking pretty strong as well with a 5 year Revenue CAGR of 30.81% and Revenue consistent growth from 2015 - 2022 where it then took a little dip in 2023 before continuing to rise in 2024. Once their new products begin to really roll out in 2026 then AMD will really start to tear. Honestly within the next 10 years I can see them rising to above $500, but within the next 2-3 years I see it for sure hitting the $200's with a possibility to run into the $300's.

PE: 101.11 (10 Year Avg. 34.27)

ROTA: 6.45%

ROE: 2.85%

Current Ratio: 261.63%

Gros Profit Ratio: 49.35%

Net Income Ratio: 6.36%

ROIC: 2.48%

Revenue/Share: $15.92

Net Income/Share: $1.01

Cash/Share: $3.17

Have other thoughts on Advanced Micro Devices?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

The user Zwfis has a position in NasdaqGS:AMD. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.