Last Update 03 Nov 25

Analysts have lowered their price target for Greystone Housing Impact Investors from $16 to $14, citing ongoing capital deployment and expansion of the company's construction lending joint venture as key considerations.

Analyst Commentary

Analysts have weighed in on Greystone Housing Impact Investors following the recent price target adjustment. They highlight both promising aspects and ongoing concerns for the company's outlook.

Bullish Takeaways- Bullish analysts point to the company's continued steady pace of capital deployment, suggesting confidence in its ability to identify and execute on growth opportunities.

- The expansion of Greystone's construction lending joint venture, particularly with the addition of a new investor, is seen as a sign of external validation and potential for scale.

- Maintaining an Outperform rating indicates that analysts still see upside potential in the shares, even after the target price adjustment.

- Efforts to broaden the joint venture could enhance the company’s competitive positioning in the affordable and workforce housing finance market.

- Bearish analysts caution that the ongoing pace of capital deployment might expose the company to execution risk if investments do not materialize as projected.

- The lowered price target reflects some concern about valuation given the evolving market environment.

- Expansion efforts, while promising, may bring integration challenges and increased scrutiny over immediate returns.

- The current market conditions could place pressure on Greystone Housing's ability to consistently achieve targeted growth.

Valuation Changes

- Fair Value remains unchanged at $12.50. This signals analyst consensus on the intrinsic value of the company.

- Discount Rate is steady at 12.32 percent. This indicates no shift in perceived risk or required return.

- Revenue Growth is virtually unchanged, holding at approximately 110.4 percent. This suggests consistent expectations for top-line expansion.

- Net Profit Margin is stable at 46.85 percent. This indicates analysts foresee continued strong profitability.

- Future P/E ratio is unchanged at approximately 3.56x. This reflects similar market expectations for future earnings.

Key Takeaways

- Strong demand for affordable and multifamily housing, along with expanded capital commitments, supports revenue growth and a robust investment pipeline.

- Diversified portfolio and operational efficiencies reduce risk and enhance earnings stability, with federal support ensuring a favorable funding environment.

- Ongoing market pressures, credit risks, and reliance on government incentives threaten Greystone's revenue stability, asset values, and long-term profitability.

Catalysts

About Greystone Housing Impact Investors- Acquires, holds, sells, and deals mortgage revenue bonds that are issued to provide construction and permanent financing for multifamily, student, and senior citizen housing, skilled nursing properties, and commercial properties in the United States.

- The company is benefiting from a persistent shortage of affordable and workforce housing in the U.S., combined with strong demand for multifamily and senior housing; this supports a robust investment pipeline and suggests revenue growth opportunities as Greystone continues to fund new projects and fill market gaps left by retreating banks.

- Recently announced additional capital commitments to the BlackRock construction lending joint venture and a new institutional investor significantly increase Greystone's firepower to finance new low-income housing projects, directly supporting expansion of its income-producing asset base and expected to drive higher future revenues and earnings.

- Federal support for core affordable housing programs remains intact, with Congress showing willingness to fully fund HUD initiatives and technical improvements in the Low-Income Housing Tax Credit (LIHTC) program, ensuring continued access to subsidies and low-risk lending environments that uphold returns on investment and underpin resilient net margins.

- Portfolio diversification, evidenced by Greystone's active development and leasing in both market-rate and senior housing, in addition to affordable housing, reduces market and asset-type risk-supporting earnings stability and protecting net margins from sector-specific downturns.

- Advances in operational efficiency, including the expansion of proprietary asset management and servicing platforms, along with amendments to credit facilities that extend maturities and increase borrowing capacity, enhance operational flexibility and scalability-improving long-term margins and supporting future earnings growth.

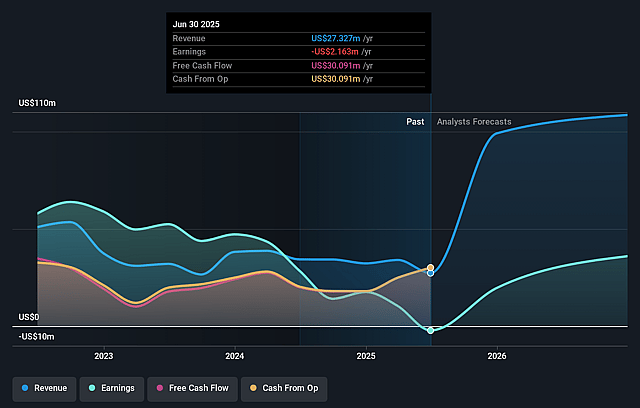

Greystone Housing Impact Investors Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Greystone Housing Impact Investors's revenue will grow by 116.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from -7.9% today to 51.8% in 3 years time.

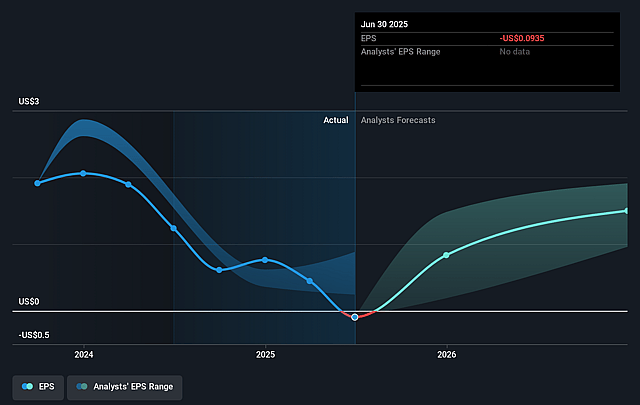

- Analysts expect earnings to reach $142.7 million (and earnings per share of $5.94) by about September 2028, up from $-2.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 3.2x on those 2028 earnings, up from -118.2x today. This future PE is lower than the current PE for the US Diversified Financial industry at 16.5x.

- Analysts expect the number of shares outstanding to grow by 1.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

Greystone Housing Impact Investors Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Elevated levels of new municipal bond issuance, combined with only moderate fund inflows, are pressuring yields and returns in the municipal bond market, which could further suppress Greystone's investment yields and negatively impact net interest income and overall revenue.

- Provisions for credit losses-particularly linked to underperforming affordable housing properties in certain markets (like South Carolina)-signal ongoing credit quality and collateral value risks that could result in further losses, pressuring net margins and reducing earnings reliability.

- Persistent underperformance of the U.S. municipal bond market, coupled with high-profile credit issues in the high-yield space, creates an uncertain investment climate and puts downward pressure on valuations, impairing asset values and potentially leading to additional unrealized losses and lower book value per share.

- Continued exposure and reliance on government programs, tax credits, and low-income housing incentives exposes Greystone to the risk of policy shifts or funding cuts, which could depress future investment pipelines and reduce revenue opportunities over the long term.

- The necessity to advance additional capital (e.g., for property taxes or operational shortfalls) into joint ventures and delayed project exits can tie up liquidity and reduce the return on invested capital, leading to higher operating costs and potential net margin compression.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $13.333 for Greystone Housing Impact Investors based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $11.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $275.4 million, earnings will come to $142.7 million, and it would be trading on a PE ratio of 3.2x, assuming you use a discount rate of 12.3%.

- Given the current share price of $10.84, the analyst price target of $13.33 is 18.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.