Key Takeaways

- Greystone is positioned for accelerated growth and higher earnings due to strong affordable housing demand, new capital partnerships, and entry into lucrative market segments.

- Conservative accounting may understate current value, with future asset sales likely to reveal substantial upside not yet captured in reported financials.

- Heavy exposure to market, credit, legislative, and geographic risks threatens margins, earnings stability, and asset quality amid rising costs, underperformance, and portfolio vulnerabilities.

Catalysts

About Greystone Housing Impact Investors- Acquires, holds, sells, and deals mortgage revenue bonds that are issued to provide construction and permanent financing for multifamily, student, and senior citizen housing, skilled nursing properties, and commercial properties in the United States.

- Analyst consensus sees the affordable housing crisis as a reliable growth driver, but they may be underestimating both the scale and duration of demand, which is likely to fuel not just sustained but accelerated portfolio growth, strengthening revenue and cash flow visibility well beyond current projections.

- While analysts broadly agree that Greystone's focus on impact investing and ESG opens doors to new capital sources, the company's expanding partnerships with institutional giants like BlackRock signal that Greystone could rapidly scale its capital base at a much lower cost and deploy it into higher-yielding projects, supporting material expansion in net margins and future earnings power.

- Greystone is actively shifting its portfolio into specialty segments like senior and student housing in fast-growing secondary and Sun Belt markets, uniquely positioning the company to capture outsized rental growth and benefit from demographic tailwinds that can drive both asset appreciation and recurring income.

- The company's disciplined approach to balance sheet management, with extended credit facilities and ample liquidity, gives it exceptional capacity to seize distressed or forced-sale opportunities during periods of market dislocation, potentially driving significant accretive growth in book value and distributable earnings.

- Greystone's JV equity structure, which does not mark-to-market carrying values and thus understates unrealized property value gains, could lead to large upward adjustments in book value and distributable income when stabilized assets are sold, providing significant upside not currently reflected in reported financials.

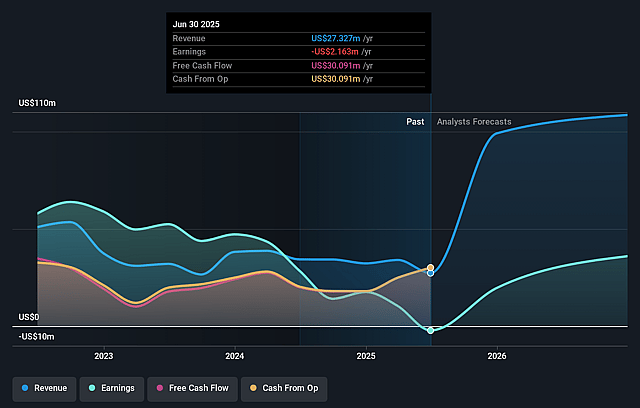

Greystone Housing Impact Investors Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Greystone Housing Impact Investors compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Greystone Housing Impact Investors's revenue will grow by 113.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -7.9% today to 68.2% in 3 years time.

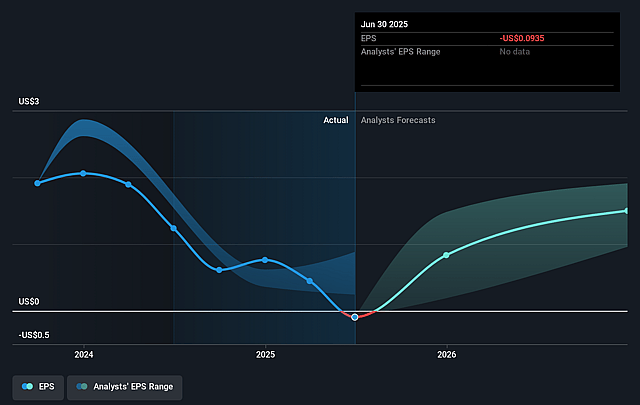

- The bullish analysts expect earnings to reach $180.8 million (and earnings per share of $7.49) by about September 2028, up from $-2.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 2.8x on those 2028 earnings, up from -118.2x today. This future PE is lower than the current PE for the US Diversified Financial industry at 16.5x.

- Analysts expect the number of shares outstanding to grow by 1.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

Greystone Housing Impact Investors Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent underperformance and heavy new issuance in the U.S. municipal bond market have led to increased supply outpacing demand, forcing underwriting firms to be more aggressive on pricing, which may compress yields and negatively affect both revenue and net margin for Greystone.

- The company's portfolio saw a significant provision for credit losses, particularly related to recently acquired South Carolina properties that have not met underwritten operating expectations and have collateral values below initial forecasts, posing ongoing risk to asset quality and overall earnings.

- Greystone relies heavily on government-sponsored programs and tax-exempt bonds, and while there are currently no major adverse legislative changes, any future reductions in federal support or reforms to tax-credit programs could materially reduce revenue streams and disrupt earnings stability.

- Increasing construction costs and longer-than-expected project exit times, as seen by capital contributions for property tax coverage and construction delays in the Vantage portfolio, reveal a vulnerability to escalating supply chain constraints and cost inflation, which can depress net margins and overall returns.

- High geographic concentration in states like California, Texas, and South Carolina combined with diversification challenges exposes the company to local economic downturns or changes in state housing policies, raising the risk of impaired asset performance and potentially reducing both net margin and long-term earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Greystone Housing Impact Investors is $15.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Greystone Housing Impact Investors's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $11.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $265.1 million, earnings will come to $180.8 million, and it would be trading on a PE ratio of 2.8x, assuming you use a discount rate of 12.3%.

- Given the current share price of $10.84, the bullish analyst price target of $15.0 is 27.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.