Key Takeaways

- Asset values and revenue growth could be hampered by municipal bond market stress, elevated credit expenses, and rising refinancing costs under high interest rates.

- Reliance on property rehabilitation and regional asset concentration leaves earnings vulnerable to local downturns, while tight lending conditions may restrict future expansion.

- Concentrated regional exposures, credit losses, municipal bond headwinds, and unhedged variable-rate debt threaten portfolio stability, revenue growth, and earnings sustainability.

Catalysts

About Greystone Housing Impact Investors- Acquires, holds, sells, and deals mortgage revenue bonds that are issued to provide construction and permanent financing for multifamily, student, and senior citizen housing, skilled nursing properties, and commercial properties in the United States.

- While Greystone stands to benefit from heightened long-term demand for affordable and multifamily housing, ongoing underperformance in the municipal bond market and surging new issuance could weigh on asset values and liquidity, potentially dampening revenues and book value growth.

- Despite strong secular demand and recent government support for affordable housing initiatives, the company faces operational risk as recent credit loss provisions tied to underperforming properties show how rehabilitation projects may drag on near-term earnings and elevate credit expenses if property results fail to stabilize.

- Although sustainable investing trends and the recent BlackRock JV highlight expanded investor interest, persistently high interest rates and the risk of further municipal bond market stress may increase refinancing costs and limit access to low-cost capital, putting pressure on net margins and return on equity.

- While portfolio diversification and matched debt funding strategies reduce some risk, significant exposure to market rate fluctuations through unhedged debt, as well as property concentration in states like South Carolina where asset underperformance occurred, could leave earnings volatile and susceptible to localized downturns.

- Even as government programs remain funded and institutional interest is resilient, the ongoing pullback in affordable construction lending by banks and the possibility of future federal or state fiscal tightening could stall the pace of Greystone's pipeline expansion, constraining future revenue and NOI growth opportunities.

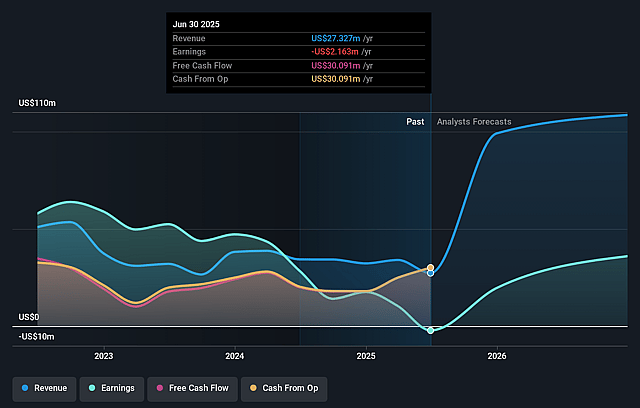

Greystone Housing Impact Investors Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Greystone Housing Impact Investors compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Greystone Housing Impact Investors's revenue will grow by 101.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -7.9% today to 41.1% in 3 years time.

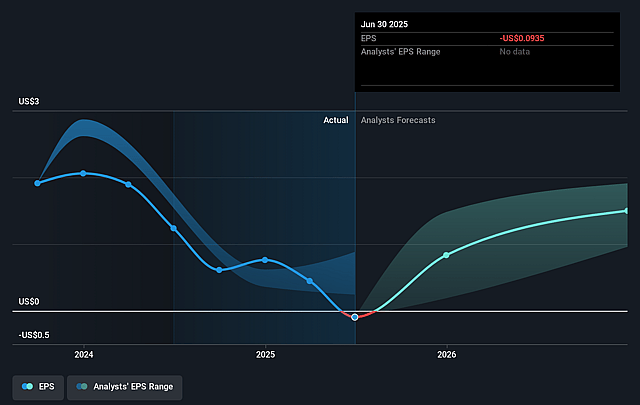

- The bearish analysts expect earnings to reach $91.7 million (and earnings per share of $3.56) by about August 2028, up from $-2.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 4.1x on those 2028 earnings, up from -113.9x today. This future PE is lower than the current PE for the US Diversified Financial industry at 16.0x.

- Analysts expect the number of shares outstanding to grow by 1.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

Greystone Housing Impact Investors Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company reported a GAAP net loss of $7.1 million for the quarter, driven by provisions for credit losses and unrealized losses on interest rate derivatives, suggesting underlying portfolio credit and market value pressures which could negatively impact future earnings and book value.

- Provisions for credit losses of $9.1 million were linked to three nonprofit owner mortgage revenue bonds in South Carolina where property operating results and collateral values failed to meet original underwriting, raising concerns about the stability of Greystone's income streams and the risk of further write-downs eroding revenue and net margins.

- Persistent underperformance in the municipal bond market, coupled with a significant increase in new supply and only moderate investor demand, may continue to pressure bond values and returns, potentially lowering Greystone's portfolio valuations and interest income over time.

- A substantial portion of the debt portfolio is secured by properties in just three states with notable exposure to California, Texas, and South Carolina, making the company vulnerable to region-specific economic slowdowns or regulatory changes that could adversely affect occupancy, asset values, and revenues in those areas.

- While most of the company's debt is hedged, 20 percent remains exposed to variable rates without designated hedging, leaving Greystone at risk of higher interest expenses during periods of rising rates or refinancing, which could compress net interest margins and reduce available cash for distribution.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Greystone Housing Impact Investors is $11.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Greystone Housing Impact Investors's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $11.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $222.9 million, earnings will come to $91.7 million, and it would be trading on a PE ratio of 4.1x, assuming you use a discount rate of 12.3%.

- Given the current share price of $10.45, the bearish analyst price target of $11.0 is 5.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.