Last Update 04 Dec 25

ZBRA: Margin Pressures From Tariffs Will Ease After 2025 Supporting Profitability

Analysts have modestly reduced their price target on Zebra Technologies by about $19 per share, reflecting concerns over decelerating organic growth and cautious extrapolation of softer Q4 guidance into the medium term.

Analyst Commentary

Recent research notes present a mixed but generally balanced view of Zebra Technologies, with analysts updating price targets and recommendations in response to Q3 performance, tariff dynamics, and forward guidance.

Bullish Takeaways

- Bullish analysts highlight incremental upside to prior expectations, as reflected in modest price target increases into the mid $340s to $350 range. This suggests confidence in management execution despite a choppy macro backdrop.

- Several notes point to Zebra's ability to navigate tariff headwinds more effectively than the broader industrial peer group. This supports margin resilience and underpins higher valuation multiples than would otherwise be warranted.

- The Elo Touch Solutions acquisition is viewed positively by bullish analysts, who see it as a strategically complementary asset acquired at an attractive multiple. They note that it may enhance Zebra's long term growth and cross sell opportunities.

- Some previews of Q3 earnings for the broader industrials complex anticipate that Zebra can deliver in line or modestly better outcomes even in a mixed demand environment. This supports a view that current earnings power may be understated by the market.

Bearish Takeaways

- Bearish analysts have trimmed price targets by roughly $15 to $20 per share, citing a deceleration in organic growth. They note expectations for flat organic growth in Q4 after mid single digit growth in prior quarters, which raises concern about the durability of the growth profile.

- There is caution that investors are extrapolating weaker Q4 guidance into 2026, compressing valuation multiples as the market questions whether current softness is cyclical or more structural.

- Hold ratings from more cautious analysts reflect a view that, while the business remains fundamentally sound, limited near term growth catalysts and slower order momentum cap upside to the current share price.

- Macro and sector level commentary points to a "mixed bag" for machinery and multi industry names, with risk to margins in the near term. This reinforces a more conservative stance on execution and earnings trajectory for Zebra through 2025.

What's in the News

- Zebra and Digimarc are collaborating to embed a new digital security layer for gift cards into Zebra's retail scanners, aiming to automate tamper detection, reduce fraud, and speed checkout across Zebra's scanner portfolio (client announcement).

- The company released its 18th Annual Global Shopper Study, which highlights declining shopper satisfaction, persistent inventory issues, and rising retailer investment plans in AI, RFID, and computer vision. The report also connects these findings to new Zebra and Elo solutions for inventory visibility and in-store media (product-related announcement).

- Zebra's board adopted amended and restated by-laws that introduce a majority vote standard for uncontested director elections. Candidates must now receive more votes for than against to secure a board seat (corporate governance filing).

- Management issued Q4 2025 earnings guidance calling for 8% to 11% sales growth year over year, with most of the increase driven by acquisitions and foreign currency tailwinds (company guidance).

- The company completed a major share repurchase tranche, buying back about 3.09% of its shares outstanding for approximately $464 million under the authorization announced in May 2022 (buyback update).

Valuation Changes

- Fair Value: Unchanged at approximately $358.47 per share, indicating no revision to intrinsic value estimates.

- Discount Rate: Fallen slightly from about 8.92% to 8.89%, reflecting a marginally lower perceived risk profile or cost of capital.

- Revenue Growth: Essentially unchanged at around 6.89% expected annual growth, signaling stable top line assumptions.

- Net Profit Margin: Flat at roughly 13.43%, suggesting no material change in long term profitability expectations.

- Future P/E: Edged down slightly from about 25.80x to 25.78x, implying a marginally lower valuation multiple applied to forward earnings.

Key Takeaways

- Demand for automation and digital solutions drives Zebra's growth, with strong market leadership and expanding opportunities in supply chain and customer-facing technologies.

- A focus on recurring revenue, acquisitions, and operational efficiencies supports margin expansion, earnings stability, and sustained cash flow.

- Ongoing reliance on hardware, trade uncertainties, and acquisitions in competitive markets heighten risks to margins, earnings stability, and successful revenue diversification.

Catalysts

About Zebra Technologies- Provides enterprise asset intelligence solutions in the automatic identification and data capture solutions industry worldwide.

- The accelerating shift toward automation, digital transformation, and real-time workflow optimization-driven by ongoing labor shortages, e-commerce expansion, and increased supply chain demands-continues to fuel robust demand for Zebra's portfolio (hardware, software, RFID, machine vision), supporting sustained revenue growth and long-term earnings visibility.

- The strategic acquisition of Elo expands Zebra's addressable market by approximately $8 billion, enhances its presence in customer-facing automation and self-service technologies, and provides significant cross-selling and global distribution synergies, which are expected to be immediately accretive to earnings and bolster long-term revenue growth.

- Increasing penetration of IoT, edge computing, RFID, and industry-tailored automation solutions across logistics, retail, and manufacturing settings positions Zebra to benefit from long-term trends toward intelligent supply chains and track-and-trace requirements, sustaining market leadership and driving steady revenue and margin expansion.

- Continued pivot toward higher-margin, recurring revenue streams (e.g., SaaS, software, and services) and ongoing operational efficiencies (including tariff mitigation, global supply chain optimization, and portfolio rationalization) are expected to improve EBITDA margins and earnings stability over time.

- Zebra's deeply embedded, mission-critical solutions coupled with a growing installed base and high customer retention, especially as customers undertake multi-year digital upgrade and device refresh cycles, underpin predictable cash flows and sustained growth in both revenue and free cash flow conversion.

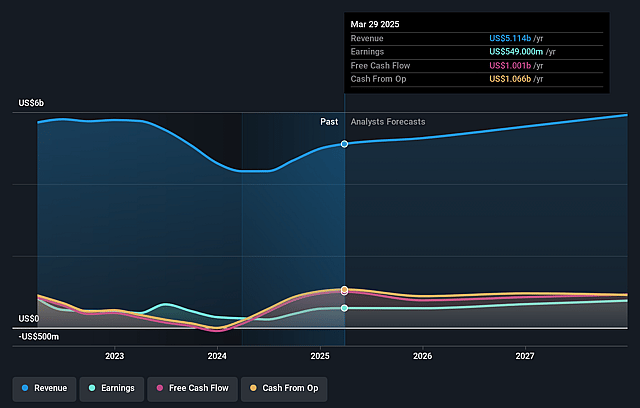

Zebra Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Zebra Technologies's revenue will grow by 6.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.6% today to 13.9% in 3 years time.

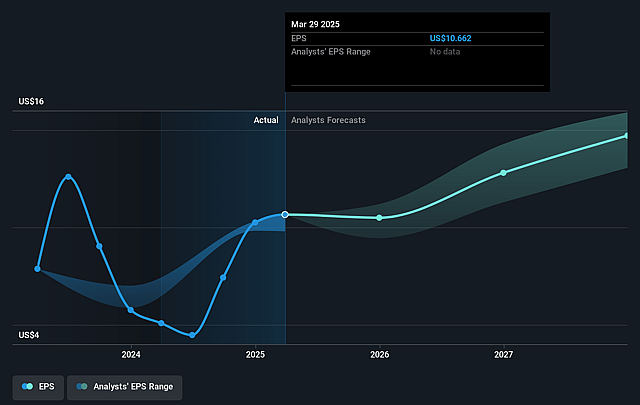

- Analysts expect earnings to reach $855.4 million (and earnings per share of $17.2) by about September 2028, up from $548.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.2x on those 2028 earnings, down from 29.0x today. This future PE is greater than the current PE for the US Electronic industry at 23.9x.

- Analysts expect the number of shares outstanding to decline by 1.42% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.56%, as per the Simply Wall St company report.

Zebra Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Uncertainty around global trade policies and ongoing exposure to U.S. import tariffs present a persistent risk; future escalations or removal of current exemptions could increase costs, reduce gross margins, and pressure net earnings despite current mitigation strategies.

- The Elo Touch Solutions acquisition moves Zebra further into consumer-facing and point-of-sale markets, which are more fragmented and competitive than its core industrial mobile computing segment, increasing the risk of price competition and potential margin compression over the long term.

- Despite progress, the recurring revenue from software and services continues to grow only slightly, and the business still relies heavily on hardware sales; a slower-than-needed shift toward SaaS could result in lower earnings stability and higher earnings volatility.

- Persistent softness in key markets such as EMEA and lagging growth in manufacturing highlight vulnerabilities if these segments do not recover or face further macro/geopolitical headwinds, directly impacting overall revenue growth.

- Heavy ongoing R&D investment and capital deployed for acquisitions like Elo and Photoneo, while intended for innovation and growth, may not achieve the expected synergies or could strain cash flow and reduce near-term net margins if integration or cross-selling underperforms.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $364.667 for Zebra Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $421.0, and the most bearish reporting a price target of just $300.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.2 billion, earnings will come to $855.4 million, and it would be trading on a PE ratio of 26.2x, assuming you use a discount rate of 8.6%.

- Given the current share price of $312.17, the analyst price target of $364.67 is 14.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.