Last Update 04 Feb 26

Fair value Decreased 4.99%ZBRA: Automation And Data Center Demand Will Support Future Upside

Zebra Technologies' fair value estimate has shifted from US$421.00 to US$400.00 as analysts factor in updated assumptions on revenue growth, profit margins and future P/E, in the context of Street research that includes a higher US$368 price target from Barclays for the broader industrial technology and distribution outlook.

Analyst Commentary

Bullish analysts are highlighting Zebra Technologies as a key beneficiary of themes tied to industrial technology and distribution, with attention on areas such as data centers, factory and warehouse automation, electronics, test and measurement, and semiconductors.

These views are feeding into updated valuation work, including the refreshed US$368 price target that sits above the latest fair value estimate of US$400.00 and is framed within a broader 2026 outlook for the group.

Bullish Takeaways

- Bullish analysts see Zebra positioned in end markets that are a focus area for industrial technology spending, which supports their case for a premium P/E relative to less exposed peers.

- The higher US$368 price target reflects confidence that management execution in automation and data center related offerings can support earnings power that aligns more closely with constructive long term assumptions.

- By tying their target to a 2026 outlook, bullish analysts are signaling comfort with Zebra's ability to participate in long running themes such as warehouse and factory automation, which they view as important to sustaining valuation levels.

- Positive sentiment around the broader group, including semiconductors and test and measurement, is being extended to Zebra, with bullish analysts treating this as a supporting factor for the stock's risk reward profile.

What's in the News

- Zebra will showcase new AI driven hardware, software and services at NRF 2026, including TC501 and TC701 handheld mobile computers with AMOLED displays and color imaging scan engines. The company will also feature the ET401 enterprise tablet with integrated RFID for item location and real time stock updates (Product Related Announcements).

- The company is expanding its retail offering with ShareCradle modular charging, a Salesforce Retail Cloud POS solution built for Android devices, a device rental service for seasonal peaks, and updated Workcloud Sync and Task Management tools for frontline communication and tasking (Product Related Announcements).

- Zebra's 18th Annual Global Shopper Study reports shopper satisfaction at 79% for in store and 73% for online experiences. In addition, 87% of retail leaders cite Gen AI and automation as important for loss prevention and 84% prioritize real time inventory synchronization (Product Related Announcements).

- Datex completed Zebra's Enterprise Testing Program for its Footprint WMS solution, confirming interoperability with Zebra mobile computers. This offers warehouse customers a scalable, integration ready platform that ties closely into Zebra hardware for data capture and visibility (Client Announcements).

- Zebra is partnering with GreyOrange and Digimarc, pairing SmartLens RFID with GreyOrange's gStore platform for item level store inventory accuracy. The company is also integrating Digimarc's digital security layer into Zebra scanners to help retailers detect tampered gift cards automatically at checkout (Client Announcements).

Valuation Changes

- Fair Value Estimate adjusted from US$421.00 to US$400.00, reflecting updated modeling inputs.

- Discount Rate moved slightly from 8.90% to 8.91%, indicating a marginal change in the assumed risk profile.

- Revenue Growth revised modestly from 8.68% to 8.81%, fine tuning expectations for top line expansion.

- Net Profit Margin adjusted slightly from 13.37% to 13.43%, reflecting refined assumptions on profitability.

- Future P/E reset from 28.93x to 27.27x, indicating a lower multiple applied in the updated valuation work.

Key Takeaways

- Broad adoption of automation, real-time tracking, and workflow digitization is fueling sustained growth, improved margins, and industry outperformance as customers modernize operations.

- Regulatory pressures and workforce shortages are expanding Zebra’s market and driving demand for recurring revenue software, margin expansion, and greater operating leverage.

- Reliance on hardware amid rising automation, trade barriers, and sustainability demands threatens Zebra’s margins, recurring revenue growth, and long-term market relevance.

Catalysts

About Zebra Technologies- Provides enterprise asset intelligence solutions in the automatic identification and data capture solutions industry worldwide.

- Strong, sustained demand from the rapid growth of e-commerce and the transition to omnichannel retail is driving robust, broad-based top line growth across key verticals—including retail, logistics, and even healthcare—with Zebra’s data capture and automation offerings (barcode, mobile, RFID) positioned for further revenue acceleration as these markets continue modernizing.

- Fast-expanding needs for real-time asset tracking and supply chain visibility, amplified by the proliferation of IoT devices, are leading customers to adopt more of Zebra’s core solutions and recurring software/services, supporting higher long-term recurring revenue streams and structurally improving gross margins and earnings predictability.

- Zebra’s continuous investment in workflow digitization, AI-enabled mobile solutions, and next-generation automation (like the AI suite for mobile computing and new 3D machine vision solutions through the Photoneo acquisition) is enabling cross-selling and greater wallet share, setting the stage for revenue growth outpacing the overall industry as customers modernize their logistics and manufacturing operations.

- Secular workforce shortages and labor cost pressures are catalyzing further adoption of Zebra’s workflow optimization hardware and software, accelerating deployments in logistics, healthcare, and manufacturing, which is likely to drive margin expansion and support higher operating leverage as demand for automation and efficiency tools grows.

- Regulatory and customer-driven mandates for end-to-end supply chain transparency and traceability in industries such as food, pharmaceuticals, and global logistics are expanding the company’s total addressable market and creating additional tailwinds for recurring revenues from Zebra’s track and trace technologies—directly supporting long-term revenue growth and improved free cash flow conversion.

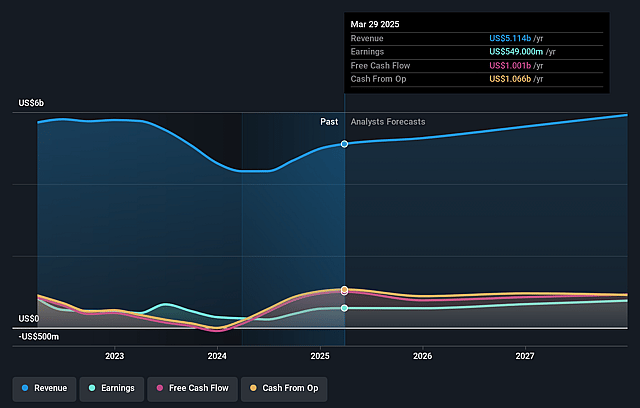

Zebra Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Zebra Technologies compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Zebra Technologies's revenue will grow by 7.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 10.7% today to 13.7% in 3 years time.

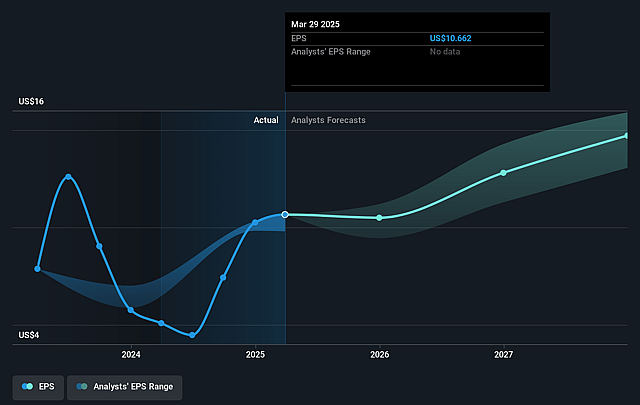

- The bullish analysts expect earnings to reach $862.6 million (and earnings per share of $16.97) by about July 2028, up from $549.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 28.7x on those 2028 earnings, down from 30.4x today. This future PE is greater than the current PE for the US Electronic industry at 23.8x.

- Analysts expect the number of shares outstanding to decline by 1.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.96%, as per the Simply Wall St company report.

Zebra Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating shift towards automation and AI-based tracking systems threatens the long-term relevance of Zebra’s core barcode and mobile computing solutions, which could diminish its addressable market and reduce future revenue growth.

- Ongoing and heightened global trade restrictions and tariff uncertainties have already caused increased direct costs, as indicated by the $70 million gross profit impact modeled for 2025, and could further disrupt international sales and squeeze net margins if export markets become more restricted.

- Zebra continues to derive the majority of its revenue from hardware rather than software or recurring services, making the company especially vulnerable to hardware commoditization and intensifying price competition, likely eroding gross margins and EBITDA over time.

- The slow growth in recurring software and services—evident from only slight increases in that segment this quarter—limits Zebra’s ability to transition to higher-margin, subscription-based revenue streams, putting long-term earnings per share potential at risk if this trend continues.

- New and impending e-waste regulations and sustainability mandates could lead to rising compliance and operational costs for Zebra’s hardware-centric business, potentially discouraging frequent hardware refresh cycles and negatively affecting both gross margin and top-line revenue.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Zebra Technologies is $410.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Zebra Technologies's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $410.0, and the most bearish reporting a price target of just $263.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $6.3 billion, earnings will come to $862.6 million, and it would be trading on a PE ratio of 28.7x, assuming you use a discount rate of 8.0%.

- Given the current share price of $328.1, the bullish analyst price target of $410.0 is 20.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Zebra Technologies?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.