Key Takeaways

- U.S. import tariffs and geopolitical uncertainties threaten gross profits and revenue predictability by increasing costs and compressing margins.

- Slowing manufacturing growth and competitive pressures could hinder revenue growth, particularly if planned pricing increases aren't fully realized.

- Strong sales growth and operational efficiency, alongside innovation through R&D and strategic acquisitions, position Zebra Technologies for sustainable growth despite supply chain and tariff challenges.

Catalysts

About Zebra Technologies- Provides enterprise asset intelligence solutions in the automatic identification and data capture solutions industry worldwide.

- The company is experiencing challenges from U.S. import tariffs, which are expected to have a significant negative impact on gross profits. These tariffs could reduce gross profit by $70 million for 2025, potentially compressing net margins and limiting earnings growth.

- The geopolitical landscape and trade uncertainties could lead to shifts in manufacturing locations and potentially higher costs. This shifting could impact revenue predictability and lead to reduced net profits if costs are not efficiently managed.

- There is a concern about slowing growth in manufacturing, which could lag behind other verticals. This slower growth in a key segment may lead to revenue growth below consensus expectations.

- The company has planned increased pricing to offset tariff impacts, but there is uncertainty about the full realization of these price increases due to competitive pressures. Failure to realize these increases could result in lower revenue and compressed margins.

- A potential economic downturn and changes in customer sentiment due to global trade uncertainties could lead to reduced demand and pullbacks in projects, which would negatively impact both revenue and earnings growth.

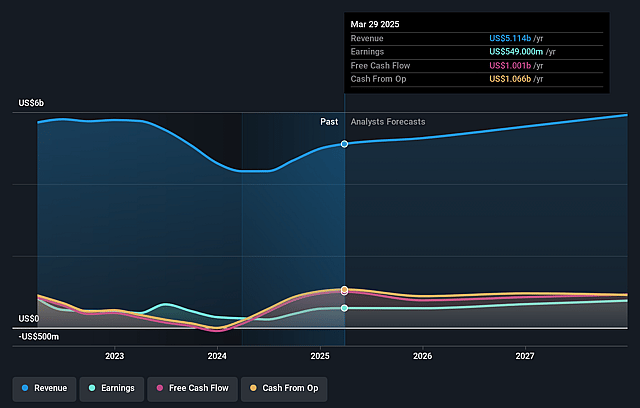

Zebra Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Zebra Technologies compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Zebra Technologies's revenue will grow by 5.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 10.7% today to 12.1% in 3 years time.

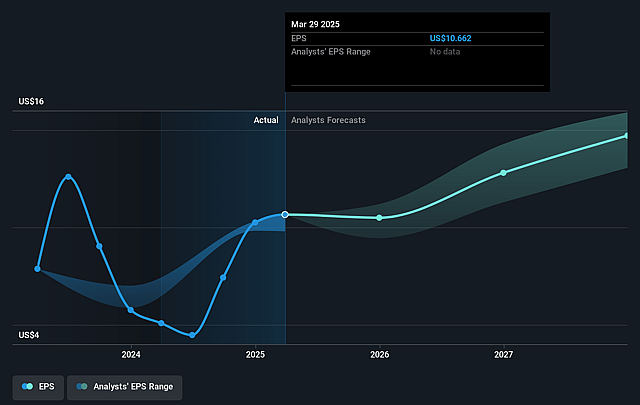

- The bearish analysts expect earnings to reach $719.5 million (and earnings per share of $13.93) by about July 2028, up from $549.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 22.1x on those 2028 earnings, down from 31.2x today. This future PE is lower than the current PE for the US Electronic industry at 23.8x.

- Analysts expect the number of shares outstanding to decline by 1.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.96%, as per the Simply Wall St company report.

Zebra Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Zebra Technologies reported a strong performance in the first quarter, with sales exceeding $1.3 billion, a 12% increase compared to the prior year, which suggests robust demand across its product categories and regions, potentially driving revenue growth.

- The company achieved an adjusted EBITDA margin of 22.3%, a 240 basis point increase, indicating effective cost management and operational efficiency that could positively affect net margins.

- Zebra's ongoing efforts to diversify its supply chain outside China and its capital-light business model could help mitigate risks related to tariffs, preserving profitability and protecting earnings.

- The company's strategic focus on innovation, including significant reinvestment into research and development and strategic acquisitions like Photoneo, positions Zebra to capitalize on the trend towards digitization and automation, potentially contributing to long-term revenue and earnings growth.

- Despite tariffs, Zebra's ability to adjust pricing and its strong free cash flow generation of over $1 billion over the trailing four quarters provides flexibility to navigate uncertainties, potentially safeguarding profit margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Zebra Technologies is $263.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Zebra Technologies's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $410.0, and the most bearish reporting a price target of just $263.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $5.9 billion, earnings will come to $719.5 million, and it would be trading on a PE ratio of 22.1x, assuming you use a discount rate of 8.0%.

- Given the current share price of $336.77, the bearish analyst price target of $263.0 is 28.0% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Zebra Technologies?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.