Last Update 19 Dec 25

Fair value Increased 3.35%JACK: Turnaround Plan Will Seek EBITDA Recovery Amid Ongoing Sales And Margin Pressures

Analysts have trimmed their average price target on Jack in the Box to about $20.56 from $19.89, reflecting modestly higher long term valuation multiples even as they factor in Del Taco's sale, weak same store sales trends, and a multi year turnaround under the Jack on Track plan in a challenging quick service backdrop.

Analyst Commentary

Street research following the latest quarterly update has coalesced around lower price targets, but with a split view on the long term potential of Jack in the Box as a streamlined, standalone brand following the Del Taco sale.

Bullish Takeaways

- Bullish analysts view the announced sale of Del Taco and the shift to a standalone Jack in the Box model as simplifying the story and improving focus on core brand execution, which could support valuation multiples over time.

- Initial 2026 EBITDA guidance of approximately $225M to $240M is generally seen as achievable, with potential upside if traffic stabilizes and efficiency gains from the Jack on Track plan materialize faster than expected.

- Some forecasts assume sequential improvement in same store sales through 2026, with the view that easier comparisons, marketing initiatives, and menu optimization could turn negative comps into modestly positive growth by the back half of the year.

- Supportive voices argue that, at current depressed share levels and reduced expectations, modest operational improvement could drive outsized equity returns as sentiment and earnings estimates reset higher.

Bearish Takeaways

- Bearish analysts highlight ongoing same store sales weakness and traffic softness, noting that management itself expects comps to remain challenged in the near term. This is seen as constraining visibility and justifying lower price targets.

- There is concern that 2026 guidance may be ambitious given the tough quick service backdrop, with some models now assuming flat to slightly negative same store sales even after the turnaround actions.

- Margin pressure from sales deleverage, commodity inflation, and higher labor costs, including in key markets like Chicago, is seen as a structural headwind that limits near term EBITDA recovery and compresses valuation.

- More cautious views frame 2026 as a rebuilding year rather than an inflection point, arguing that the Jack on Track plan will take longer to translate into sustainable growth and that the equity story remains high risk despite the lower share price.

What's in the News

- Jack in the Box is launching a year long 75th anniversary celebration, featuring the return of the Chicken Supreme sandwich in multiple combo options, limited edition Jibbi bag charms, app exclusive taco deals, and a pipeline of nostalgic menu items and merch slated throughout 2026 (company product announcement).

- The company rolled out its new value focused Munch Better Deals lineup, with three structured meals starting at $7. Options include a Brunchie Meal, a Lunchie Meal, and a Gremlins themed Midnight Meal that bundles core items with limited edition collectibles (company product announcement).

- Jack in the Box is gamifying promotions with DealQuest: Revenge of the Munchies. This is an in app Halloween campaign where players unlock escalating food offers and enter sweepstakes for gaming themed prizes by progressing through a choose your own adventure style experience (company product announcement).

- Management plans to keep the restaurant base roughly flat at 2,050 to 2,100 locations in 2026. This approach balances about 20 new openings against 50 to 100 predominantly franchised closures, highlighting a focus on pruning underperforming units while selectively expanding (company guidance).

- In connection with investor GreenWood Investors, Jack in the Box agreed to add two independent directors and form a Board level Capital Allocation Committee. This signals heightened scrutiny of capital deployment and alignment with an activist shareholder (company investor activism announcement).

Valuation Changes

- The consensus analyst price target has risen slightly, with fair value increasing from approximately $19.89 to about $20.56 per share.

- The discount rate is unchanged at 12.5 percent, indicating no shift in the assumed cost of capital or perceived risk profile.

- Revenue growth expectations remain effectively flat, holding around negative 7.61 percent, signaling a continued view of top line contraction in the near term.

- Net profit margin assumptions are essentially unchanged, staying near 7.46 percent and reflecting stable long term profitability expectations.

- Future P/E has risen modestly from roughly 6.24x to about 6.45x, implying slightly higher valuation multiples despite largely unchanged operating assumptions.

Key Takeaways

- Expansion in high-growth urban areas and modernization of restaurants are set to boost revenue, customer retention, and operational efficiency.

- Menu innovation, technology investment, and franchise-led growth are driving market share gains, improved margins, and long-term profitability.

- Heavy dependence on vulnerable customer segments and core regions, combined with rising labor costs and weak sales, threatens long-term growth and financial stability.

Catalysts

About Jack in the Box- Operates and franchises quick-service restaurants under the Jack in the Box and Del Taco brands in the United States.

- Strong early sales from new market openings in Chicago and Durham, combined with continued urbanization and population growth in core and expansion markets, position Jack in the Box for outsized revenue growth as these locations ramp and as the company increases its presence in high-growth urban corridors.

- Rollout of modernization initiatives, including upgrades to 1,000+ restaurants and full digital POS deployment, is likely to boost throughput, customer experience, and drive-thru convenience-directly supporting higher transaction volumes, improved customer retention, and ultimately higher top-line revenue.

- Focus on menu innovation (e.g., craveable flavor launches, targeted value offerings, and product variety) and culturally relevant marketing (especially to diverse and younger demographics) leverages demographic shifts in the US, positioning the brand to gain share and lift same-store sales over the long term.

- Enhanced technology investments-including digital ordering, loyalty, and data analytics-plus operational improvements and restaurant closures (via JACK on Track) are poised to reduce labor costs and overhead, supporting a sustainable improvement in net margins and operating leverage.

- Franchise-led expansion and attractive franchisee economics (via healthy real estate divestitures, improved value propositions, and operational initiatives) lay a foundation for long-term earnings growth and return on equity, even as capital intensity remains modest.

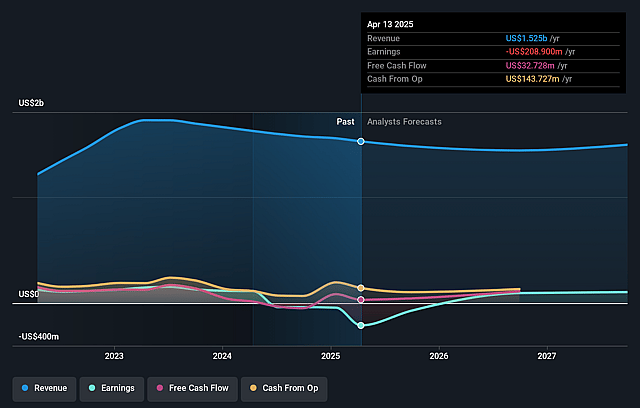

Jack in the Box Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Jack in the Box's revenue will decrease by 0.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -4.3% today to 6.9% in 3 years time.

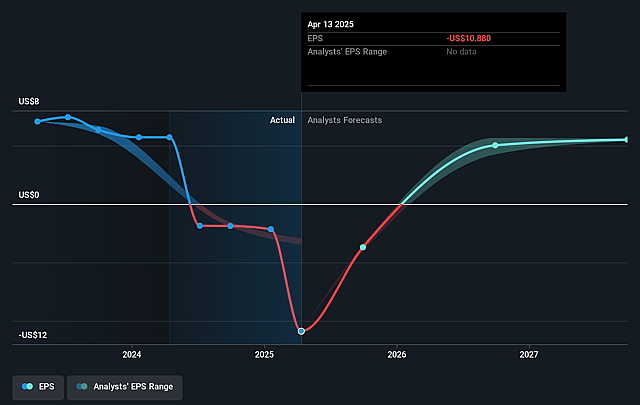

- Analysts expect earnings to reach $104.4 million (and earnings per share of $5.65) by about September 2028, up from $-64.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 5.9x on those 2028 earnings, up from -5.3x today. This future PE is lower than the current PE for the US Hospitality industry at 24.0x.

- Analysts expect the number of shares outstanding to grow by 0.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

Jack in the Box Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on lower-income and Hispanic customer segments, who are exhibiting sustained spending pullbacks due to macroeconomic pressures, poses a long-term risk to traffic trends and revenue stability, particularly as these groups are over-indexed in Jack in the Box's core regions.

- Persistent same-store sales declines (-7.1% for Jack, -2.6% for Del Taco this quarter) and negative transaction growth, even amid price hikes, indicate weak underlying demand and threaten the company's ability to deliver sustained revenue and earnings growth.

- Elevated labor costs (Jack's labor cost at 34.5% of sales, Del Taco's at 39.6%) driven by wage inflation, regulatory changes (e.g., California minimum wage increases), and payroll tax adjustments continue to pressure restaurant-level margins, with further wage inflation anticipated, reducing net margins.

- High geographic concentration in California, Texas, and the Southwest limits diversification and increases vulnerability to localized economic downturns or policy changes, risking earnings volatility and compounding the impact of regional consumer weakness.

- Ongoing restaurant closures (80–120 expected in 2025, with more over time) and discontinued dividend/share buyback signal operational and financial strain, which may deter long-term investors and reduce per-share earnings power unless offset by successful turnarounds in new markets or aggressive cost containment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $23.056 for Jack in the Box based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $55.0, and the most bearish reporting a price target of just $16.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $104.4 million, and it would be trading on a PE ratio of 5.9x, assuming you use a discount rate of 12.3%.

- Given the current share price of $17.97, the analyst price target of $23.06 is 22.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Jack in the Box?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.