Key Takeaways

- Shifting consumer preferences toward health and digital-first competitors threaten ongoing declines in traffic, sales, and overall brand relevance.

- Persistent labor cost pressures, store closures, and reliance on vulnerable demographics risk deeper margin compression and limit sustainable long-term earnings growth.

- Expansion into new markets, operational modernization, and technology upgrades are driving improved brand perception, operational efficiency, and profitability for Jack in the Box.

Catalysts

About Jack in the Box- Operates and franchises quick-service restaurants under the Jack in the Box and Del Taco brands in the United States.

- The accelerating consumer demand for healthier eating and wellness lifestyles is expected to further erode demand for traditional quick-service food like that offered by Jack in the Box, putting the company at risk of sustained declines in traffic and same-store sales, which could significantly depress future top-line revenue.

- Wage inflation is forecasted to intensify in the coming years due to rising minimum wage legislation and ongoing labor activism, while Jack in the Box is already experiencing labor costs above 34 percent of sales and faces further pressure; this dynamic is likely to cause meaningful margin compression and reduced net earnings power for the foreseeable future.

- The company's strategy to close 80 to 120 underperforming restaurants by the end of calendar year 2025 demonstrates both a lack of growth prospects in mature markets and ongoing core brand weakness, resulting in long-term unit contraction, continued sales deleverage, and an eventual decline in royalty and rental income streams.

- Intensifying competition from digital-native foodservice brands and fast-casual upstarts is expected to continue, eroding Jack in the Box's consumer appeal and putting further pressure on prices and traffic, ultimately driving structurally lower average unit volumes and compressing operating margins.

- Jack in the Box's heavy reliance on a vulnerable demographic, including over-indexing with price-sensitive Hispanic and lower-income consumers, makes it highly susceptible to ongoing shifts in consumer mobility and spending patterns, risking persistent weakness in systemwide revenue and hindering any sustainable recovery in earnings growth.

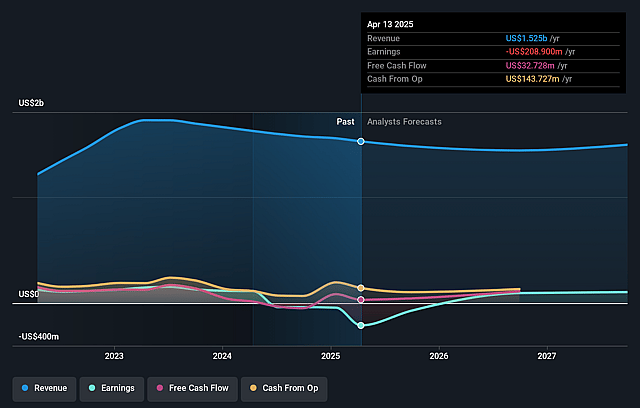

Jack in the Box Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Jack in the Box compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Jack in the Box's revenue will decrease by 2.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -4.3% today to 12.2% in 3 years time.

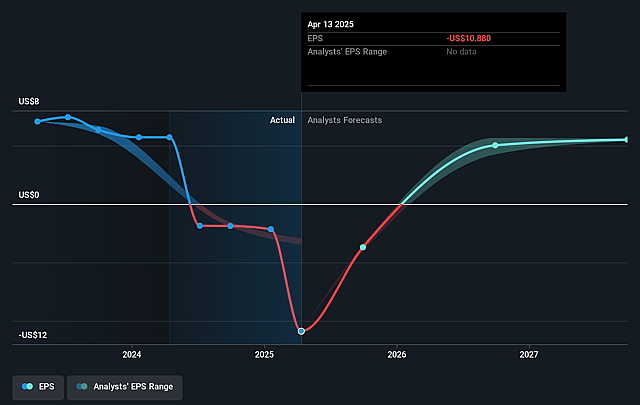

- The bearish analysts expect earnings to reach $170.3 million (and earnings per share of $8.64) by about September 2028, up from $-64.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 2.5x on those 2028 earnings, up from -5.3x today. This future PE is lower than the current PE for the US Hospitality industry at 24.0x.

- Analysts expect the number of shares outstanding to grow by 0.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

Jack in the Box Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong initial sales and successful new market openings in key areas like Chicago and Salt Lake City demonstrate that Jack in the Box has the potential to grow its customer base and top-line revenue through geographic expansion, particularly as new units perform above expectations.

- The multiyear restaurant modernization program, with high franchisee interest and significant planned investment, could improve the guest experience systemwide, leading to higher repeat traffic, stronger brand perception, and ultimately supporting improved sales and earnings over time.

- Rapid progress and high adoption rates in digital and technology modernization, including new POS systems and digital ordering channels already exceeding 18% of sales, position the company to benefit from the growing secular trend toward mobile and off-premise dining, supporting greater order volume and operational efficiency that can boost both revenue and margins.

- The JACK on Track structural initiatives, including targeted restaurant closures of underperforming units and planned sales of at least $100 million in real estate, are designed to streamline the portfolio and enhance overall profitability, potentially resulting in margin expansion and improved cash flows for reinvestment or debt reduction.

- A renewed focus on menu innovation, value proposition, and operations excellence-backed by executive changes and investments in staff training and recognition-could reconnect the brand with both core and lapsed customers, driving improved same-store sales trends and supporting net margin expansion over the longer term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Jack in the Box is $16.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Jack in the Box's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $55.0, and the most bearish reporting a price target of just $16.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $170.3 million, and it would be trading on a PE ratio of 2.5x, assuming you use a discount rate of 12.3%.

- Given the current share price of $17.97, the bearish analyst price target of $16.0 is 12.3% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Jack in the Box?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.