Key Takeaways

- Rapid digital adoption, urban expansion, and strong appeal among diverse, younger consumers position Jack in the Box for outperformance in major markets and long-term sales growth.

- Accelerated restaurant upgrades, franchisee demand, and innovative menu strategies are expected to drive sustained traffic, higher per-unit performance, and greater market share.

- High geographic concentration, rising costs, weakening key customer demand, and reliance on short-term tactics threaten Jack in the Box's sustained revenue growth and financial stability.

Catalysts

About Jack in the Box- Operates and franchises quick-service restaurants under the Jack in the Box and Del Taco brands in the United States.

- Analyst consensus expects strong revenue growth from new market openings, but current performance in Chicago shows outperformance above legacy expansion markets and suggests a higher ceiling for new market ramp, indicating long-term upside to system sales growth as urban infill accelerates and brand relevancy rises with urban, multicultural populations.

- While analysts broadly see technology modernization and digital as a positive for throughput and retention, Jack in the Box has reached a digital sales penetration threshold faster than expected, and with further enhancements (including loyalty and data-driven marketing), the brand could drive sustained step-changes in same-store sales and a structural boost to EBITDA margins by leveraging digital ordering and customer analytics more aggressively than peers.

- The company's persistent over-indexing with diverse and younger demographics, especially Hispanic guests in high-density, fast-growing US markets, positions Jack in the Box to capture incremental market share and comp outperformance as these segments recover their spending power, fueling a long-term lift in traffic and revenue resilience across cycles.

- The multiyear plan to touch and upgrade an additional 1,000+ restaurants, backed by exceptionally strong franchisee demand for modernization funding (over three times oversubscribed in prior rounds), creates a robust pipeline for accelerated asset refresh, which should drive higher average unit volumes, improved customer satisfaction, and meaningfully improved ROIC.

- Jack in the Box's aggressive menu architecture overhaul-including more value tier offerings, culturally relevant limited-time launches, leveraging 24-hour and variety strengths, and third-party facilitated delivery-will drive higher frequency and capture incremental share of wallet from consumers seeking affordable, craveable, and convenient dining, improving both transaction volumes and average check size.

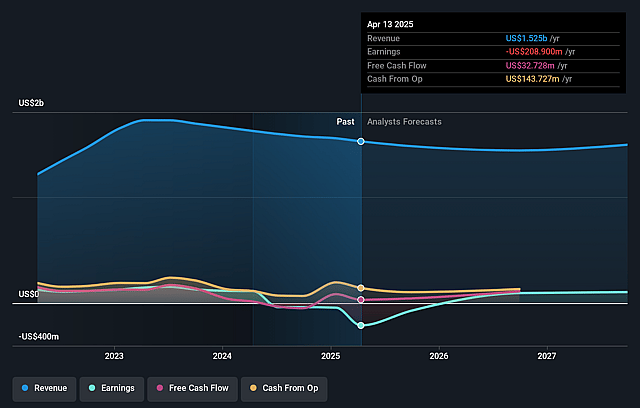

Jack in the Box Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Jack in the Box compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Jack in the Box's revenue will decrease by 0.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -4.3% today to 12.3% in 3 years time.

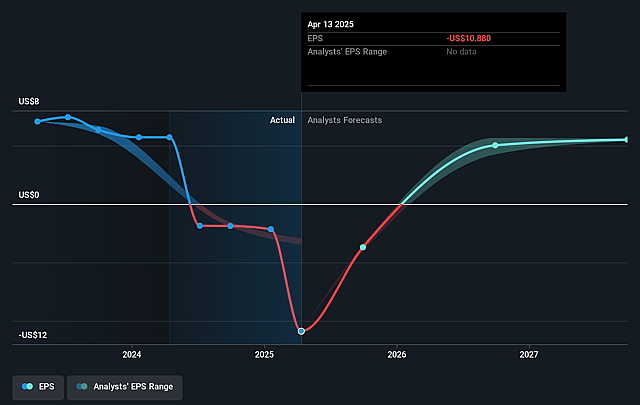

- The bullish analysts expect earnings to reach $187.7 million (and earnings per share of $9.96) by about September 2028, up from $-64.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 5.7x on those 2028 earnings, up from -5.8x today. This future PE is lower than the current PE for the US Hospitality industry at 23.9x.

- Analysts expect the number of shares outstanding to grow by 0.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

Jack in the Box Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Jack in the Box's heavy concentration in the Western and Southwestern U.S.-notably California and Texas-makes it especially exposed to regional economic downturns, demographic shifts, or competitive pressures, limiting its long-term revenue growth potential and leaving it vulnerable to ongoing sales declines as indicated by the most recent same-store sales decreases.

- Persistently rising labor costs, especially driven by minimum wage hikes and increased payroll taxes in core markets like California, are compressing restaurant-level margins and directly threaten the company's net margins despite occasional price increases.

- The company's sales and traffic softness among key customer segments, particularly the low-income and Hispanic consumer bases which Jack in the Box "significantly over-indexes" to, reveals a secular risk if these groups continue reducing spending, directly affecting top-line revenue for an extended period.

- Despite efforts to innovate with menu and technology, the company has historically faced stagnation in menu differentiation and has been reliant on short-term product promotions and price-centric value offers, which risks longer-term brand erosion and undermines sustainable gains in same-store sales or earnings growth.

- Closure of underperforming restaurants as part of the JACK on Track initiative and planned asset sales may temporarily improve franchisee portfolios, but the high number of closures and continuing costs for modernization, coupled with significant outstanding debt and discontinued dividend, may weaken free cash flow and earnings if sales and profit recovery do not materialize as planned.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Jack in the Box is $39.95, which represents two standard deviations above the consensus price target of $23.06. This valuation is based on what can be assumed as the expectations of Jack in the Box's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $55.0, and the most bearish reporting a price target of just $16.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $187.7 million, and it would be trading on a PE ratio of 5.7x, assuming you use a discount rate of 12.3%.

- Given the current share price of $19.94, the bullish analyst price target of $39.95 is 50.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.