Last Update 23 Jan 26

Fair value Increased 3.09%WULF: Long Dated Fluidstack Contracts Will Support Future High Performance Compute Capacity

Analysts have raised their price target on TeraWulf by about $0.66 to roughly $22, citing the company's expanded high performance compute contracts, long term hosting commitments and increased confidence in securing 250 to 500 MW of annual capacity as key supports for the revised valuation.

Analyst Commentary

Recent research on TeraWulf has focused on its shift toward high performance compute, the scale of its long term contracts, and the feasibility of its capacity goals. Here are the key themes analysts are focused on right now.

Bullish Takeaways

- Bullish analysts point to the transition from pure bitcoin mining toward high performance compute AI infrastructure as a key driver for their higher price targets, tying this shift to potential diversification of revenue and business model.

- Several research notes highlight TeraWulf's access to low cost renewable electricity and fiber connected sites as a core asset. They see this as supportive of data center economics and, in turn, their higher valuation work.

- The long dated 25 year hosting commitment with Fluidstack, representing about US$9.5b in contracted revenue and a 51% stake for TeraWulf, is framed by bullish analysts as improving visibility on future cash flows and supporting confidence in the colocation build out.

- Analysts citing the Q3 adjusted EBITDA of US$18.1m, along with progress at Lake Mariner and ongoing builds at WULF Den, CB-1, and CB-2, describe these execution points as reinforcing their upward revisions to TeraWulf's price targets.

- Research notes that reference the 250 to 500 MW annual capacity target suggest that recent site acquisitions, financing plans, and the Fluidstack joint venture give analysts more comfort that these capacity goals may be achievable. This view feeds into their more constructive perspectives on growth and the balance sheet.

Bearish Takeaways

- Some commentary flags the sharp stock decline around the time of the Q3 print as a sign that execution and communication will need to stay tight for the market to fully credit the higher capacity and contract targets in valuation multiples.

- Certain bearish analysts express caution that, while large contracts and multi decade commitments support long term visibility, they also raise questions about counterparty risk, contract durability, and how changes in AI compute demand could affect long run economics.

- The reliance on scaling to 250 to 500 MW of annual capacity is seen by more cautious voices as execution heavy, with potential risks around permitting, power availability, capital access, and timing of build outs relative to demand.

- Another point of concern is regulatory and policy uncertainty around crypto and digital assets more broadly, particularly where parts of the business still tie back to bitcoin mining. This could affect how investors value TeraWulf's legacy operations alongside its high performance compute ambitions.

What's in the News

- TeraWulf entered a long term high performance computing joint venture with Fluidstack to develop 168 MW of critical IT load at its Abernathy, Texas campus, backed by an investment grade, long duration infrastructure commitment supporting workloads for a global hyperscale AI platform (Key Developments).

- The 25 year Fluidstack hosting commitment represents about US$9.5b in contracted revenue to the joint venture. TeraWulf holds a 51% majority stake and retains the exclusive right to partner on up to 51% of the next approximately 168 MW Fluidstack led data center project on similar terms (Key Developments).

- TeraWulf reported that its contracted high performance computing platform now exceeds 510 MW of critical IT load. The company is targeting an additional 250 MW to 500 MW of contracted critical IT load each year, with the Abernathy facility expected to be delivered in the second half of 2026 (Key Developments).

- The company indicated that the joint venture will be project financed, with Google supporting about US$1.3b of Fluidstack’s long term lease obligations to back project related debt financing. TeraWulf’s equity contributions are planned in stages and no TeraWulf equity securities or warrants were issued for this transaction (Key Developments).

- Japan’s financial regulator plans to require cryptocurrency exchanges to hold reserves against liabilities to help protect customers in the event of hacks or other loss events. This move could affect listed crypto related firms including TeraWulf (Nikkei, Periodicals).

Valuation Changes

- Fair Value: updated slightly higher from US$21.44 to US$22.10 per share, reflecting a modest uplift in the modelled estimate.

- Discount Rate: adjusted marginally from 8.96% to 8.98%, a very small change in the assumed risk profile.

- Revenue Growth: kept broadly in line, shifting from 83.74% to 83.71%, indicating little change in growth assumptions.

- Net Profit Margin: reduced meaningfully in the model, moving from 7.72% to 3.19%, which lowers the implied profitability outlook used in the valuation.

- Future P/E: increased substantially from 176.94x to 441.68x, implying a much higher earnings multiple embedded in the updated assumptions.

Key Takeaways

- Transition to diversified digital infrastructure with major institutional backing reduces reliance on bitcoin price, boosting revenue stability and supporting margin growth.

- Expansion of sustainable, regulatory-compliant infrastructure positions the company to meet rising enterprise demand, drive new revenue streams, and achieve operational efficiency.

- Aggressive diversification into AI and HPC hosting exposes TeraWulf to rising costs, tenant risks, and operational challenges that threaten margin stability and long-term financial health.

Catalysts

About TeraWulf- Operates as a digital asset technology company in the United States.

- TeraWulf's recent multi-billion-dollar, multi-year hyperscale hosting agreements (e.g., with Fluidstack and Google), mark a significant shift from a pure bitcoin mining model toward diversified, contracted revenue streams in high-demand digital infrastructure-this underpins higher revenue visibility and insulates earnings from bitcoin price volatility.

- Long-term partnerships and investments from marquee players (Google's $1.8B lease backstop and equity stake) signal institutional validation, enhance creditworthiness, and are likely to lower WULF's future cost of capital, directly supporting margin expansion and accelerated infrastructure growth.

- Rapid expansion of zero-carbon, high-capacity digital infrastructure (Lake Mariner and Cayuga) positions TeraWulf to capture rising enterprise demand for sustainable, regulatory-compliant compute, supporting long-term revenue and improved net margins as regulatory and ESG pressures rise globally.

- Proven operational track record (on-time, on-budget delivery, experienced team, long-standing contractor relationships) de-risks future capacity scale-up and enables disciplined cost management, supporting sustained margin improvement and higher EBITDA.

- Growing momentum for institutional and enterprise digital asset adoption, coupled with TeraWulf's expansion into grid-interactive, renewable-powered data centers, positions the company to benefit from both higher transaction volumes and new ancillary revenue streams, enhancing long-term earnings stability and upside.

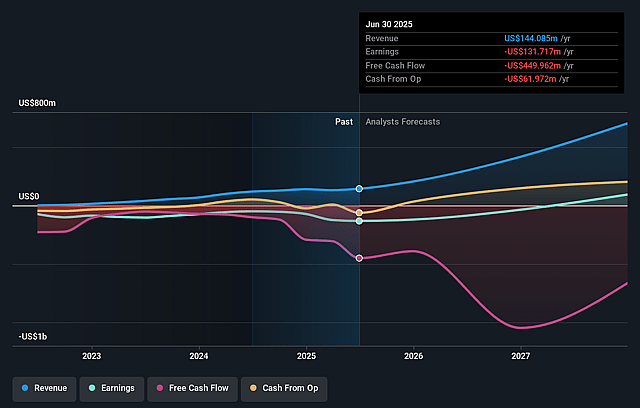

TeraWulf Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming TeraWulf's revenue will grow by 85.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from -91.4% today to 17.1% in 3 years time.

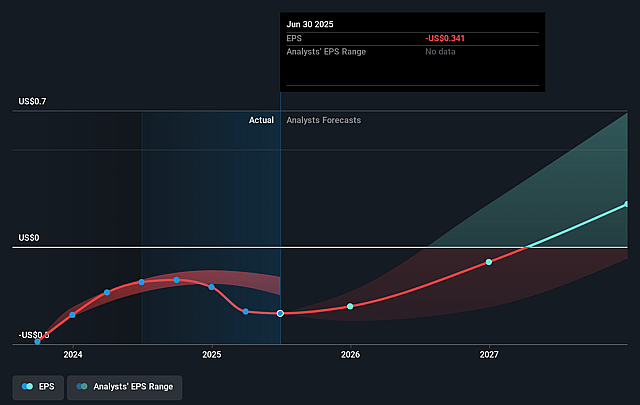

- Analysts expect earnings to reach $157.9 million (and earnings per share of $0.33) by about September 2028, up from $-131.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $405.2 million in earnings, and the most bearish expecting $-45.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 42.4x on those 2028 earnings, up from -27.8x today. This future PE is greater than the current PE for the US Software industry at 36.6x.

- Analysts expect the number of shares outstanding to grow by 1.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.78%, as per the Simply Wall St company report.

TeraWulf Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- TeraWulf's aggressive expansion into High Performance Computing (HPC) and AI data center hosting (e.g., the Fluidstack deal and Cayuga site development) requires substantial capital expenditures and increases debt exposure, introducing long-term risks to free cash flow, net margins, and balance sheet stability-especially if demand or execution timelines falter.

- The company's revenue stream is rapidly diversifying away from its legacy crypto mining business, but longer-term returns are highly dependent on maintaining "transformative" leases with newer tenants (e.g., Fluidstack) whose own financial stability, customer base, and AI sector demand are not fully transparent, creating potential risks to recurring revenue and earnings should counterparties struggle or market conditions shift.

- Although Google's backstop reduces near-term counterparty risk, its credit support for the Fluidstack lease declines over time and is tied to equity dilution, potentially impacting future shareholder value and exposing TeraWulf to ongoing concentration risks if similar structures are used in future expansions.

- TeraWulf faces escalating operational costs (e.g., labor, custom buildouts, supply chain constraints) as evidenced by higher CapEx on Fluidstack versus Core42 and increasing SG&A guidance, posing a risk to gross and net margins unless efficiencies scale materially or future contracts continue to deliver very high site-level net operating income.

- The company's long-term growth relies on sustained strong demand in both the AI infrastructure and crypto mining sectors, both of which could be adversely affected by regulatory changes (e.g., U.S. energy/environmental policy, digital asset legislation) or technology disruptions, leading to potential declines in revenue, EBITDA, or asset utilization if sectoral sentiment or policy support weakens.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $12.182 for TeraWulf based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $6.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $920.8 million, earnings will come to $157.9 million, and it would be trading on a PE ratio of 42.4x, assuming you use a discount rate of 8.8%.

- Given the current share price of $8.98, the analyst price target of $12.18 is 26.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on TeraWulf?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.